Union Budget 2023-24 Begins

FM Nirmala Sitharaman Presents Union Budget 2023-24.

- The Minister proposes reduction of the highest surcharge rate to 25% in the new tax regime. Maximum tax rate down to 39%.

Relief for the Middle Class: Rebate to be increased from INR 5 lakh to INR 7 lakh. Five tax slabs introduced, which means more money in people's pockets.

- India today has the largest ecosystem of start-ups, says the FM. Further, the Minister announces extension of the date of incorporation for Income Tax benefits to start-ups from March 31, 2023 to March 31, 2024.

- MSMEs up to INR 2 crore turnover will get an enhancement of INR 3 crore as part of Income Tax relief, announces FM Sitharaman.

- 'I propose to reduce the number of basic custom duty rates on goods other than textiles and agriculture, from 21% to 13%. As a result, there are minor changes in the basic custom duties, cesses & surcharges on some items including toys, bicycles, automobiles,' Sitharaman says.

- Tax exemption on capital goods and lithium batteries announced.

- Minister Sitharaman announces GST exemption on CNG.

- Air Travel: Focus on tourism development likely to boost air travel to important tourist sites. Creation of theme-based tourist circuits and facilitation of rural infrastructure could benefit RCS/UDAN routes, says FM Sitharaman.

- Fiscal Deficit: The fiscal deficit is targetted to be 5.9% of the GDP in FY24. The Government intends to bring this down to 4.5% by 2025-26.

- Finance Minister Nirmala Sitharaman announces credit guarantee for MSMEs. Revamped scheme will kick off with INR 9,000 crore corpus.

- Skill India: 36 Skill India centres will be set up across states, and will be used to equip youth with abilities in drones and other emerging technologies, the Minister announces.

- Replacing all polluting vehicles is important, says the FM. 'We are adding funds to replace old polluting ambulances in the vehicle scrappage policy,' she announces.

- Shipping: Costal shipping will be promoted with energy efficient transportation for both passengers and cargo through PPP mode, announces the Minister.

- Ease of Doing Business: Over 39,000 compliance processes to be reduced for the industry.

- A Green Credit Programme will be notified under the Environment Protection Act, announces FM Sitharaman.

- Energy transition: An outlay of INR 35,000 crore has been commissioned for energy transition, announces the Minister.

- Energy transition: Our target is to reach green hydrogen production of 5 MMT by 2030, says the FM. Outlay of INR 19,700 crore.

- Good news for MSMEs: In cases of MSMEs that failed to abide by contracts during the COVID period, the government will return 95% of the forfeited amount.

- Government to set up three Centres of Excellence for Artificial Intelligence in top institutes.

- Spend of INR 10,000 crore annually on urban infrastructure development fund has been announced.

- The government has also identified 100 additional transport projects for critical sectors, says the FM.

- Minister Sitharaman announces that 50 new airports, helipads, waterports and aerodromes for additional transport needs.

- INR 2.40 lakh crore of oulay has been announced for railways, which is nine times higher than the outlay in 2013-14.

- FM Sitharaman announces that Capex outlay is being increased to INR 10 lakh crore, which is three times higher than 2019.

- FM Sitharaman announces agriculture accelerator fund for start-ups in rural areas.

- We are implementing many programmes for green mobility, green energy, among other green initiatives. 'Green growth among the top seven priorities of this years budget,' says FM.

- Economy has become a lot more formalised, says FM Sitharaman. There's a strong focus on job creation.

- G20 boosting India in global order, Sitharaman says. India's economy grew from 10th to being 5th largest now.

- FM Nirmala Sitharaman is presenting her 5th budget.

- World has recognised Indian economy as a bright star, says the Minister.

More Highlights From Economic Survey 2023

- India has reinforced the country’s belief in its economic resilience as it has withstood the challenge of mitigating external imbalances caused by the Russian-Ukraine conflict without losing growth momentum in the process.

- India’s stock markets had a positive return in CY22, unfazed by withdrawals by foreign portfolio investors. Inflation rate did not creep too far above its tolerance range compared to several advanced nations and regions.

- While commodity prices have retreated from record highs, they are still above pre-conflict levels. Strong domestic demand amidst high commodity prices will raise India’s total import bill and contribute to unfavourable developments in the current account balance.

- Entrenched inflation may prolong the tightening cycle, and therefore, borrowing costs may stay ‘higher for longer’. Global economy may be characterised by low growth in FY24 but this presents two silver linings – oil prices will stay low, and India’s CAD will be better than currently projected.

- India’s recovery from the pandemic was relatively quick, and growth in the upcoming year will be supported by solid domestic demand and a pickup in capital investment. Aided by healthy financials, incipient signs of a new private sector capital formation cycle are visible.

- Construction activity has significantly risen in FY23 as the much-enlarged capital budget (Capex) of the central government and its public sector enterprises is rapidly being deployed.

- Indian economy appears to have moved on after its encounter with the pandemic, staging a full recovery in FY22 ahead of many nations and positioning itself to ascend to the pre-pandemic growth path in FY23.

- Yet in the current year, India has also faced the challenge of reining in inflation that the European strife accentuated. Measures taken by the government and RBI, along with easing of global commodity prices, have finally managed to bring retail inflation below the RBI upper tolerance target.

- India’s economic growth in FY23 has been principally led by private consumption and capital formation and they have helped generate employment as seen in the declining urban unemployment rate and in the faster net registration in Employee Provident Fund.

- Moreover, the world’s second-largest vaccination drive involving more than 2 billion doses also served to lift consumer sentiments that may prolong the rebound in consumption. Still, private capex soon needs to take up the leadership role to put job creation on a fast track.

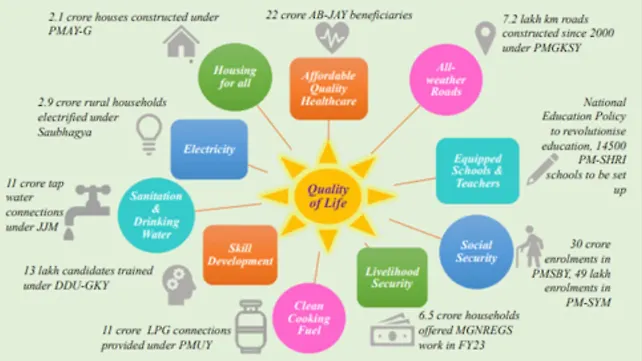

The Ecosystem of Quality Of Life

The Economic Survey also listed multifaceted initiatives by the government to improve the ecosystem of quality of life.

Economic Survey 2023 – Outlook for 2023-24

Dwelling on the Outlook for 2023-24, the Survey says, India’s recovery from the pandemic was relatively quick, and growth in the upcoming year will be supported by solid domestic demand and a pickup in capital investment. It says that aided by healthy financials, incipient signs of a new private sector capital formation cycle are visible and more importantly, compensating for the private sector’s caution in capital expenditure, the government raised capital expenditure substantially.

Budgeted capital expenditure rose 2.7 times in the last seven years, from FY16 to FY23, re-invigorating the Capex cycle. Structural reforms such as the introduction of the Goods and Services Tax and the Insolvency and Bankruptcy Code enhanced the efficiency and transparency of the economy and ensured financial discipline and better compliance, the Survey added.

Global growth is forecasted to slow from 3.2% in 2022 to 2.7% in 2023 as per IMF’s World Economic Outlook, October 2022. A slower growth in economic output coupled with increased uncertainty will dampen trade growth. This is seen in the lower forecast for growth in global trade by the World Trade Organisation, from 3.5% in 2022 to 1% in 2023.

On the external front, risks to the current account balance stem from multiple sources. While commodity prices have retreated from record highs, they are still above pre-conflict levels. Strong domestic demand amidst high commodity prices will raise India’s total import bill and contribute to unfavourable developments in the current account balance. These may be exacerbated by plateauing export growth on account of slackening global demand. Should the current account deficit widen further, the currency may come under depreciation pressure.

Entrenched inflation may prolong the tightening cycle, and therefore, borrowing costs may stay ‘higher for longer’. In such a scenario, global economy may be characterised by low growth in FY24. However, the scenario of subdued global growth presents two silver linings – oil prices will stay low, and India’s CAD will be better than currently projected. The overall external situation will remain manageable.

FM Meets President Droupadi Murmu

Office of President Droupadi Murmu has tweeted images of the Union Minister of Finance and Corporate Affairs Nirmala Sitharaman, Minister of State Dr Bhagwat Kishanrao Karad, Minister of State Pankaj Chaudhary and senior officials of the Ministry of Finance meeting her at Rashtrapati Bhavan before presenting the Union Budget 2023-24.

Bharat Needs A Boost

While urban India is seeing a surge in buying SUVs and cars, the rural landscape is still reeling from the realities of inflation and joblessness, and needs help from the budget if 2W sales have to grow.

Read our commentary 'For Automakers, Bharat Needs The Boost In Budget 2023' for a deeper insight.

Budget Live Updates

Even as recessionary pressures engulf many parts of the western world, and China continues to experience growth slowdown, India remains one of the markets with greater promise. Before the Economic Survey 2023 was announced on Tuesday, even Prime Minister Narendra Modi said that the world has its eyes on India’s Budget amid global gloom.

What were some of the highlights of the Economic Survey 2023?

- - India to witness GDP growth of 6-6.8% in 2023-24, depending on the trajectory of economic and political developments globally.

- - Economic Survey 2022-23 projects a baseline GDP growth of 6.5% in real terms in FY24.

- - Economy is expected to grow at 7% (in real terms) for the year ending March 2023; this follows an 8.7% growth in the previous financial year.

- - Credit growth to the Micro, Small, and Medium Enterprises (MSME) sector has been remarkably high, over 30.5%, on average during Jan-Nov 2022.

- - Capital Expenditure (CAPEX) of the Central Government, which increased by 63.4% in the first eight months of FY23, was another growth driver of the Indian economy in the current year.

- - RBI projects headline inflation at 6.8% in FY23, which is outside its target range.

- - Return of migrant workers to construction activities helped housing market witnessing a significant decline in inventory overhang to 33 months in Q3 of FY3 from 42 months last year.

- - Surge in growth of exports in FY22 and the first half of FY23 induced a shift in the gears of the production processes from mild acceleration to cruise mode.

- - Private consumption as a percentage of GDP stood at 58.4% in Q2 of FY23, the highest among the second quarters of all the years since 2013-14, supported by a rebound in contact-intensive services such as trade, hotel and transport.

- - Survey points to the lower forecast for growth in global trade by the World Trade Organisation, from 3.5% in 2022 to 1% in 2023.