Indian electric vehicle market maintained its upward trajectory in January 2025, recording retail growth across multiple segments. According to the Federation of Automobile Dealers Associations (FADA), the overall electric two-wheeler market share increased to 6.4 per cent from 6.1 per cent in December 2024 and 5.4 per cent in January 2024. The electric three-wheeler segment retained a dominant 56 per cent market share, while electric passenger vehicles and commercial vehicles saw a rise in retail sales.

In the electric two-wheeler segment, total sales stood at 97,734 units, reflecting an 18.97 per cent year-on-year increase and a 33.20 per cent month-on-month rise. OLA Electric led the market with 24,336 units sold, marking a 76.72 per cent increase from December but a 24.94 per cent decline from January 2024. TVS Motor Company followed with 23,809 units, reporting a 38.17 per cent month-on-month growth and a 55.03 per cent rise from the previous year. Bajaj Auto recorded an impressive 95.67 per cent year-on-year growth, selling 21,310 units. Ather Energy and Greaves Electric Mobility also posted strong numbers, with 12,906 and 3,611 units, respectively. River Mobility saw a staggering 1293.02 per cent year-on-year growth, albeit from a low base, selling 599 units compared to 43 units in January 2024.

The electric three-wheeler segment continued to dominate, with 59,959 units sold in January, reflecting a modest 12.15 per cent year-on-year increase and a marginal 0.89 per cent growth from December. Mahindra Group led the category with 6,147 units, marking a 31.66 per cent increase from January 2024. Bajaj Auto recorded the highest growth at 239.33 per cent year-on-year, selling 5,358 units. Other notable contributors included YC Electric Vehicle (3,882 units) and Saera Electric Auto (2,270 units). However, some players, including Dilli Electric Auto and Mini Metro EV, saw a decline in sales.

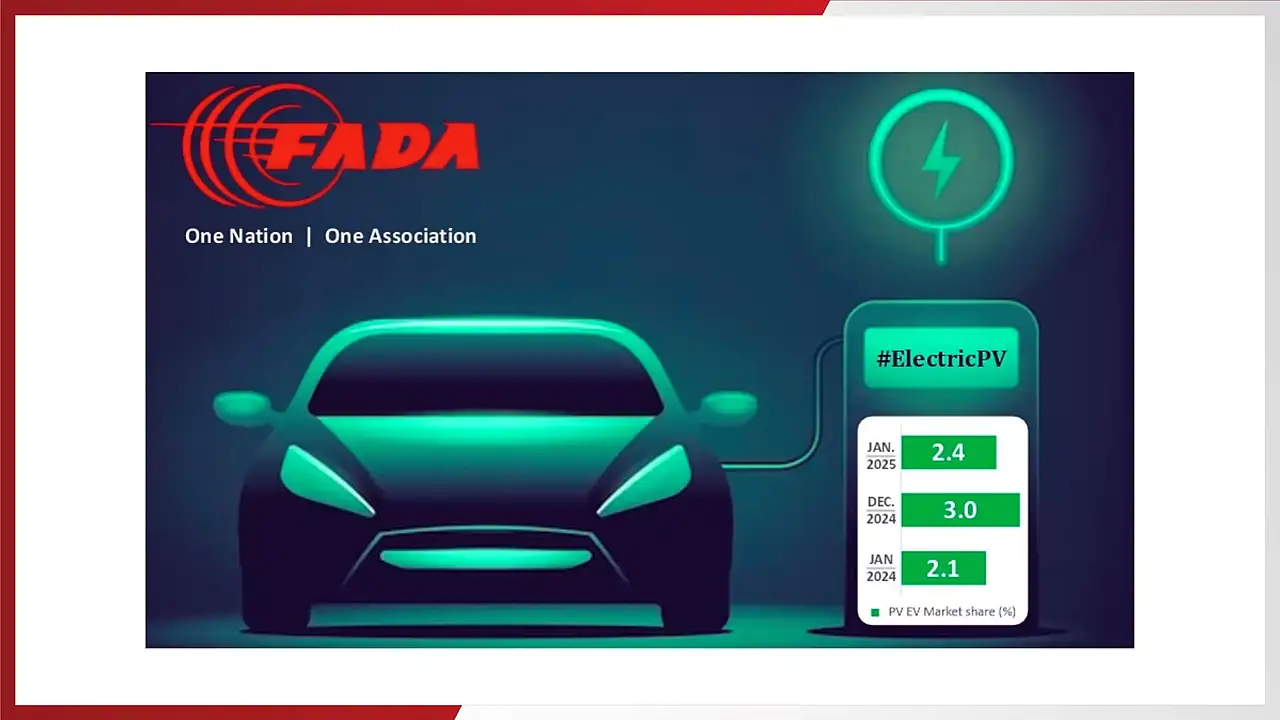

Electric passenger vehicle sales reached 11,266 units in January 2025, marking a 32.28 per cent year-on-year increase and a 27.70 per cent rise from December. Tata Motors led the market with 5,047 units, reporting a 24.71 per cent month-on-month growth but a 13.01 per cent decline compared to January 2024. MG Motor India posted a significant 252.20 per cent year-on-year growth, selling 4,237 units, up from 1,203 units a year earlier. Mahindra & Mahindra recorded 688 units, while Hyundai surged to 321 units from just 19 units in December, reflecting a remarkable 1589.47 per cent increase. BYD India, BMW India, Mercedes-Benz, and Kia India also saw notable gains in sales.

The electric commercial vehicle segment registered 972 units, reflecting a 39.26 per cent month-on-month increase and a marginal 2.2 per cent year-on-year rise. Tata Motors led with 340 units, despite a 25.4 per cent decline from January 2024. Switch Mobility recorded 200 units, marking a 640.7 per cent year-on-year growth. Mahindra Group and PMI Electro Mobility Solutions also posted strong increases, with 128 and 68 units, respectively. JBM Auto reported the highest month-on-month growth at 380 per cent, but its sales remained lower than the previous year.

C S Vigneshwar, President, FADA, noted that the Bharat Mobility Global Expo had reinforced the focus on green-energy vehicles, and with over 30–35 new EV launches expected in 2025, market share across all segments is likely to expand further.

Also Read