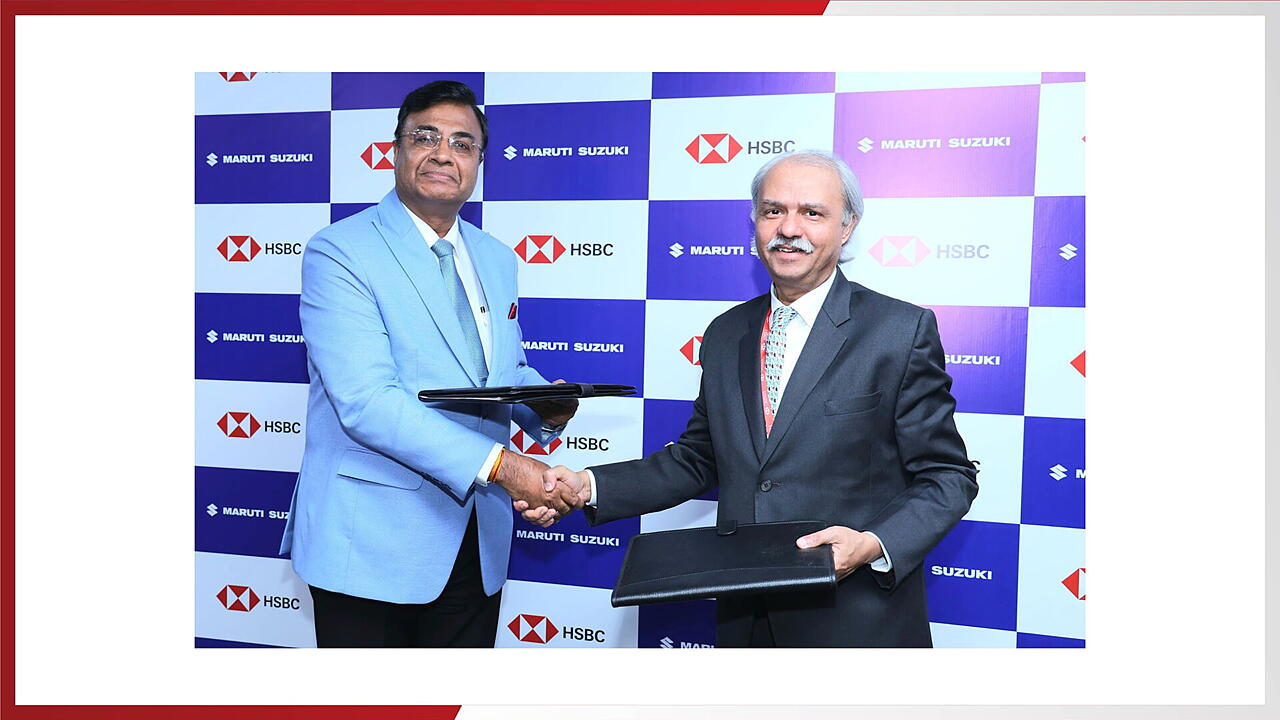

Maruti Suzuki India Limited (MSIL) has entered a strategic partnership with HSBC India to offer comprehensive inventory funding solutions for its extensive network of over 4,000 sales outlets across India. Under this new agreement, HSBC India will provide financing options to support Maruti Suzuki dealers in meeting their working capital needs, enhancing their ability to manage inventory and better respond to changing market demands. This Memorandum of Understanding (MoU) was signed by senior executives from both companies, marking an important step in supporting India’s leading automotive network with innovative financial solutions.

The MoU was signed in the presence of Partho Banerjee, Senior Executive Officer for Marketing & Sales at Maruti Suzuki, along with other top executives from both organisations. Banerjee highlighted the importance of this collaboration, stating, “We are committed to supporting our dealers in ensuring they are prepared for evolving customer and market needs. Our collaboration with HSBC India aims to deliver innovative financing solutions tailored specifically to our dealer network.” He further emphasised that this alliance leverages the strengths of Maruti Suzuki and HSBC to provide vital working capital solutions for dealers nationwide, enabling them to remain competitive and responsive.

Ajay Sharma, Head of Commercial Banking, HSBC, noted that the bank’s deep understanding of business dynamics within India’s automotive sector would help address the unique needs of Maruti Suzuki dealers. Sharma added, “Our tailored product offerings will enable us to support dealers through each stage of their business growth, ensuring they have the resources needed to thrive in a demanding market.”

This partnership arrives at a time when inventory management is increasingly critical for automotive dealers, who must adapt to shifts in demand, regulatory changes, and market fluctuations. With HSBC India’s financial backing, Maruti Suzuki dealers are expected to benefit from improved cash flow flexibility, allowing them to optimise their inventory levels and operational efficiency.

Also Read

The New Maruti Dzire Is Playing A Familiar And Time-Tested Tune