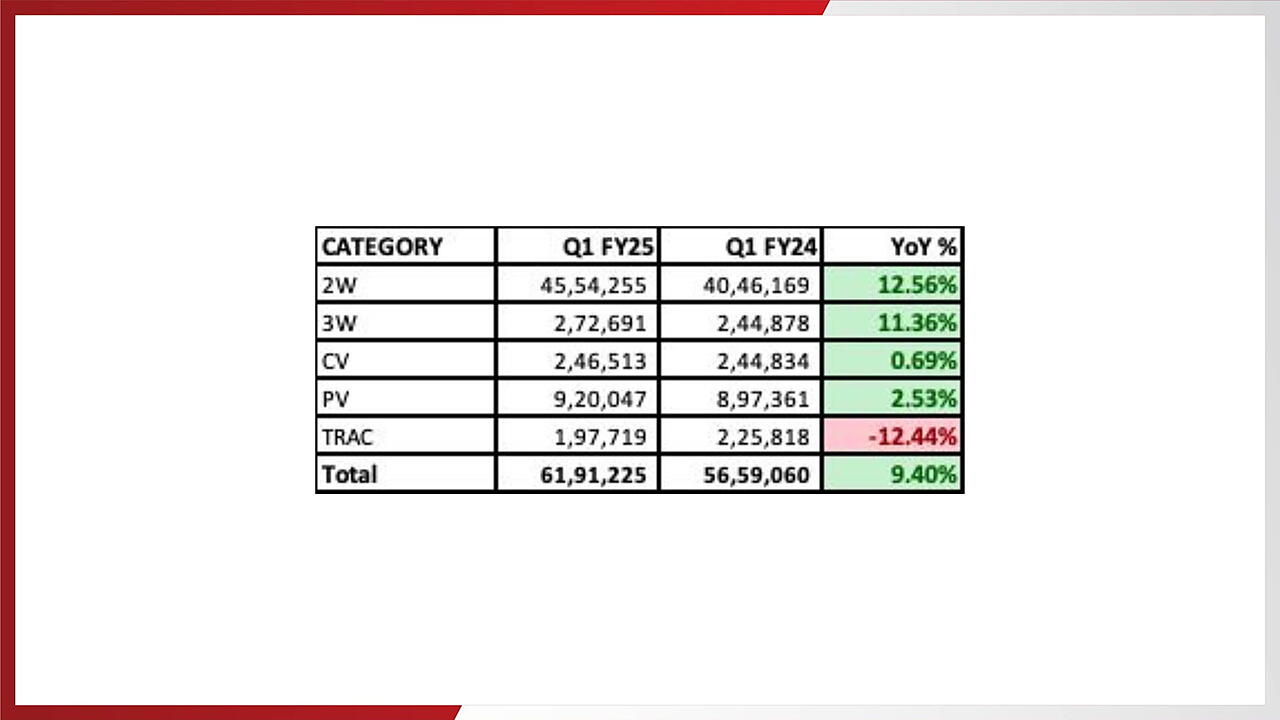

The Federation of Automobile Dealers Associations (FADA) has released its quarterly report, showing an expected performance in the Indian auto retail sector for Q1 FY2024-25. The sector achieved an overall year-on-year growth of 9.40%, driven primarily by notable performances in the two-wheeler (2W) and three-wheeler (3W) segments.

The two-wheeler segment led the growth with 12.56% increase, with sales rising from 4,046,169 units in Q1 FY2023-24 to 4,554,255 units in Q1 FY2024-25. The three-wheeler segment followed closely with an 11.36% rise, from 244,878 units to 272,691 units. Passenger vehicles (PV) also saw a modest increase of 2.53%, growing from 897,361 units to 920,047 units. However, the commercial vehicle (CV) segment recorded a marginal growth of 0.69%, moving from 244,834 units to 246,513 units. The tractor segment faced a decline of 12.44%, with sales dropping from 225,818 units to 197,719 units.

FADA President, Manish Raj Singhania, stated FADA remains committed to advocating for prudent inventory control, improved financing options, and strategic planning to ensure the auto retail sector's resilience and sustained growth. Our focus is on elevating the customer experience and revitalizing dealer synergy as we continue to transform the future of auto retail in India'.

Despite the overall growth, the auto sector faced significant challenges. The monsoon, which initially advanced on track up to Maharashtra, lost momentum, causing delays in key agricultural states such as West Bengal, Bihar, Uttar Pradesh, Chhattisgarh, and Madhya Pradesh. This, combined with an intense heatwave in northwest India, resulted in a prolonged dry spell, delaying kharif crop sowing operations and adversely impacting rural sales.

The passenger vehicle segment, despite reaching an all-time high, struggled to maintain its growth pace. FADA had anticipated a growth rate of below 5% for this fiscal year. Despite strong bookings and customer flow, high competition, excess supply, and discounting posed challenges. Dealers reported significant impacts from elections, extreme heat, and market liquidity issues. The heatwave led to an 18% drop in showroom walk-ins in May, and inventory levels reached a high of 62 to 67 days by the end of June. Although improved product availability and substantial discounts aimed to stimulate demand, market sentiment remained subdued due to extreme heat and delayed monsoons, resulting in 15% fewer walk-ins.

Also Read