Maruti Suzuki India will issue equity shares on a preferential allotment basis to parent company, Suzuki Motor Corporation (SMC), as part of its intent to take over 100% control in Suzuki Motor Gujarat (SMG).

The Board, in its meeting on July 31 had approved termination of the contract manufacturing agreement with SMG and acquiring its shares from SMC.

The Maruti Suzuki Board then looked at the options of either payment in cash or issuing equity shares on a preferential allotment basis before opting for the latter as the best way forward.

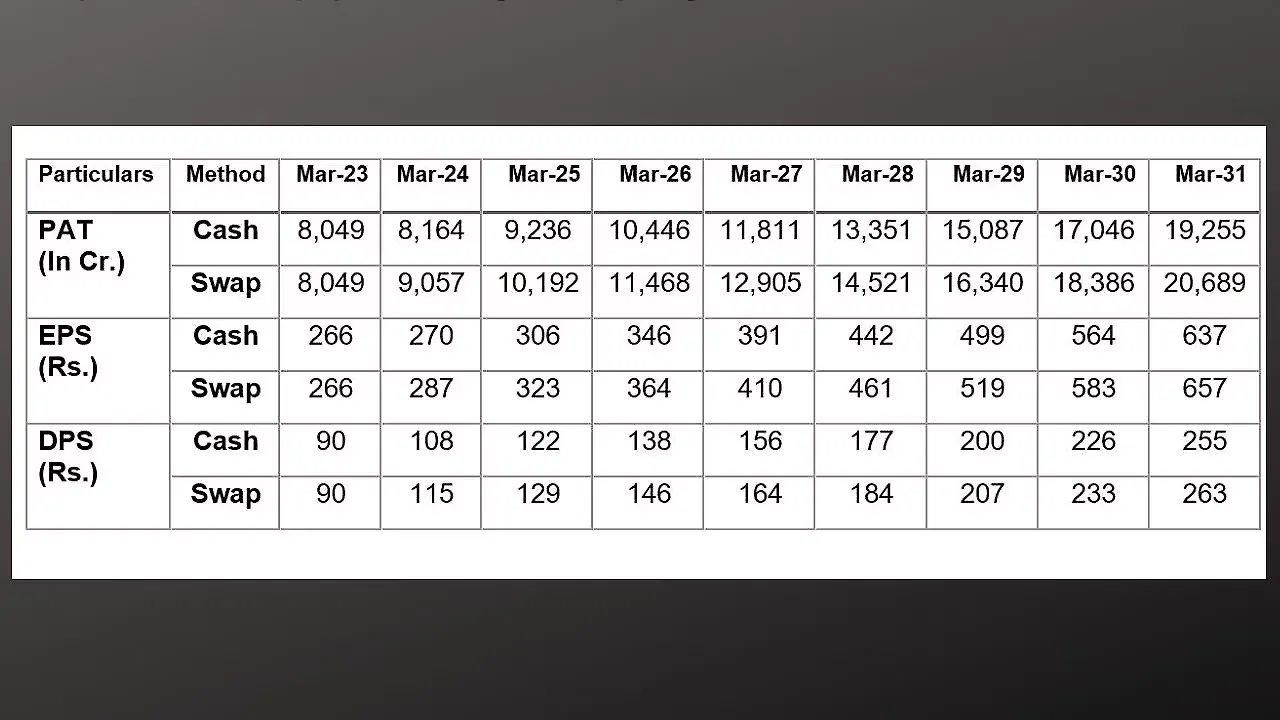

The impact of both options on its profitability, earnings per share and the dividend payment to shareholders was considered for each year up to 2031 (see table).

The data showed that a) Maruti Suzuki’s profit after tax would be higher in the share swap option each year increasing by over INR 1,400 crore in FY31; b) the EPS would be higher in the swap option starting from INR 7 per share and going up to INR 20 per share in FY31; and the dividend payable, with the same payout ratio would also be higher in the swap option.

This is because, in the swap option while there is a continued additional earning of interest income, the equity dilution is very low. The Board therefore concluded that the option of acquiring SMG shares by issue of Maruti Suzuki shares to SMC would ‘clearly be beneficial to minority shareholders and to MSIL’.

According to the press release, there are some assumptions and disclaimers that need to be factored in. One, PAT for FY23 is actual and future figures are based on an assumed 12.5% growth each year.The PAT figures are not to be taken as Maruti’s projections of profit. Cash profit is lower because of loss of interest income. The difference between swap and cash PAT would occur under different growth rates of profit also.Two, the total number of shares of Maruti Suzuki after swap, are based on book value of SMG at end of FY23 and the company’s share price of June 30, ’23. The actual would depend on when the date of the EGM/postal ballot is fixed by the Board. The comparison would be similar.

Three, the dividend amount is based on a 40% payout ratio on assumed PAT. Results would be similar on a different payout ratio. Finally, an interest rate of 7% is assumed.Further it was decided that minority shareholders’ approval would be sought at an EGM or through postal ballot on a date to be fixed for i) terminating the contract manufacturing agreement; ii) acquiring SMG shares from SMC; and iii) approving this acquisition by issue of MSIL equity shares equal to the book value of SMG as calculated according to the contract pact and subject to relevant valuation reports.

The approval of all shareholders would be sought at the same EGM or through postal ballot for issue of equity shares on preferential basis to SMC.

Also Read:

Maruti Suzuki Smart Finance Reaches One Million Loans Milestone

Maruti Suzuki Driving School Surpasses Two Mn Learners Milestone