India’s auto sector, which grew at a rate of more than 10% in the early 2010s, is now struggling to stay in the green owing to various factors such as semiconductor chip shortages, rising input costs, rising commodity prices, and rising fuel costs. As a result, the overall auto-components and forging industry had witnessed a considerable impact, the Association of Indian Forging Industry (AIFI) has said.

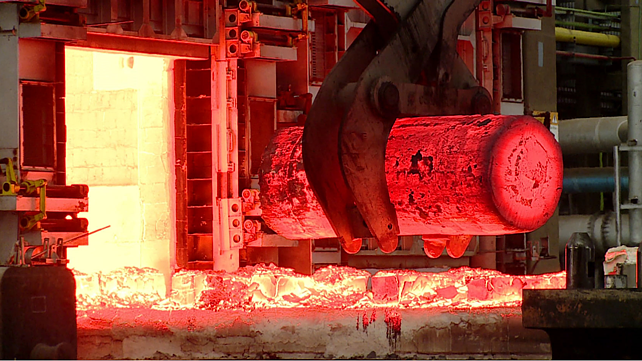

The forging industry primarily caters to the automotive industry, accounting for 60-70% of the forging production. However, with the auto sector witnessing a slowdown, the forging industry has seen an average downturn of 50% of the total capacity.

According to AIFI, the Indian forging industry has about 400 units with an annual output of about 20 lakh metric tonne in FY21. While about 80% comprises tiny enterprises, 10% is medium-sized units, and the remaining is large scale. While SMEs contribute 30% of forging production, the medium and large-scale units contribute 70%, churning out a total output worth about INR 50,000 crore. In addition, the sector provides direct employment to more than 300,000 people in the country, along with an additional 60,000 contract labourers.

In addition to depleting prospects, AIFI also expressed concerns about the high steel prices. Vikas Bajaj, President, AIFI, said, “The rise in steel prices has harmed India’s forging industry. The basic requirement in forging industry is steel and the current price hike has disturbed the supply chain. If this continues to exist, the high steel prices will reach inflation levels more than what the country is currently witnessing. Additionally high raw material prices continue to be a challenge and high fuel prices continue to have an impact on customers and purchase decisions. If manufacturing production and demand do not improve in the coming months, the forging and auto-component sectors will continue to struggle”.

Yash Jinendra Munot, Vice President, AIFI, said the government must take a comprehensive approach to revive the reeling forging sector and provide the necessary impetus. The revival will be critical in strengthening the forging industry and providing collaborative platforms to address the industry’s challenges. The introduction of electric vehicles (EVs) will directly impact the forging industry, reducing demand for moveable parts used in vehicles, which will result in major unutilised forging capacities. However, the industry continues to support the government in its green mission, he said. Therefore, it is time for the forging industry to expand into non-automotive domains such as infrastructure, defence, healthcare, and railways, where the current government is also investing heavily, he added.