The Federation of Automobile Dealers Associations (FADA) has released its October 2024 vehicle retail data showing a substantial 32% year-on-year (YoY) growth across all segments and a 64% increase month-on-month (MoM). The month’s strong performance was heavily influenced by the convergence of key festivals, Navratri and Diwali, which together account for nearly a third of India’s annual vehicle sales. With these major festivities falling in October the retail data reflects the boosted consumer demand backed by an uptick in rural spending.

Growth In 2W & PV Segments

Two-wheelers (2W) led the retail growth with a sharp 36% YoY increase and an even higher 71% MoM increase driven largely by rural market demand. Attractive festive offers, the launch of new models, and improved stock availability further spurred sales. Favourable monsoons and higher crop yields strengthened rural purchasing power contributing to this segment’s robust performance. FADA’s data highlights the role of rural markets in boosting two-wheeler demand which shows positive sentiment across both rural and urban regions.

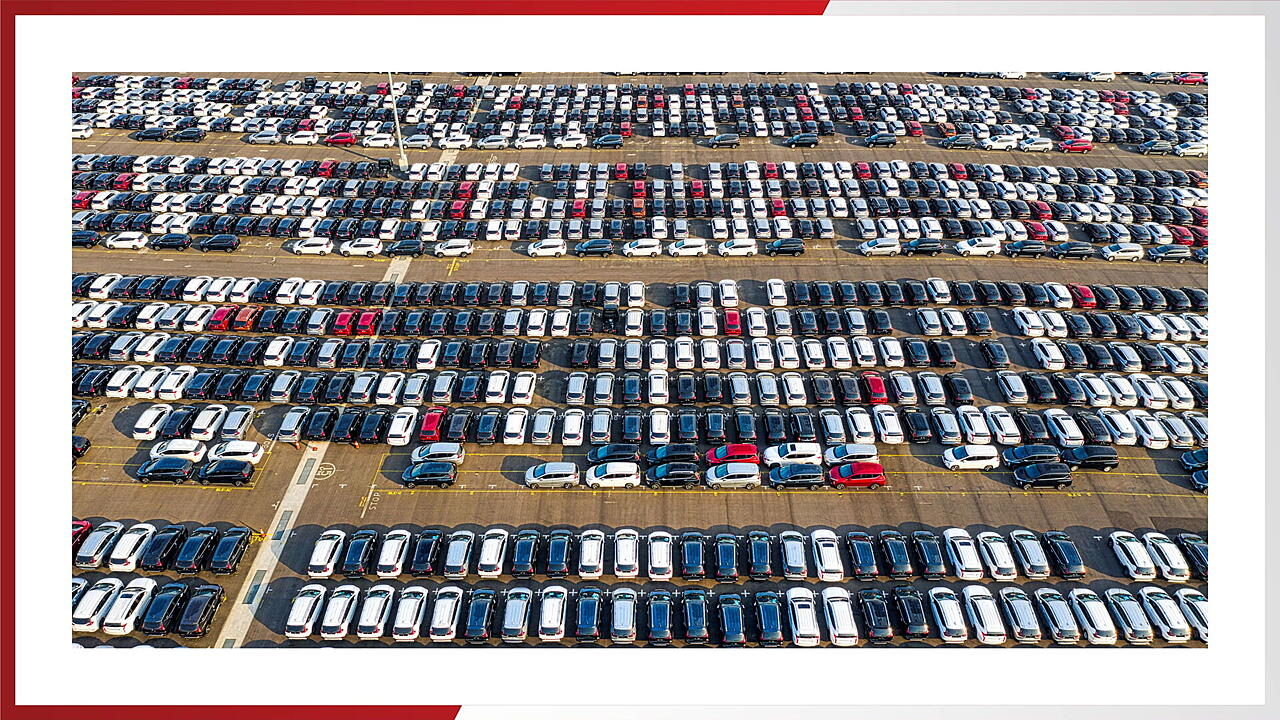

Passenger vehicles (PV) also experienced significant growth, registering a 32% YoY and 75% MoM rise. The demand surge was fuelled by aggressive festive discounts, new model introductions, and sustained interest in SUVs, although the high inventory levels, at 75–80 days, remain a concern. This inventory build-up may lead to continued discounts as dealers seek to manage stock levels through the end of the calendar year.

Modest Growth In CV & Trac Segments

The commercial vehicle (CV) segment saw a modest 6% YoY growth aided by demand from the agricultural sector and bulk container purchases. This growth was tempered by persistent challenges, including sluggish construction activities, higher vehicle prices, and financial constraints among buyers. Despite the slight improvement during the festive season, dealers remain cautious about post-festivity demand and the potential impact of economic headwinds on this segment.

Tractor sales showed minimal growth at 3% YoY reflecting mixed conditions in the agriculture sector. Although improved crop yields and supportive rural market sentiment helped, the segment continues to face constraints from fluctuating demand and external economic pressures.

Wedding Season Expected To Further Boost Near-Term Demand

The upcoming wedding season in November and December is projected to support continued growth in the two-wheeler and passenger vehicle segments. FADA estimates that around 4.8 million weddings will take place across India in the coming months, traditionally a peak period for vehicle sales especially for two-wheelers and compact passenger vehicles. With positive crop yields and buoyant rural market sentiments the outlook remains optimistic.

Potential challenges persist, particularly in managing PV inventory levels, which may result in excess stock and prolonged discount periods. FADA has urged OEMs to adjust supply levels to prevent overstocking, a critical factor as the year-end approaches. In the commercial vehicle segment dealers are cautious due to ongoing economic constraints, slow construction activity, and the potential for demand softening post-festivity.

Strategic Inventory Management Needed To Sustain Growth

The two-wheeler and passenger vehicle segments are expected to benefit from the upcoming wedding season, though careful inventory management will be essential to sustain momentum. The commercial vehicle segment faces ongoing challenges and the tractor segment remains constrained by sector-specific fluctuations. FADA’s report highlights the need for cautious optimism as the industry navigates the remainder of the year amid both opportunities and pressures on inventory and economic stability.

Also Read

Sustainable Profitability Is Key For Auto Dealerships: FADA President Vigneshwar