In a milestone performance that underscores its market dominance, Maruti Suzuki India Limited (MSIL) closed FY25 with its highest-ever annual sales, reaching a total of 2,234,266 units. This figure includes record domestic sales of 1,795,259 units and record exports of 332,585 units, showcasing the brand’s growing reach both within India and across global markets. MSIL has achieved a landmark production feat by surpassing 2 million units in a single year for the first time in its history—underscoring its growing scale, operational efficiency, and global competitiveness.

In March 2025 alone, MSIL sold 192,984 vehicles, comprising 153,134 units in the domestic market, 6,882 units to other OEMs, and 32,968 units for export.

Commenting on the strong performance, Partho Banerjee, Head of Sales & Marketing at MSIL, stated, “We achieved an all-time high in both wholesale and retail numbers. A major focus this year was helping our dealer partners manage inventory more efficiently, which we supported by driving strong retail growth.”

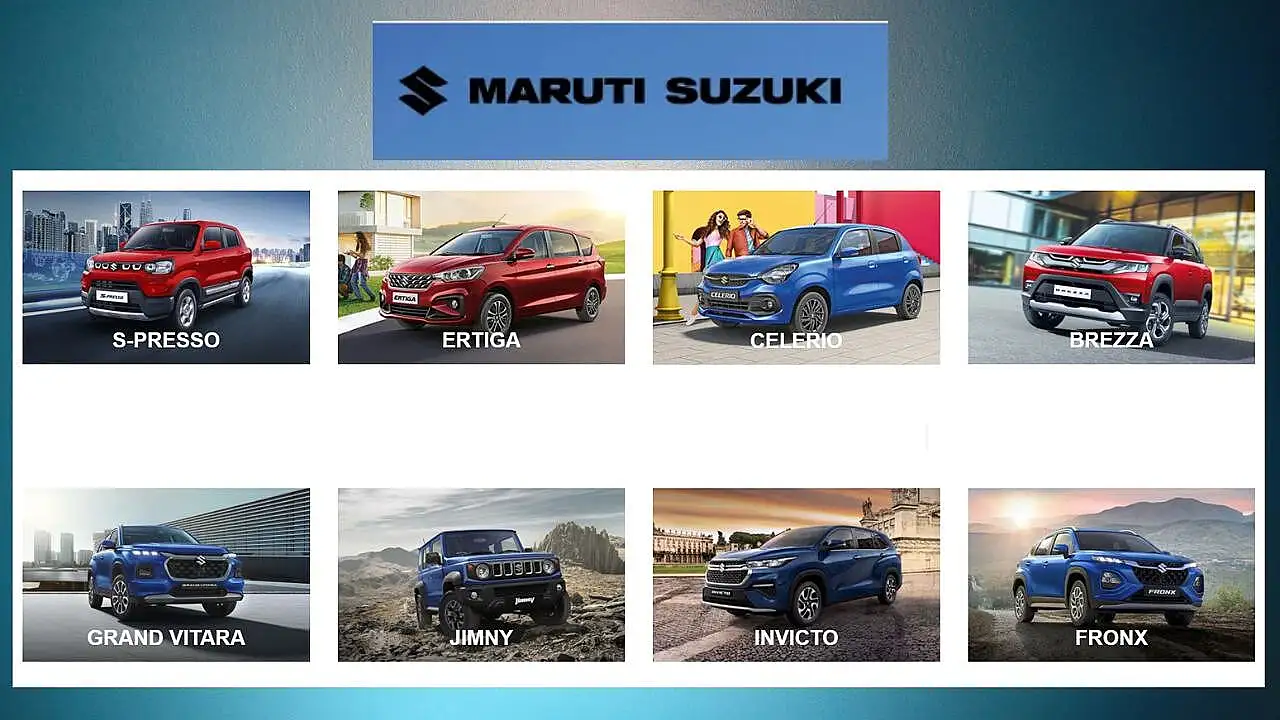

A standout achievement for the brand was placing seven models in the industry’s top 10 best-sellers, reinforcing its product appeal and market leadership.

The company also saw noteworthy growth in rural markets, expanding its network to over 150 new upcountry locations, leading to a 10% increase in rural sales. This expansion strategy has been key to tapping into underpenetrated regions and sustaining long-term growth.

On the global front, MSIL's exports soared by 17.5% over the previous year’s figure of 283,067 units, as the company continued to strengthen its presence in key international markets.

Reflecting on the company’s record-setting performance, Rahul Bharti, Executive Director, Corporate Affairs at MSIL, highlighted the significant leap in export volumes: “Against our forecast of 3 lakh units, we successfully exported 3.3 lakh vehicles in FY 2024-25. That’s nearly a three-and-a-half times growth in just four years.”

This remarkable export surge has repositioned the OEM from a domestic champion to a formidable global player. While exports accounted for just 5.8% of overall volumes in FY 2018-19, the share rose sharply to 15% in FY 2024-25—a testament to the company’s expanding global footprint and the growing acceptance of made-in-India vehicles, he pointed out.

MSIL has also retained its crown as India’s number one passenger vehicle exporter for four consecutive financial years and four consecutive calendar years, commanding a dominant 43% share of the export market. The company’s consistent focus on quality, cost-efficiency, and wide model appeal has enabled it to strengthen its export strategy while maintaining leadership in India’s competitive automotive landscape, Bharti added.

Maintaining Market Stronghold

Even in a year marked by intense competition and over ten new model launches across segments, MSIL has successfully held its ground, maintaining its market share and reinforcing its position as India’s top carmaker.

At the forefront of this success is the WagonR, which continued its reign as the top-selling model in the country, with 1,98,451 units sold in FY25. Interestingly, the demand was fairly balanced—51.2% of WagonR sales came from urban areas, while the remaining were driven by the growing aspirations of rural consumers. Meanwhile, the Alto K10 remained a steady performer, finishing 15th on the overall sales chart with 1,02,232 units sold.

Banerjee said, the company maintained its market share compared to last year. Despite the flood of new models in the market, its core strength—wide product availability across segments—continues to resonate with Indian consumers.

Emphasising a customer-first and technology-agnostic approach, Banerjee added, “It’s vital for us to be present across all form factors—compact cars, sedans, and SUVs. We believe in offering every possible option to our customers. We’ve also announced our entry into the electric vehicle space with the E-Vitara, showcased at the Bharat Mobility Global Expo. Our strategy is not about backing one technology, but ensuring we cater to every customer preference.”

Charts Cautious Path In EV Transition

As the vehicle maker continues to evolve with shifting market dynamics, the company has made a strategic decision to discontinue production of the Ciaz sedan, citing current market trends. Speaking on the development, Banerjee noted, “We have taken a call to stop production for now. A future decision will be based entirely on market requirements.”

Turning attention to electric vehicles, Banerjee offered a candid view on the current limitations of EV adoption in India. “At present, the EV is still a secondary car in most households, not the primary one,” he explained. “Customers continue to raise valid concerns around driving range, public charging infrastructure, and after-sales service. Unless these core issues are addressed, the EV will remain a secondary vehicle—and as a result, the volumes will grow gradually, not rapidly.”

He stressed that the onus doesn’t lie solely with the government. “It is equally the responsibility of OEMs to instill confidence in customers by ensuring a hassle-free EV experience. That’s exactly the mindset with which Maruti is approaching this space—our goal is to make the electric vehicle viable as a primary car,” he added.

On the overall outlook for FY26, Banerjee remained pragmatic, stating, “We are not expecting very high growth next year,” adding that the company will maintain industry growth, which, according to SIAM, will be around 2%.

This clear-eyed strategy reflects Maruti Suzuki’s commitment to long-term customer trust and market readiness, as it balances its legacy strengths with measured steps into the electrified future.

Also Read:

Maruti Suzuki Begins Commercial Production At Kharkhoda Plant