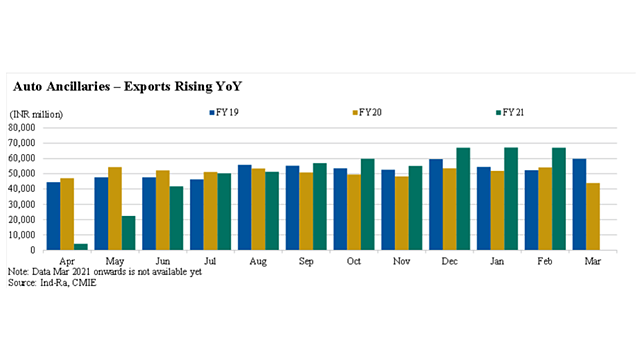

Marred by local lockdowns and shutting of OEMs’ plants to divert oxygen for medical supplies, the auto ancillary industry has partially offset the sluggish domestic sales from April to June of the ongoing financial year, says India Ratings and Research (Ind-Ra).

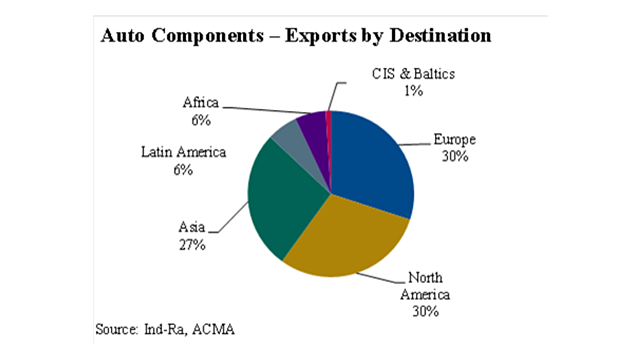

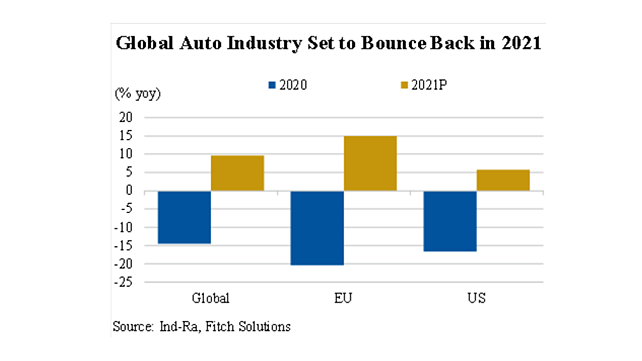

Export demand remains buoyant as most overseas geographies see traction in demand though overall sales are being affected by global supply chain issues. Moreover, the key export markets are not facing the spread of infection as severe as India.

As per Ind-Ra’s discussions with rated industry players, the heavy domestic demand in Q3-Q4FY21 had resulted in a backlog in servicing export orders, which is being serviced by auto ancillaries at present. The export demand overall remains comparable to that witnessed in Q4FY21.

Ind-Ra believes that auto ancillaries would see a materially lower revenue in Q1FY22, following a strong turnaround in H2FY21.

The second COVID wave leading to localised lockdowns has impacted the economic activity, resulting in shutdowns/ advancement of maintenance activities at the vehicle makers’ plants, causing lower volume offtake from ancillaries.

Ind-Ra opines the industry will see pent-up demand in the subsequent quarters if the lockdowns are lifted from end-June, which could compensate for the loss of revenues in Q1.

The rating agency also expects a bounce-back in the aftermarket demand once the lockdowns are eased. However, if the lockdowns remain in force for a longer duration, there could be a downside risk to Ind-Ra’s revenue growth estimate of 18%-20% YoY for FY22.

The focus on cost-cutting measures and better cash flow generation over H2FY21 and financing through the lower-cost emergency credit line guarantee scheme loans in FY21 has resulted in better liquidity for sector companies versus year-ago levels.

Ind-Ra does not foresee any major negative rating actions unless there is material stress to the credit profiles of the rated entities.

Weak economic activity & consumer sentiments amid rising infections dampen the demand; Ind-Ra expects that sector revenues in Q1FY22 would be 50%-60% of those recorded in Q3-Q4FY21 while remaining exposed to downside risks relating to the instances of infections and severity of restrictions.

The research agency expects the domestic demand in June could be similar to May.

Outlook

Ind-Ra also expects that the demand lost in Q1FY22 from OEMs is likely to be deferred to the following quarters. Hence, the agency does not expect a sharp change to its forecast of revenue growth of 18%-20% YoY for FY22, assuming that the restrictions are lifted by the end-June. Ind-Ra could consider a downward revision in the same subject to the restrictions continuing beyond June or in case of the third wave of infections.