The second wave’s severe impact across rural and urban regions is likely to have an adverse impact on demand for automobiles. However, the expectations of strong macroeconomic growth expectations albeit on a lower base in FY21, along with an average monsoon from the Indian Meteorological Department and a good Rabi harvest, may assist demand for the sector in FY22, India Ratings and Research (Ind-Ra) said in a report.

The rise in cases has interrupted the momentum recorded by the industry in the third and fourth quarter of FY21, with many original equipment manufacturers (OEMs) advancing maintenance shutdowns to April and May on account of dampening consumer sentiments, closure of automotive dealerships, as well as supply-side constraints.

The decline in the sector was mainly on account of the increasing number of COVID-19 infections, resulting in state-wise lockdowns coming into effect during the latter part of the month.

Passenger vehicle and two-wheeler sales volumes declined by 10% and 34% M-o-M, respectively, in April 2021.

While three-wheeler sales volumes declined by 57% amid a further reduction in preference for shared mobility, exports volumes continued the growth trend in April 2021, up 19% M-o-M, mainly led by 21% M-o-M growth in two-wheeler exports.

Passenger vehicle demand remained resilient in April 2021 and witnessed the least decline, benefitting from the increased consumer preference for personal mobility.

The domestic PV market continues to see an increasing shift towards utility vehicles (UVs), which accounted for 42% of domestic PV sales (April 2019: 30%).

While volumes in the UV segment declined by 11% M-o-M (increased by 47% compared to April 2019), passenger car volumes also declined by 10% M-o-M and by 12% from April 2019, led by a 14% M-o-M fall in the sales volume of compact cars.

Motorcycle and scooter sales fell 34% and 33% M-o-M, respectively, in April 2021. The 2-wheeler segment is price-sensitive, and hence, impacted more by the increased cost of ownership amid price hikes by OEMs, coupled with historically high fuel prices in India.

This is apparent in the 36% M-o-M decline in the sales volume of the more price-sensitive entry-level motorcycles under 125cc.

Demand has also been adversely affected due to schools and colleges remaining closed, which typically restart during the first quarter. Volumes were also impacted by maintenance shutdowns undertaken by the largest two-wheeler OEM, Hero MotoCorp, in a phased manner from 22 April 2021.

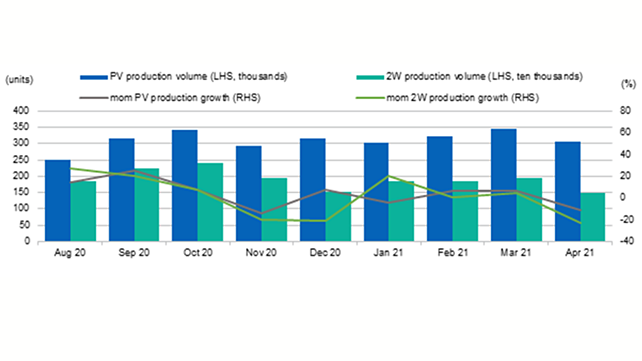

The total production (excluding CVs) decreased 21% M-o-M, led by an 11% and 23% M-o-M decline in the production levels of passenger vehicles and two-wheelers, respectively, in April 2021.

Three-wheeler production was at 86% of the previous month’s level, amid lower demand in domestic markets. Inventory at the dealership levels for PVs increased to 15-17 days (March 2021: 10-15 days).

In addition to the shutdown of dealerships due to the lockdown, Ind-Ra expects that the increase is due to OEMs replenishing inventory with dealers, in view of the supply chain issues witnessed in Q4FY21.

Inventory at two-wheeler dealerships remained steady at 30-35 days at end-April 2021.

Retail sales also declined in April 2021 – with passenger vehicle and two-wheeler volumes declining 25% and 28%, respectively, on an M-o-M basis.

The decline follows a sustained uptick in demand across most segments over December 2020-March 2021, suggesting a dampening of the improving consumer sentiments.