SMEV, the registered association representing Indian manufacturers of electric vehicles (EV), has today welcomed the move by the Ministry of Heavy Industries (MHI) to start settling pending issues of OEMs and bring the sector back to its feet.

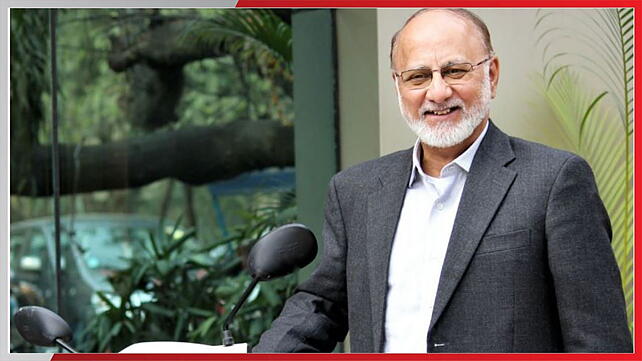

Sohinder Gill, Director General SMEV, said, “The beginning of the resolution of disputed issues for OEMs augurs well for the sector. It is time that the sector is allowed to stand on its feet again, and efforts to revive the E-Mobility sector can begin.'

Terming the news about the Ministry giving clean chits to various companies as a move in the right direction, Gill said that the sector was desperate to resolve the subsidy blockade that has all but choked the sector for the last 15 months.

Companies like Hero Electric, Okinawa and Ampere, who were market leaders in FY19 and FY20 with 82% share of the market, have reported a drastic drop in sales and were able to muster only a 24% market share in April ‘23. If these companies are not revived, the organisations that built the EV ecosystem for the initial ten years or more may have to shut down, setting a bad example in the EV world, including the global investment funds. MHI’s decision to take a practical view of the limitations and difficulties of OEMs is a good step and will bring much-needed relief to the sector, a communication from SMEV said.

Gill said, “There are various ways to look at the issues relating to the subsidy and pricing, but at a basic level they are simple teething troubles of a nascent industry.” It was important to understand that OEMs passed on subsidies fairly and honestly. “There is not a single case of any OEM not passing on the subsidy to customers. That is a fact and has not been challenged by anyone so far,” he said. The idea that there was an attempt to profit from importation, as has been made out, has no basis in reality, he added.

Debunking Imports

All OEMs prefer to buy locally – rather than import. Importation is an expensive and dicey affair with currency issues, customs and duty additions, time lag, delays, spare shortages, guarantee and warranty complications and above all, pricing is always cumulatively higher. The issue of localisation has been magnified to become a China-centric debate among some quarters. This myth must be debunked. Importation is allowed under FAME II, which is a fact. Even today, 50% of the EV is officially allowed to be made up of imported components.

Localisation

Logically it should have been much higher to start with - say 70 -80% as the supply chain did not exist then and was allowed to taper down to 50% progressively. Unfortunately, this was not the case with FAME II PMP norms that mandated item-by-item localisation conditions, which were tougher to meet and created supply bottlenecks that led to OEMs scrounging for parts, which in turn created the issues OEMs are facing today.

SMEV observed that force-localisation comes with dangers, as the industry has seen some OEMs trying to procure locally at the cost of quality components that have resulted in fires and short circuits and parts that have required to be recalled later.

According to the industry body, the solution lies in a flexi-policy approach until total localisation can occur. In 2019 when the FAME policy was launched, there was no supply chain. So the subsidy scheme was a non-starter. Then two years of COVID finished off the market, and it was only in late 2022 could the supply chain sustain the 50% localisation efforts of the OEMs.

The Ministry has been cognizant of the ground realities, which is why the extensions provided by it sustained the sector in 2021. However, with the unfortunate controversy created by anonymous emails and the actions of the Ministry, the entire sector collapsed in 2022. The Ministry may also consider offering incentives to local enterprises to ensure that a sustainable manufacturing eco-system can be created, Gill added.

Also Read: