Tata Motors Passenger Vehicles (TMPV) and Tata Passenger Electric Mobility (TPEM), subsidiaries of India’s leading automobile manufacturer Tata Motors Ltd., have signed a Memorandum of Understanding (MoU) with Saraswat Bank, one of the country’s largest cooperative banks.

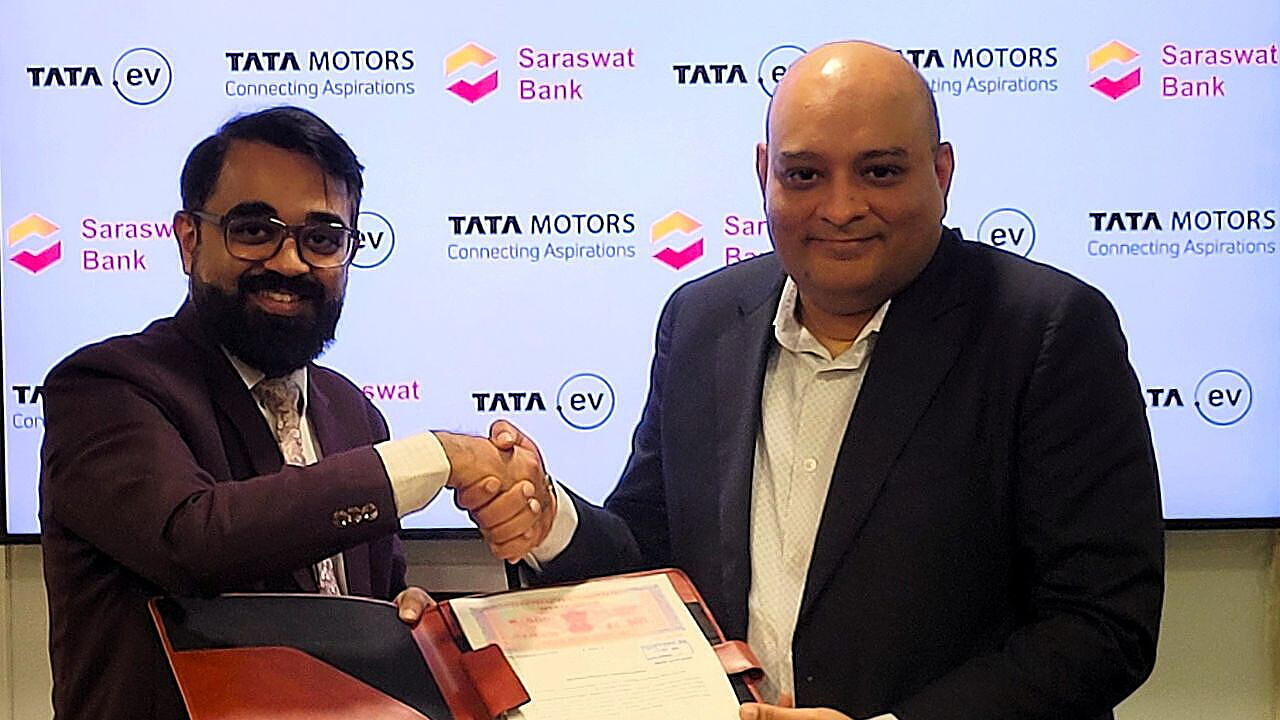

Through this collaboration, Saraswat Bank will provide competitive interest rates and tailored financing plans, enhancing affordability and convenience for Tata Motors’ customers. This initiative seeks to expand the accessibility of Tata’s popular passenger vehicles, improving the overall purchasing experience. The MoU was signed in the presence of senior leadership from both Tata Motors and Saraswat Bank.

Dhiman Gupta, Chief Financial Officer of Tata Passenger Electric Mobility Ltd. and Vice President of Tata Motors Passenger Vehicles Ltd., said, “This partnership with Saraswat Bank is a step forward in offering tailored financing options with competitive rates. It reaffirms our commitment to making Tata Motors’ ICE and EVs more accessible while providing a seamless and rewarding customer experience.”

Gautam Thakur, Chairman of Saraswat Bank, said, “This tie-up not only expands the choices available to our customers but also promotes the adoption of EVs in India.”

Also Read:

Tata Motors Revamps Pune Design Studio To Bolster Innovation