The Indian transport sector, which was already reeling under pressure due to various structural changes, is now staring higher NPAs and loan defaults as 70% of the trucks are idle because 80% of the country is under lockdown. According to estimates, there are one crore trucks in the country, and about 70 lakh trucks are idle.

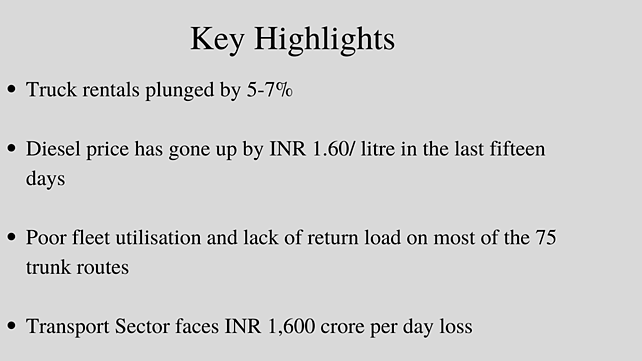

The transport sector faces as much as INR 1,600 crore loss per day as only 30% of trucks that are carrying daily essentials, and medical supplies are moving on the road, said Bal Malkit Singh, Chairman – Core Committee and former President, All India Motor Transport Congress.

While this was not enough to aggravate the pain of the transporters, the fuel prices are touching an all-time high, and low freight rates are acting as a double whammy for them.

According to the Indian Foundation of Transport Research and Training (IFTRT), truck rentals have plunged on key trunk routes by 5-7% in the past 15 days because of low economic activity due to lockdowns in various parts of the country. Apart from this, during the last fortnight, diesel price has gone up by INR 1.60/ litre on back oil marketing companies (OMCs) resuming daily price revision formula, post elections in five states; simultaneously international crude oil price had touched a high of $67.92 per barrel.

“The fleet owners repayment capacity of truck loan EMIs has further been strangled by poor fleet utilisation and lack of return load on most of the 75 trunk routes,” said SP Singh, Senior Fellow & Coordinator, IFTRT.

Research and Rating Agency Moody’s also indicated that auto loan delinquencies are likely to remain elevated over the next six to twelve months. It said reduced demand for freight transport and lower freight rates, and rising fuel costs are key reasons for stress in the transport sector.

Out of the one crore total trucks, 80% are owned by small fleet operators, which have one five to ten trucks. These are most likely to default on loans because of the financial pressure and cash crunch.

Bal Malkit Singh pointed out that even for the truckers operating, they have the idle time of two to three days to get business. The situation is grim than last year as there was a national lockdown and the government-supported various policies and moratorium. We have requested a moratorium this year but haven’t heard back yet.

Experts tracking the sector indicated that this time ‘V’ shape is very likely to happen. At present, there is low economic activity due to which consumption of most of the goods and services is very low. Also rising cases of COVID-19 and death toll has marred the overall consumer sentiment. So the overall movement of the goods will be less.

Sachin Haritash, Founder Mavyn and Director Chetak Logistics said, “There are higher chances of loan defaults this year, especially from the small fleet operators. A lot of them had already opted for a moratorium last year. Their overall cost of EMI has risen, on the hand there is no business along with low freight rates and rising fuel prices putting pressure.”

Going forward, the outlook of the situation remains unstable, and the overall customer sentiment is weak because of rising COVID-19 cases. The demand recovery is linked with decreasing cases and opening up of the market, but overall cost pressure remains as fuel prices continue to rise and freight rates are low.