The Federation of Automobile Dealers Associations (FADA) has released vehicle retail data for August 2024, showing a modest year-on-year (YoY) growth of 2.88%. However, this growth was uneven across different vehicle segments reflecting the varied challenges faced by India’s automotive sector. Weather-related disruptions, high inventory levels, and weak market sentiment have been significant obstacles, impacting vehicle sales across multiple categories.

Two-Wheeler Segment Grows Despite Weather Challenges

The two-wheeler (2W) segment recorded a 6.28% YoY growth in August, driven in part by improved stock availability and early signs of the festive season. However, on a month-on-month (MoM) basis, the segment saw a decline of 7.29%, primarily due to excessive rainfall and market saturation in certain regions. Customers also delayed purchases, anticipating new product launches or awaiting more favourable conditions. The monsoon season’s heavy rains, especially in flood-affected areas, further exacerbated the decline, leading to postponements in buying decisions. This highlights the fragility of the segment, which remains sensitive to both weather and consumer sentiment.

Passenger Vehicle Sales Decline Amid High Inventory Levels

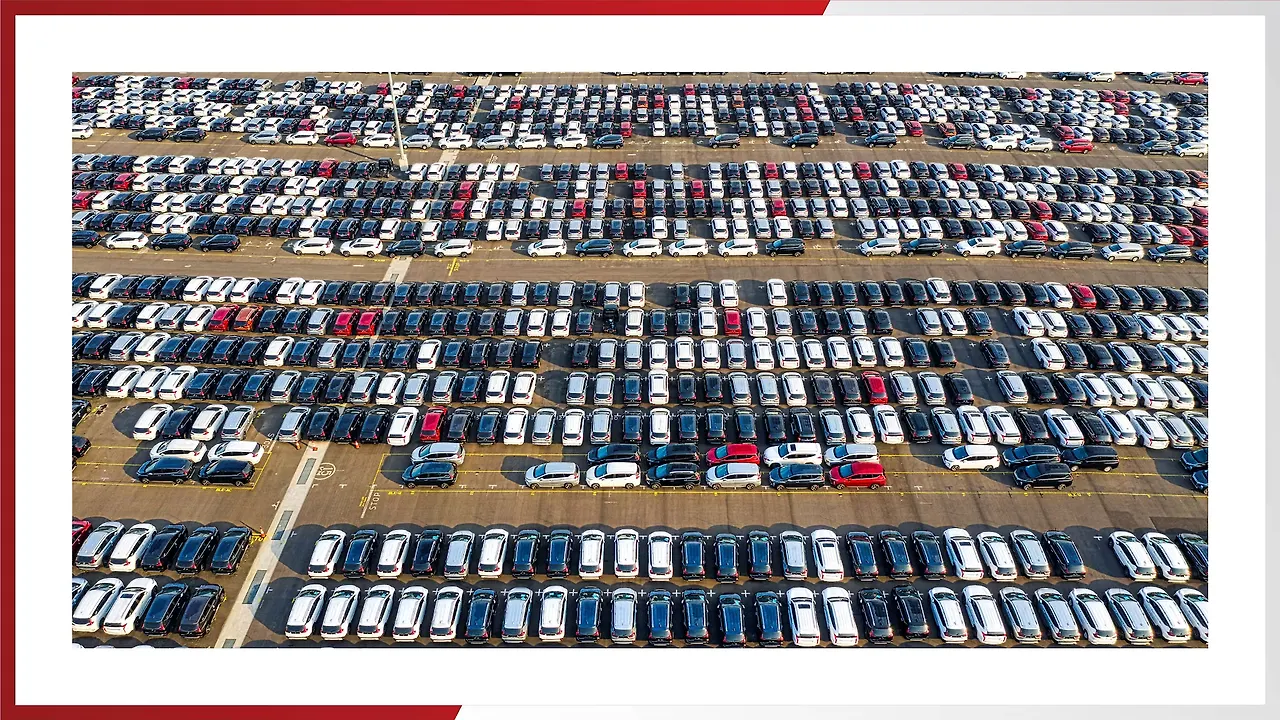

Passenger vehicle (PV) sales, in contrast, experienced a 4.53% YoY decline and a 3.46% drop from July 2024. This reduction is largely attributed to poor consumer sentiment and continued heavy rains. High inventory levels in the PV segment have also emerged as a major concern. Dealers are facing cash flow challenges due to the excessive stock, with inventory levels reaching 7.8 lakh vehicles, valued at INR 77,800 crore. FADA has raised an SOS signal, urging banks and non-banking financial companies (NBFCs) to curb funding to dealers with high inventories. Additionally, FADA is calling on original equipment manufacturers (OEMs) to adjust their supply strategies to prevent further stockpile issues.

Commercial Vehicle Segment Faces Decline In Sales

Commercial vehicle (CV) sales saw an 8.5% MoM decline and a 6.05% YoY drop, driven by several factors. Heavy rains and flooding severely impacted construction activities and industrial demand, key drivers of CV sales. Additionally, aggressive discounting practices by competitors and sluggish market sentiment have further strained the sector. The segment's decline reflects broader weaknesses in India's industrial output, highlighting the dependency of CV sales on external economic factors.

Agricultural Sector & Tractor Sales Hit by Excess Rainfall

Tractor sales experienced the steepest drop, with an 11.39% YoY and an 18.12% MoM decline. The decline was mainly due to excessive rainfall, which negatively impacted farming operations, particularly in regions dependent on stable weather conditions for crop growth. As agriculture is highly sensitive to weather fluctuations, the continuous rain disrupted both crop cycles and rural purchasing power, contributing to the slump in tractor sales.

Festive Season Offers Glimmer Of Hope But Risks Remain

Looking ahead, the Indian automotive industry faces a mix of challenges and opportunities. On the positive side, the upcoming festive season, including festivals like Ganesh Chaturthi and Navratri, is expected to boost consumer sentiment, particularly in urban areas. Additionally, favourable rainfall in some regions has improved agricultural prospects, which could help lift rural sales once the monsoon subsides.

However, there are also significant risks. The Indian Meteorological Department (IMD) has forecast continued heavy rains for September, which could further damage crops and weaken rural purchasing power. The Shraddh period, traditionally seen as an inauspicious time for purchases, is also likely to pause PV sales temporarily. High inventory levels and continued discounting pressures remain key concerns for dealers, particularly in the PV and CV segments, threatening profitability.

Strategic Inventory Management Key To Navigating Challenges

FADA’s data highlights the importance of strategic inventory management and targeted marketing efforts to navigate the current challenges. As the automotive industry approaches a critical festive season, dealers and OEMs must carefully balance supply with demand to avoid further inventory build-up. Additionally, proactive engagement with consumers, particularly in rural areas, will be crucial to maximising sales during the festive period.

Also Read

FADA, Frost & Sullivan Release 2024 Customer Experience Index