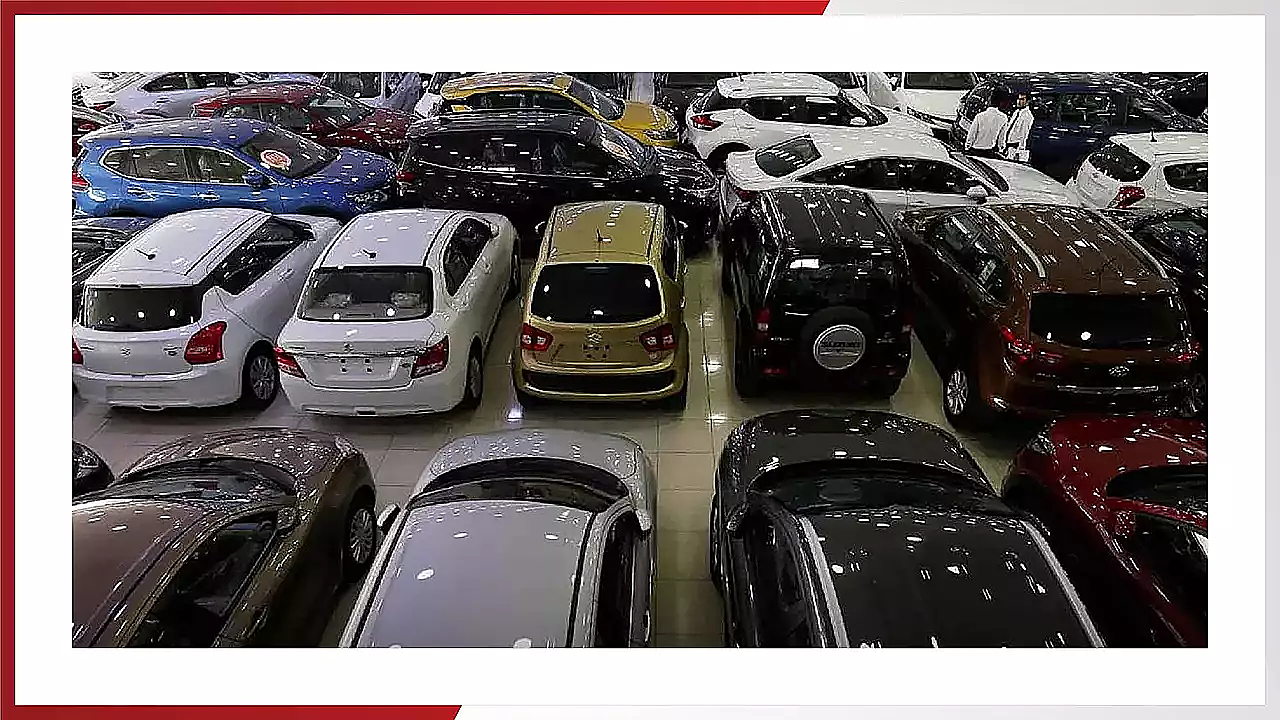

The Federation of Automobile Dealers Associations (FADA) has unveiled the November 2023 Vehicle Retail Data, showcasing an unprecedented surge in sales, marking a historic achievement for the Indian Auto Retail Industry.

In November 2023, a staggering 28.54 lakh vehicles were sold, eclipsing the previous record set in March 2020 during the transition from BS-4 to BS-6 emission norms, which saw 25.69 lakh vehicles sold. Notably, the 2W and PV categories shattered all-time highs, with 2W sales reaching 22.47 lakh vehicles and PV sales totalling 3.6 lakh vehicles.

On a year-on-year basis, the overall retail sales grew by an impressive 18%. The 2W, 3W, and PV categories exhibited robust growth rates of 21%, 23%, and 17%, respectively, while Tractor and CV experienced declines of -21% and -2%.

The 2W category stole the spotlight with a remarkable 49% month-on-month growth, fuelled by festive enthusiasm and strengthened by rural sentiments, thanks to flourishing agricultural incomes. The introduction of new models and improved supply chains further propelled the market, with electric vehicle sales showing promising growth.

However, challenges loom in the near term. The commercial vehicle (CV) category faced challenges driven by poor market sentiment, seasonal slumps, and delayed deliveries.

Looking ahead, the 2W category anticipates a boost from the ongoing marriage season and liquidity influx in agricultural regions. On the other hand, the CV category is expected to recover post-elections, with positive movements in key sectors like cement and coal. The PV sector shows growth potential with year-end offers and discounts but grapples with slow-moving inventory, emphasizing the need for strategic adjustments in inventory management.

FADA President, Manish Raj Singhania, highlighted the historic significance of November 2023, underscoring the industry's resilience in navigating through complexities. As the Indian Auto Retail faces challenges in consumer preferences, high PV inventory, and external economic factors, strategic adaptation becomes crucial for sustained success.

Key findings from FADA's Online Members Survey revealed that PV inventory remains above 60 days, emphasizing the need for OEMs to reduce dispatches of slow-moving vehicles. The sentiment among dealers reflects optimism, with 45.58% expressing a positive outlook, while liquidity and growth expectations for December remain favourable, indicating a buoyant industry landscape.

Also Read