Mahindra & Mahindra (M&M) reported a robust financial performance in Q3 FY25, with consolidated PAT surging 20% to INR 3,181 crore. The company's Auto and Farm businesses led the charge, delivering 16% profit growth, while Mahindra Finance’s AUM expanded by 19%. Tech Mahindra also witnessed impressive deal traction and EBIT improvement of 480 basis points, reinforcing the group's strong execution capabilities.

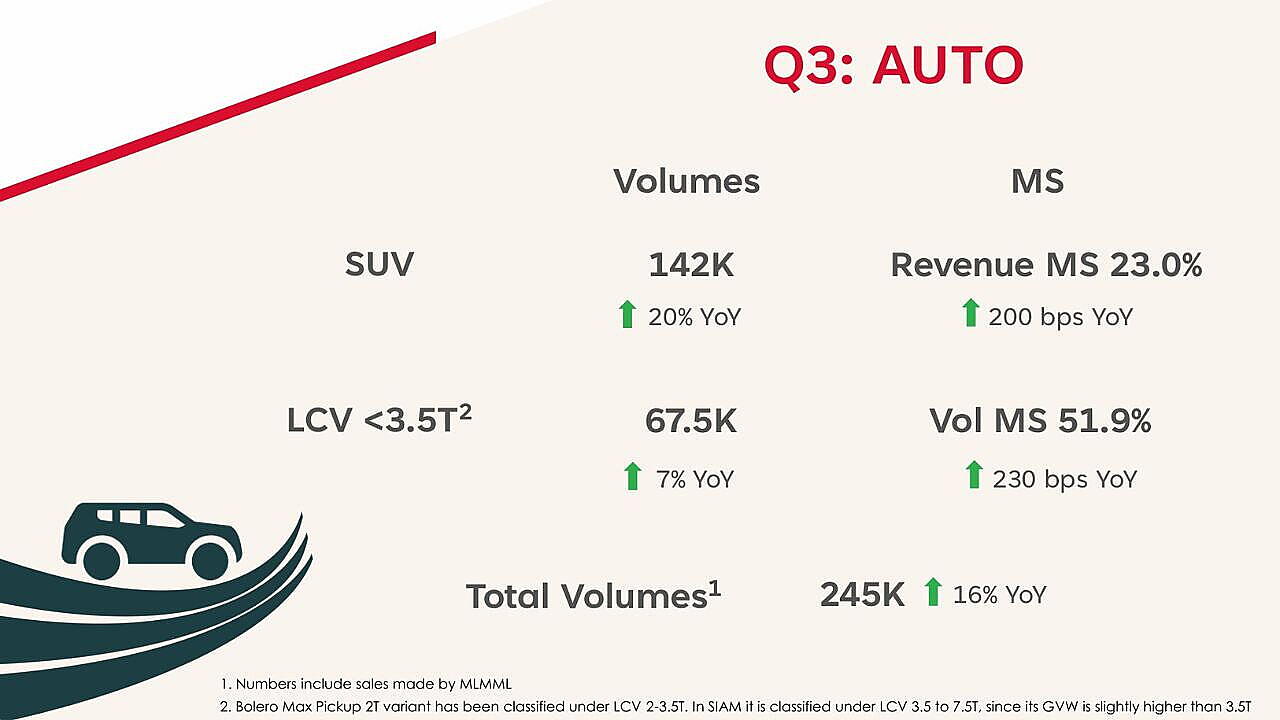

M&M's automotive division continued its strong growth trajectory, recording quarterly volumes of 245,000 units, up 16% year-on-year. Utility Vehicle (UV) sales reached 142,000 units, reinforcing the brand's leadership.

Standalone PBIT surged 37% to INR 2,167 crore, with PBIT margins improving by 120 basis points to 9.7%. On a consolidated level, revenue climbed 21% to INR 23,391 crore, while PAT grew by 20% to INR 1,438 crore.

The launch of the flagship Electric Origin SUVs, BE 6 and XUV.e9, along with Thar ROXX showcased M&M’s product innovation and market leadership. The company gained 200 basis points in SUV revenue market share and expanded its LCV < 3.5T market share to 51.9%, a 230 basis point gain year-on-year.

M&M’s Farm Equipment business delivered a record Q3 market share of 44.2%, with tractor volumes up 20% to 121,000 units. Standalone PBIT soared 42% to INR 1,479 crore, with margins expanding by 260 basis points to 18.1%. Consolidated revenue increased by 11% to INR 9,537 crore, while PAT rose 11% to INR 996 crore. The strong performance in the farm segment was driven by focused execution, an expanding product portfolio, and a favourable market environment, solidifying M&M’s position as a leader in the tractor industry.

M&M’s services sector also saw strong growth, with Mahindra Finance’s AUM increasing by 19%, GS3 at 3.9%, and standalone PAT surging 63%. Tech Mahindra’s EBIT margin improved by 480 basis points, with PAT rising 93%, signalling momentum in its transformation journey. Mahindra Lifespaces recorded INR 334 crore in residential pre-sales, though down 25%, while Mahindra Logistics revenue increased 14% to INR 1,594 crore. Club Mahindra's total income grew by 5% to INR 391 crore. Overall consolidated services revenue reached INR 9,607 crore, up 14%, while PAT rose by 34% to INR 747 crore.

Dr Anish Shah, Managing Director & CEO, M&M Ltd., highlighted the company’s execution strength, stating that Auto and Farm continue to deliver on growth and margins, while Tech Mahindra is gaining traction in transformation. MMFSL is balancing asset quality and growth, and the company’s ‘Growth Gems’ are progressing steadily. Rajesh Jejurikar, Executive Director & CEO (Auto & Farm), M&M Ltd., emphasised market leadership, stating that their flagship EV launches and leadership in SUV revenue market share reinforce an innovation-driven approach. Tractor market share hit an all-time high, and auto PBIT margins expanded 120 basis points year-on-year, underscoring strong execution.

Group CFO, Amarjyoti Barua, reiterated the company’s disciplined financial approach, stating that despite global headwinds, the Q3 results demonstrate strong execution across businesses. He added that the company remains committed to disciplined capital allocation for long-term shareholder value.

Also Read:

Mahindra Reveals BE 6 & XEV 9e Pack 3 Prices, Launches ‘Three For Me’ Scheme