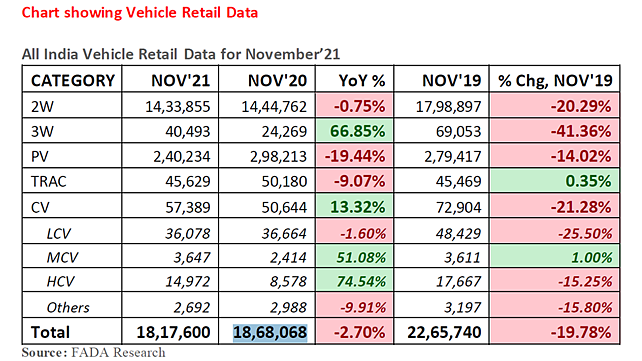

Passenger vehicle registrations saw year-on-year degrowth of 19.44% to 2,40,234 units in November 2021 due to continuing semiconductor shortage, the Federation of Automobile Dealers Association (FADA) has said based on VAHAN.

The retail sales of two-wheelers dropped by 0.75% to 14,33,855 units in November 2021, against 14,44,762 units in the same month last year, while three-wheelers witnessed 66.85% to 40,493 units in November 2021 against the same month a year ago. Except for LCVs, which saw a 1.6% drop in sales, all other commercial vehicles performed well during the month. MCVs shows 51.08% growth to 3,647 units while the sales of HCVs improved 74.54% over the same month last year.

The tractor segment saw a 9.07% dip in sales to 45,629 units, against 50,180 units in the same month a year ago period.

According to Vehicle Retail Data for November’21 released today by FADA, the total vehicle registrations at Regional Transport Offices, which are proxies for sales, dropped by 2.70% to 18,17,600 units in November this year against 18,68,068 units during the same period last year.

Releasing the retail data, Vinkesh Gulati, President, FADA, said the auto retail for November 2021 continued to remain negative despite Diwali and marriage season in the same month. In addition, the unwanted rains in southern states further spoiled the party. Unless rural India starts showing signs of strength, overall retails will continue to remain weak.

While the 2W segment saw almost at par sales compared to last year (which itself was a bad year), overall sentiment remained low as marriage season also didn’t help in revival except in one or two states. Apart from this, crop loss due to incessant rains and floods in southern states, high acquisition prices, and fuel costs kept the customers away. Further, there are no signs of increased inquiry levels which is a significant cause of concern, he said.

Speaking on PVs, he said this segment continues to face the brunt of semiconductor shortage. While the new launches keep customers’ interest high, only the lack of supply does not allow sales to conclude. In addition, the extended waiting period is now starting to make customers jittery, which may lead to a loss of interest in vehicle buying.

The CV segment continues to see traction in the M&HCV segment. This aided by low base resulted in double-digit growth. However, the bus segment is still witnessing a dry run as educational institutes continue to remain closed. Moreover, with diesel prices at record highs, the supply of CNG vehicles are not able to meet the demand. In addition, tight liquidity and unavailability of finance for customers who availed moratorium also act as sales barriers, Gulati added.

Near Term Outlook

The new variant of COVID ‘Omicron’ has once again gripped the entire nation in fear. It will further impact the overall vehicle demand.

Educational Institutions and offices that were planning to reopen fully have once again deferred their plans and allow work/study from home. Price rises due to high input costs and fuel costs continuing to add customers woes.

FADA is hopeful that the chip shortage will ease in times to come and therefore reduce the waiting period of vehicles and help in increasing sales. 'On the 2W front, we once again request all OEMs to announce attractive scheme which can work as a stimulus for growth in sales. FADA additionally requests them to consistently work on a 21- days inventory cycle,' FADA President said.

'Overall, we remain extremely cautious and hope that India does not see a 3rd wave with the new COVID variant. We also urge the Central and all state governments to aggressively drive the vaccination coverage so that India is not caught off-guard and recovery to pre-COVID levels is not derailed.

The average inventory for PVs ranges from 10 – 15 days, while the same for 2-wheelers goes from 30 – 35 days.

NB: Photo is representational.