The Indian auto market was on a rapid rise until FY19, but a slowing economy started to have an impact on vehicle sales the following year. And the outbreak of the pandemic made matters worse for the industry.

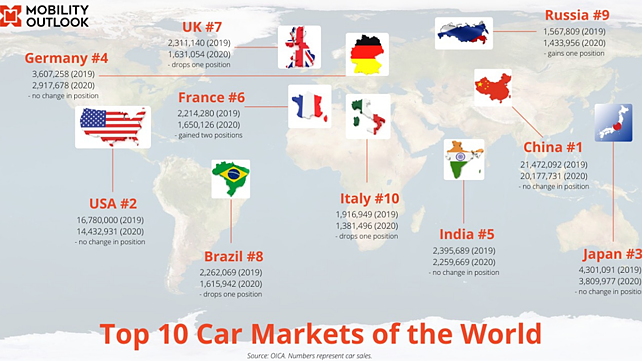

As per the latest numbers sourced from OICA, the Organisation Internationale des Constructeurs d'Automobiles – the international trade association formed of 39 national automotive industry trade associations – India continued to maintain its fifth position in the global car market in 2020, selling approximately 2.25 million units.

India had dropped a position to fifth in 2019 from its high of the fourth position in 2018. The country had overtaken Germany in 2018 by selling four million-plus units 2018.

Experts tracking the industry blame the structural slowdown, which was prevailing much before the pandemic hit the country and major macroeconomic factors such as fuel prices and inflation, being the main reasons behind slow car sales. Moreover, India saw the strictest lockdown of 40 days last year, due to which the supply chain was broken, and companies faced serious production issues in 2020.

Ravi G Bhatia, President & CEO, JATO Dynamics said, “India experienced a severe lockdown during the first wave of COVID in 2020 relative to other top markets. People were forced to WFH and overall mobility was impacted. The demand and supply chain disruption delivered a double whammy to the automotive industry. The recovery was K shaped. We witnessed growth in luxury and top end of the market, However the middle-class buyers either deferred purchase or traded down to more affordable used cars.'

In 2018, it was projected that India will touch five million car sales by 2023. It is to note that projections were based on the promising macro-economic environment when India’s GDP was growing fastest at 6.1%.

On the contrary, car sales in India recorded a steep decline of -10.29% in 2020 and 4.2% in 2019.

Global Rankings

| World Ranking | Countries | 2020 | 2019 | % Change |

| 1 | China | 20,177,731 | 21 472,092 | -6.03 |

| 2 | USA | 14,432,931 | 16,780,000 | -13.99 |

| 3 | Japan | 3,809,977 | 4,301,091 | -11.42 |

| 4 | Germany | 2,917,678 | 3,607,258 | -19.12 |

| 5 | India | 2,259,669 | 2,395,689 | -5.68 |

China continues to be the global leader in car sales, with 20.17 million units sold in 2020, followed by the USA, which recorded sales of 14.43 million cars in 2020. Sales of cars dropped by 6.03% YoY in China, and 13.99% YoY in the USA.

Japan at number three accounted for 3.80 million units in 2020, which was a dip of 11.62% compared to 4.30 million units in 2019.

Interestingly, among the top five car markets of the world, India saw the lowest decline of 5.68%, selling 2.25 million cars in 2020 as against 2.39 million in 2019.

Outlook

With rising cases of coronavirus, the majority of carmakers such as Maruti Suzuki, Hyundai, Tata Motors, M&M and Toyota have called for plant shut down to curb the virus. Industry captains feel that they can foresee recovery only in H2 FY22, provided proper vaccination is done. In such circumstances, the goal of reaching five million in vehicle sales seems like a distant reality.