The Indian two-wheeler segment hasn’t seen any recovery in sales ever since the national lockdown was announced last year. Amid the second wave of the COVID-19 pandemic, two wheeler-dealers wonder if demand will revive back to pre-COVID levels.

There were green shoots around the festive season, but there is no sequential demand for two-wheelers as observed in the passenger vehicle segment or tractor segment, which climbed new highs in the last fiscal, observed the Federation of Automobile Dealers Associations (FADA).

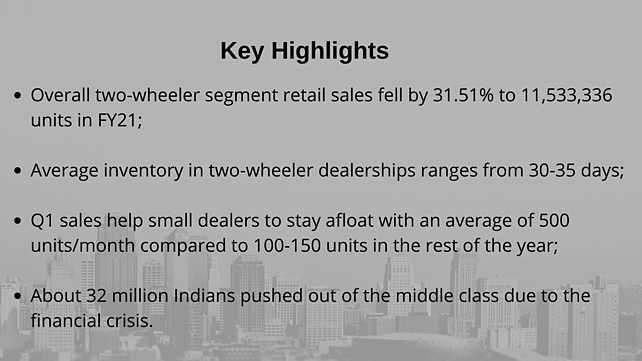

The overall two-wheeler segment retail sales fell by 31.51% to 11,533,336 in FY21 as against the 16,838,965 units sold in FY20, as per data released by FADA.

Deeply Affected

Vinkesh Gulati, President, FADA in an exclusive interaction with Mobility Outlook said, “The two-wheeler segment did not even revive back after the first COVID attack unlike PVs, which saw a good bounce back on the rise of personal mobility and new launches. The two-wheeler segment was already down by 30-35% last year, and is deeply affected this time as well as the virus has reached rural turf.”

He added, “Dealers in Tier II, Tier III cities and rural areas are small dealers, who are impacted because of the negative consumer sentiment. They are now facing viability issues as Q1 is important for them to do good numbers for the whole year. On an average, these dealers do 100-150 unit sales in a month. But in Q1, due to crop harvesting, festive season and marriages, they used to sell about 500 units a month before COVID happened.”

Q1 FY21 was a complete washout, and May this year being under staggered lockdown, will once again impact two-wheeler sales, Gulati said.

According to Pew Research, financial woes brought by COVID-19 have pushed about 32 million Indians out of the middle class, undoing years of economic gains. This had its impact on two-wheelers as it saw one of its steepest de-growth in the last few months. This coupled with high fuel prices and price increase acted as a double whammy. It not only created havoc in the entry-level customers’ mind but also kept them away from visiting showrooms.

Industry experts highlight that in the urban areas, many customers are holding back their vehicles and not upgrading to newer vehicles owing to the financial crisis.

Apart from the weak consumer sentiment, 80% of the automobile market is under lockdown and even in the rest of the market the fear of virus is gripping the dealership operations. Many dealers had stocked up assuming bumper sales during the Navratri celebrations and marriage season last year.

Two-wheeler dealer inventory is at an all-time high of 30-35 days at present. Unlike last year, when the industry was transitioning from BS IV to BS VI, there was almost nil inventory for two wheeler-dealers. Inventory carrying cost is huge for dealers. Last year, there was a lot of relief in the form of the moratorium and interest benefits, Gulati said.

Fervent Appeals

FADA has appealed to all automobile manufacturers to handhold their dealers the way they did during the last wave of COVID in 2020 and not burden them with high inventory. The apex body of dealers has also requested the Central Government to announce a financial package in terms of moratorium, and the RBI to release guidelines for relaxation of loan repayment equivalent to the number of days of lockdown each State has declared.

FADA expects to reach the highs of FY19, from the lows of FY21, only by FY23.