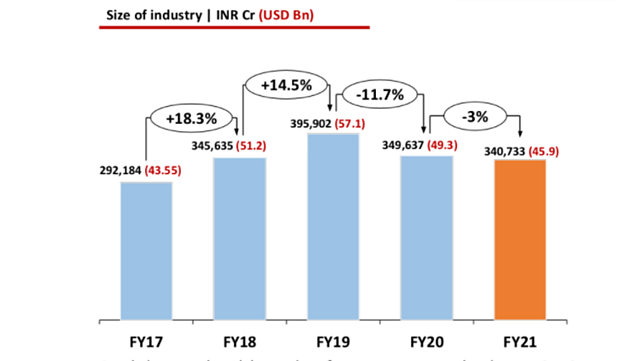

The Indian auto component industry fell by 3% to INR 3.40 lakh crore in FY21, compared to INR 3.49 lakh crore in FY20, according to the Automotive Component Manufacturers Association of India (ACMA). The primary reason behind the low single-digit fall is that vehicle sales saw an uptick in the second half of the last fiscal year after the subdued demand in the first half due to the COVID-19 pandemic and the nation-wide lockdown.

The vehicle industry in India witnessed two successive years of downfall, recording a 14.6% dip in FY19-20 and thereafter 13.6% dip in FY21.

Vinnie Mehta, Director General, ACMA, said that while Q1 FY21 was a complete washout, the industry regained significant ground in the second quarter. The component industry, in tandem, posted a subdued performance in FY21 with a de-growth of 3% over the previous year, registering a turnover of INR 3.4 lakh crore ($ 45.9 billion).

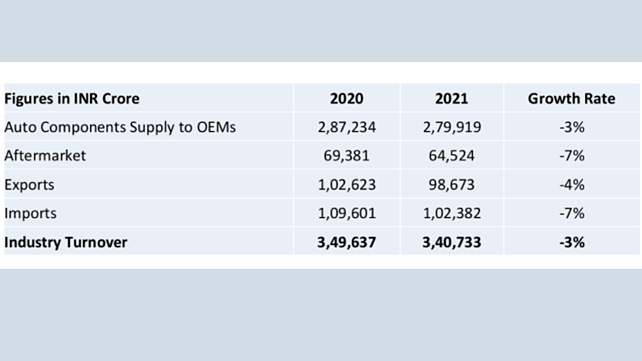

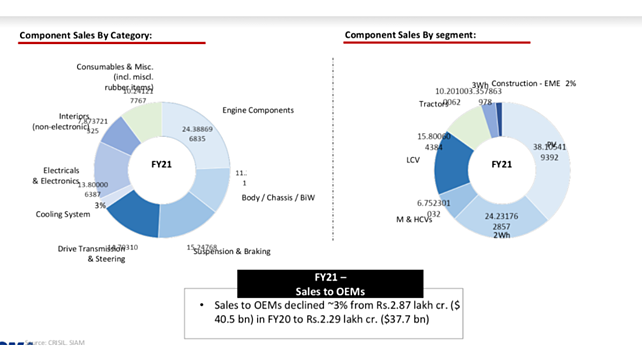

In terms of the revenue from the domestic market, auto component sales to OEMs stood at INR 2.79 lakh crore ($ 37.7 billion), declined by 3%, while the aftermarket at INR 64,524 crore ($ 8.7 billion) fell by 7%.

Exports and imports stood at INR 0.98 lakh crore ($ 13.3 billion) and INR 1.02 lakh crore ($ 13.8 billion) respectively, thus reducing the trade balance to $ 500 million, the lowest ever; exports declined by 8% while imports by 11%.

On the performance of the auto component industry, Deepak Jain, President, ACMA, said the automotive value-chain faced significant disruptions in FY21. The nation-wide lock-down in the wake of the pandemic, one of the severest in the world, put the entire supply chain in disarray. As a result, the entire industry took a significant time to stabilise again post the gradual unlocking of the economy. While vehicle sales and production improved quarter-on-quarter from Q2 FY21 onwards, the Q1 FY22 was once again confronted with another round of disruptions due to the second wave of the pandemic.

“Due to which the overall capacity utilisation remained between 60-65%. However, there is a shortage of labour or job loss in the segment,” he added.

He, however, asserted that the biggest concern is that the overall CAGR of the auto component industry remained in the low single-digit of 4% in the last four years. Due to which it is very unlikely to have any fresh hiring in the sector in the next few years.

Few other key challenges the sector possesses are the shortage of semiconductors, escalating prices, and the availability of raw materials. Moreover, challenges on logistics, including non-availability and high costs of containers, continue to hinder a smooth recovery. “We are also wary of the third wave of pandemic and hope that the current revival in demand will be a sustained one. We are optimistic that the lessons learned in managing the first two will stand us in good stead in managing the third one as well,” Jain added.

On the policy front, ACMA welcomes the PLI scheme for auto and auto components sectors. It will create an export competitive auto component industry and also give a thrust to its localisation.

However, seeing the rising demand for electric and connected vehicles, the industry body also seeks inclusion of auto electronics & xEV component manufacturing in SPECS - Scheme for Promotion of manufacturing of Electronic Components and Semiconductors or introduce a PLI scheme.

The industry is also keen on an early announcement of the details of the RODEPT (Remission of Duties and Taxes on Export Products) scheme that will refund embedded taxes and duties, previously non-recoverable, to make a component exports price competitive.