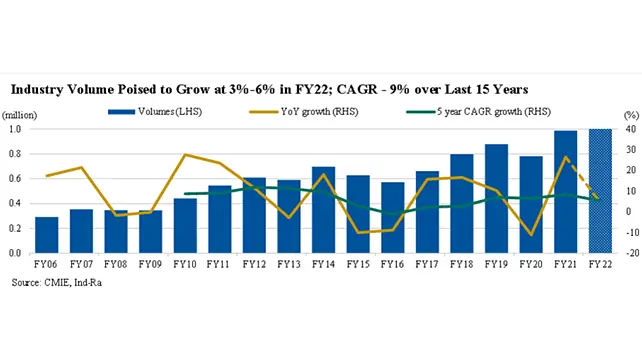

As the macroeconomic tailwinds mostly remain intact for the rural economy, including the normal monsoon forecast, the expectation of a strong Kharif harvest, and improved rural income, India Ratings and Research (Ind-Ra) expects tractor sales volumes to grow in low-mid single digits of 3%-6% yoy in FY22, mainly on a higher base following the 27% yoy growth witnessed in FY21.

However, the second COVID wave had impacted sales in April-May 2021, with the average monthly sales dropping to 76% of the monthly sales achieved in Q4FY21. The industry witnessed a sharp rebound in sales volume in June 2021, as per data released by original equipment manufacturers (OEMs).

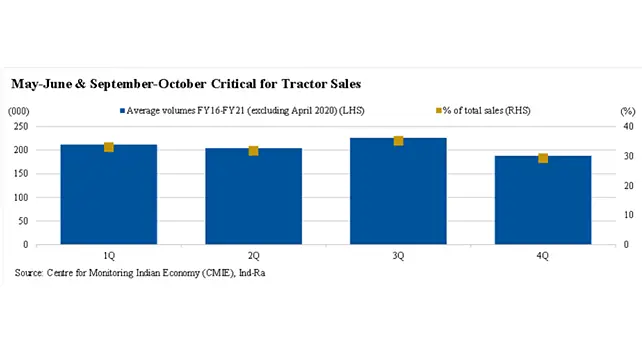

Ind-Ra expects sales volume to pick up from Q2FY22 as the localised lockdown has been relaxed. However, given that Q1 is generally a critical quarter with seasonally higher sales (around 33%), especially in May and June for land preparation for the Kharif season, the sales lost are unlikely to be recovered in the subsequent part of the year.

Factors Impacting Tractor Sales

The research and rating agency is cautious that tractor purchases may be deferred to save for higher medical expenses amid the anticipation of a third wave. If the country witnesses a third wave that is as severe as the second one resulting in localised/ nationalised lockdowns, the growth on yoy basis could be flattish.

Moreover, lower income levels in Q1FY22 and loss of lives could dampen consumer sentiments and hence tractor purchase may be deferred. This will especially be in replacement demand, which accounts for 30%-35% of the total volumes, as per industry reports.

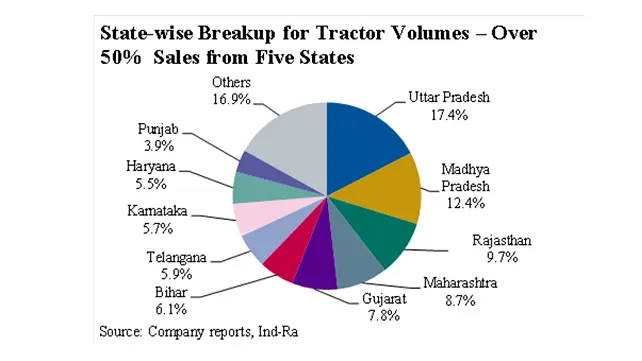

Collectively, the top five states accounting for 56% of the tractors sold in India, recorded around 34% of the total COVID-19 cases in India, with 40%-75% of their cases, amid the second wave, being recorded in rural districts.

Strong agricultural produce: The country recorded five consecutive good crop harvests (Rabi 2019, Kharif 2019, Rabi 2020, Kharif 2020, Rabi 2021) and is forecasted to have a substantial harvest of Kharif 2021 on the back of the forecast of normal monsoons. The Ministry of Agriculture and Farmers Welfare has targeted food grain production of 307.3 million tonne in FY22 (FY21: third advanced estimate 305.44 million tonne; FY20: 297.5 million tonne). This is likely to be positive for increasing farmers’ income.

Ind-Ra expects the agriculture sector’s gross value added (GVA) to grow by 3% yoy in FY22 (FY21: 3%; FY20: 4.3%). As 65%-70% of the tractors sold are used in the agriculture sector, tractor sales usually move in tandem with the agricultural GVA. Therefore, Ind-Ra expects stable growth in agricultural GVA in FY22 to support tractor demand.

Continued government thrust on agri /infra activities: The central government has taken several initiatives to improve farm income, including creating an INR1 trillion agricultural infrastructure fund, increasing subsidy for DAP fertilisers, and increasing minimum support price for Rabi crops (an increase of 2%-6%) high procurement of crops in FY21. This Ind-Ra expectsthe momentum (have added) to be maintained in FY22.

Various state governments have also provided loan waivers, subsidised loans, and incentives to farmers to opt for farm mechanisation to boost rural income. This has led to higher cash in the hands of farmers and thus enabling the purchase of tractors.

Moreover, the government’s thrust on rural infrastructure is likely to aid growth in non-agricultural tractors, accounting for around 30% of the tractor volumes.

The construction activities significantly increased in H2FY21, though the momentum broke amid the second COVID wave in Q1FY22. However, Ind-Ra believes that post lifting of lockdown restrictions from June 2021, rural infrastructure activities could pick up and hence lead to a demand recovery in the non-agricultural segment.

The rating agency expects the income levels for the non-agri rural segment, which account for around two-thirds of rural income, to be impacted by the 33% yoy reduction in budgetary allocation towards rural development to INR1.34 trillion in FY22 (revised estimates for FY21: INR1.99 trillion). In addition, non-agriculture activities have also been impacted by COVID-19 as they require high human contact. As a result, the rural household income may decline in FY22, which could negatively affect the sector.

Tractor financing to remain intact: Average collections for tractor loans, based on Ind-Ra rated transactions, declined significantly in April 2021. Ind-Ra believes the collections could have been impacted considerably in May 2021, mainly on account of restricted mobility of lenders for collections, while in June, it is likely to recover. Though there could be some moderation in rural lending, the tractor segment is unlikely to be impacted severely as it caters to the non-discretionary demand.

Higher Commodity Prices: Key inputs, including steel and rubber, which account for nearly 70% of the weight of a tractor, have witnessed a sharp spike in prices, increasing 30% and 7% respectively over January-May 2021. This has translated into an 8%-10% yoy increase in raw material prices. To maintain their margins, OEMs have undertaken process improvement measures as well as price increases.

OEMs could consider taking another price hike in Q2FY22-Q3FY22 to cover increasing raw material prices, which could be somewhat negative for incremental demand. However, the industry is likely to adopt TREM-IV emission norms in higher HP tractors (more than 50HP) from 1 October 2021, leading to some pre-buying in H1FY22 in that segment.

Ind-Ra expects the tractor industry to record 7%-10% yoy revenue growth in FY22, driven by volume growth and increased realisation per tractor. Though margins are likely to be affected due to rising input prices. As the fundamentals for tractor demand (under penetration of farm mechanisation, lesser availability of farm labour and continued government focus on increasing rural income and farm mechanisation) remain strong, OEMs expect volume CAGR growth of 4%-8% in the medium term. Therefore, large OEMs have not revised their CAPEX plans for FY22, which is higher than that incurred in FY20.