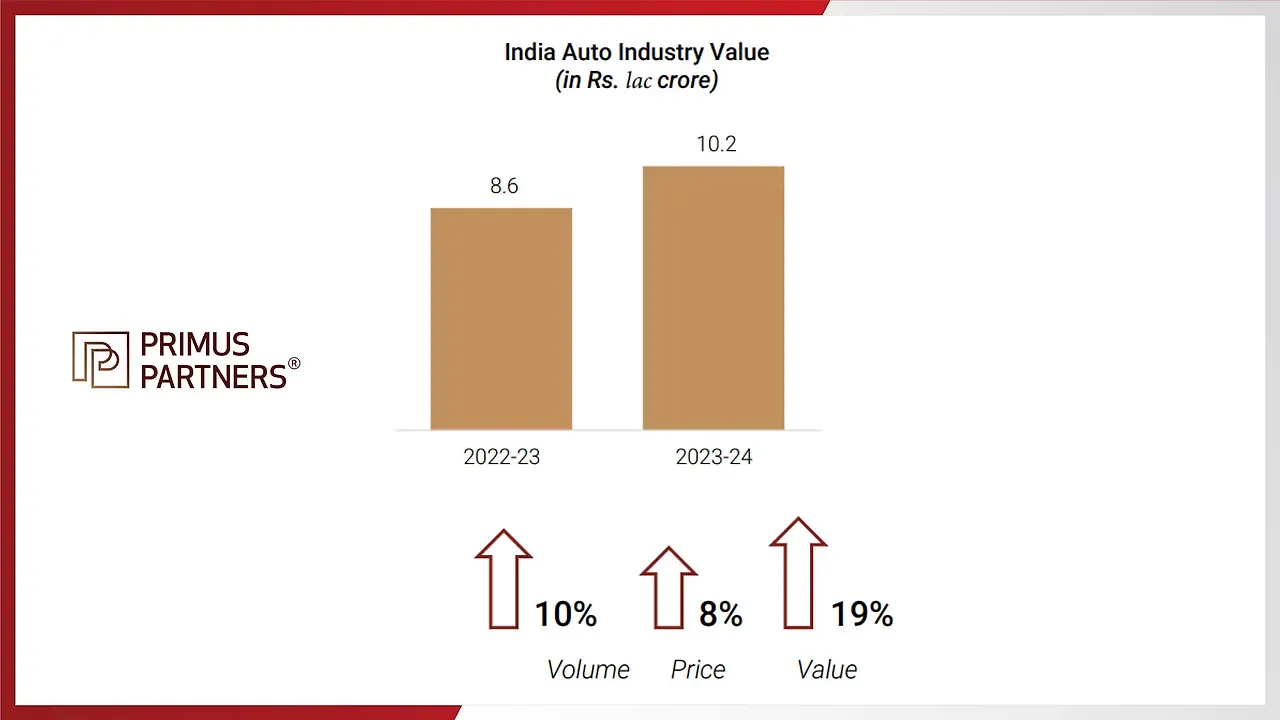

Primus Partners has unveiled their latest comprehensive analysis of the Indian automobile sector, the 'India Automobile Value Report – II.' This report highlights the growth of the industry during the fiscal year 2023-24, marking a 19% increase in value, reaching INR 10.22 lakh crore.

Key Findings

- Indian automobile industry experienced a 19% growth in value, totalling INR 10.22 lakh crore.

- Vehicle production, including two-wheelers, rose by 10%.

- The Utility Vehicle (UV) and Sport Utility Vehicle (SUV) segments saw a massive 39% increase in value, driven by a 23% rise in volume and a 16% increase in average prices.

- The passenger vehicle (PV) segment faced a 9% decline in volume, partially due to a slight price increase.

- The commercial vehicle segment contributes 18% to the industry’s total value.

India's automotive industry has demonstrated robust growth, with a notable increase of 10% in the number of vehicles produced. This growth is reflected in the SUV and UV segments, which have become increasingly popular among consumers. The report notes that these segments alone saw a 39% increase in value, highlighting the rising demand for these types of vehicles.

Anurag Singh, Managing Director of Primus Partners, stated “India is at the forefront of the global automobile market, moving towards higher-value, feature-rich vehicles. Consumer preferences and strong economic fundamentals are driving this transformation. The UV and SUV segments are becoming the preferred choice for many Indian consumers.”

The report highlights that the UV and SUV segments grew by 23% in volume and 16% in price, leading to a 39% overall increase in value. This trend is attributed to several factors, including a general rise in prices, a shift towards higher-end segments, and increased demand for hybrid and automatic vehicles. Additionally, features like sunroofs have become more popular, further driving up average prices.

Conversely, the PV segment saw a 9% decline in volume due to a slight price increase, resulting in a 4% drop in value. The two-wheeler segment, however, grew by 10% in volume and 13% in value, while the three-wheeler segment increased by 16% in volume and 24% in value. The commercial vehicle segment experienced a 3% rise in volume and a 7% increase in value.

The report also sheds light on India's standing in the global automotive market. Although India ranks third in terms of vehicle registrations, it trails behind countries like Japan and Germany in terms of value. The average price of vehicles in India remains lower compared to more advanced economies. Despite this, the value of the Indian automobile industry is growing at a faster rate than its volume, indicating a consumer shift towards higher, more expensive models across various segments.

In 2023-24, India produced 2.8 crore vehicles, with two-wheelers dominating production numbers at 76%. Four-wheeler passenger vehicles generated the highest value share, contributing 63% to the industry’s total value of INR 10.22 lakh crore. The commercial vehicle segment accounted for 18% of the industry’s value, driven by higher-priced vehicles such as trucks and specialty vehicles.