In the face of a challenging economic environment and industry transformation, ZF Friedrichshafen AG has presented a mixed but strategically pivotal financial performance for the fiscal year 2024, underlining the impact of bold restructuring and continued innovation in future mobility technologies.

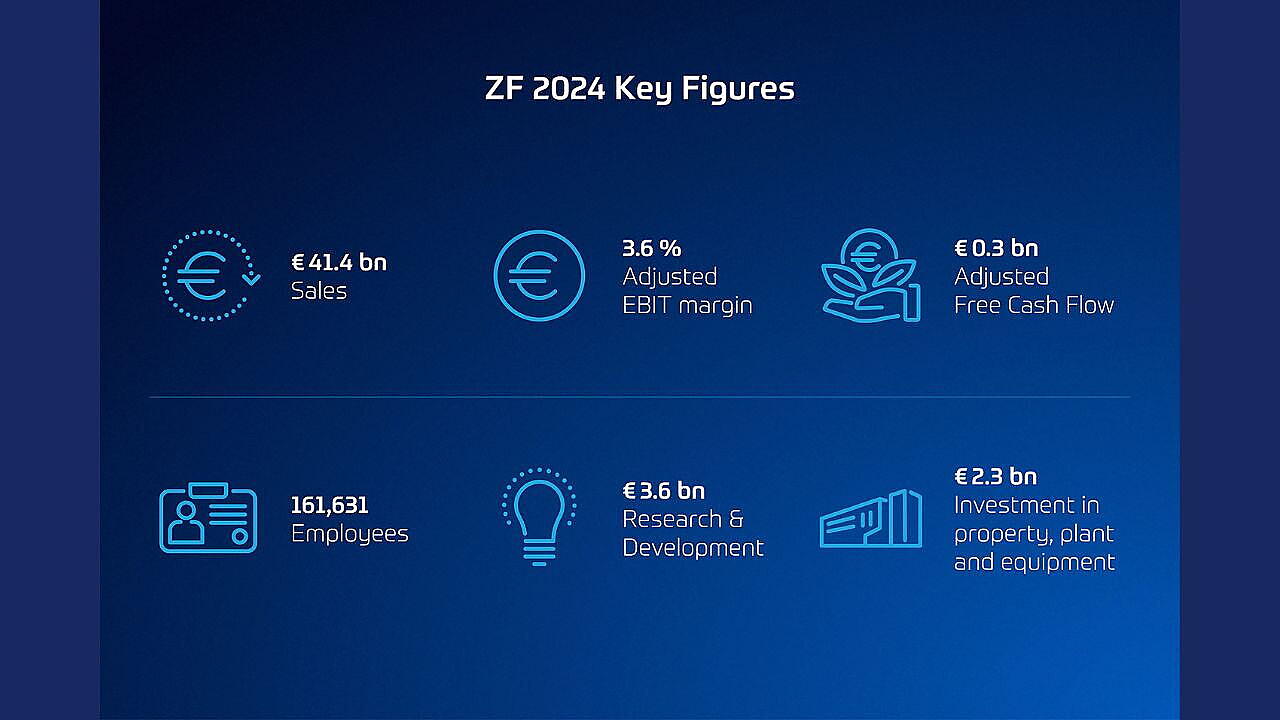

The company reported sales of €41.4 billion, down from €46.6 billion in 2023, reflecting a nominal decline of 11%, largely due to the deconsolidation of its axle assembly business (€2.6 billion), now part of the ZF-Foxconn joint venture. Organically, sales fell by a more modest 3%, aligned with ZF’s revised guidance issued in September 2024.

Despite the dip in revenue and earnings, ZF is actively laying the groundwork for a leaner, more agile, and future-focused organisation, signalling its intent to remain a major force in the global automotive and industrial technology sectors.

Strategic Reset

ZF’s adjusted EBIT for 2024 stood at €1.5 billion, down from €2.4 billion the previous year, resulting in a reduced EBIT margin of 3.6% (2023: 5.1%). Free cash flow, adjusted for M&A activities, declined sharply to €305 million (2023: €1.38 billion), reflecting the weight of restructuring costs, which totalled €600 million.

These expenses contributed to a net loss of €1.02 billion, with net debt rising to €10.47 billion. Nevertheless, ZF maintains a strong liquidity buffer of €8.1 billion, backed by solid financing operations, including green bonds and EIB/EBRD loans, reinforcing its capital planning in a volatile global market.

CEO Dr Holger Klein, said, “2024 made it clear how intense the pressure is on both our industry and ZF. However, we are making measurable progress. The steps we’ve taken—however difficult—are essential for shaping a profitable, agile, and innovative ZF.”

Repositioning Through Portfolio Optimisation, Partnerships

Central to ZF’s long-term strategy is its “Strengthening strengths – Unlocking potential” initiative, which is reshaping the company’s operational focus. ZF continues to invest in core strengths—chassis, commercial vehicles, industrial technology, and aftermarket services, all areas where the company ranks among the top three globally.

Simultaneously, ZF is seeking strategic partnerships in electric mobility, electronics, and advanced driver assistance systems (ADAS). Noteworthy examples include:

- The ZF Foxconn Chassis Modules joint venture, which consolidated axle production.

- The spin-off of its Passive Safety Systems Division, now operating as ZF LIFETEC.

- The evolution of its partnership with KPIT Technologies into Qorix, an independent software firm developing middleware for complex vehicle systems.

- A new collaboration with Qualcomm, integrating Qorix middleware into its automotive chips.

These alliances illustrate ZF’s aim to build ecosystems, not just product lines, supporting the software-defined vehicle (SDV) of the future.

Navigating Operational Realignment In Germany

A significant portion of ZF’s transformation is also internal. In Germany, the company reduced its workforce by 4,000 jobs in 2024, using methods like partial retirements and reduced working hours. While difficult, the decision reflects ZF’s response to sustained weak demand and the need for structural efficiency. As of December 31, 2024, ZF employed 161,631 people globally, down 4%, with German headcount at 52,027.

Bright Spots

While many divisions saw slower performance due to global economic conditions, ZF Aftermarket stood out, with 12% organic growth and sales reaching €3.6 billion. This growth was fuelled by increased service needs amid a slowdown in new vehicle sales, proving the strength of ZF’s lifecycle business model.

Meanwhile, in technology, ZF is making significant improvements with its 'by-wire' systems:

- A major brake-by-wire order from a leading North American OEM, to be deployed in five million vehicles.

- In China, NIO’s flagship ET9 became the first production vehicle approved for mass production with ZF’s steer-by-wire system, removing mechanical steering linkages and signalling the maturity of next-gen vehicle control systems.

The recent consolidation of ZF’s Active Safety and Passenger Car Chassis divisions into a single Chassis Solutions Division further positions the company as a global leader in integrated vehicle motion control, combining hardware and software expertise.

R&D Investment, 2025 Outlook

Despite margin pressures, R&D investments remained stable at €3.6 billion, representing an increased R&D intensity of 8.6%, reflecting ZF’s priority to innovate through the cycle. Capital expenditures also grew slightly to €2.3 billion.

Looking ahead, 2025 will remain a cautious year, with only modest economic growth expected in key regions like Europe and Germany. ZF forecasts:

- Sales above €40 billion

- Adjusted EBIT margin of 3.0% to 4.0%

- Free cash flow exceeding €500 million

Resilient Pivot Towards the Future

While 2024 tested ZF’s financial resilience, it also underscored the depth of its strategic resolve. With a leaner cost base, a sharper technological focus, and a portfolio realigned for software-defined, electrified, and modular vehicle platforms, ZF is methodically laying the foundation for sustainable growth and leadership in next-gen mobility solutions.

CFO Michael Frick stated, “We’re not yet where we want to be, but the transformation is underway—and the early signs of success are already visible.”

Also Read:

ZF Launches SCALAR Digital Fleet Platform, Highlights Aftermarket Advancements