The Indian automobile market experienced growth in July 2024 according to the latest data from the Federation of Automobile Dealers Associations (FADA). The overall vehicle retail sector saw a year-on-year (YoY) growth of 13.84%, driven by increases across most segments.

Segment Performance

The two-wheeler (2W) segment led the charge with 17.17% YoY growth. This surge can be attributed to a robust rural economy, favourable monsoon conditions, and various government support programmes that boosted rural incomes. Additionally, the launch of new models and better stock availability helped mitigate the impact of excessive rains and increased market competition. The electric vehicle (EV) segment within two-wheelers also saw a rise, thanks to discounts and the Extended Market Penetration Scheme (EMPS) deadline.

Three-wheelers (3W) followed closely, recording a 12.88% YoY increase. The passenger sub-segment within three-wheelers saw the highest growth, benefiting from urban demand and improved last-mile connectivity solutions.

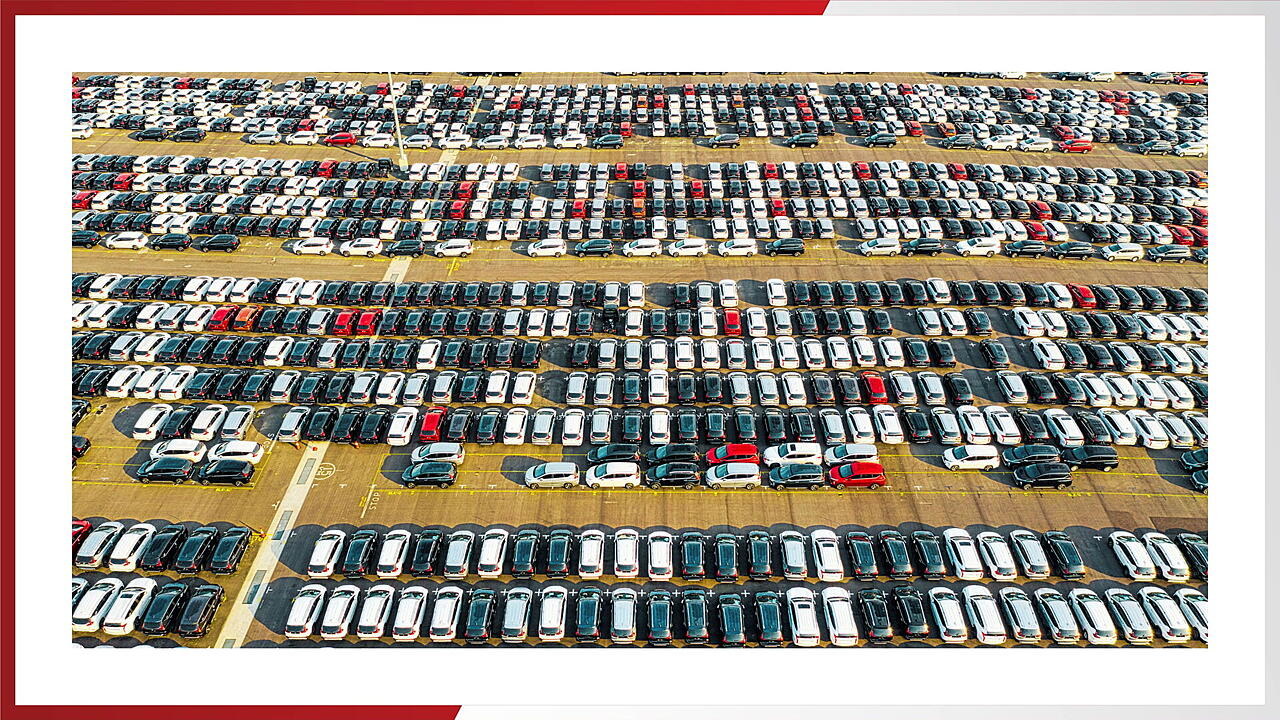

Passenger vehicles (PV) also posted a healthy 10.18% YoY growth, driven by new model launches, competitive pricing strategies, and promotional schemes. However, this segment faced significant challenges due to heavy rains, low consumer sentiment, and intense competition. A major concern is the high inventory levels, which have reached historic highs of 67-72 days, equating to INR 73,000 crore worth of stock. This poses a substantial risk to dealer sustainability and requires immediate attention from PV original equipment manufacturers (OEMs) and financial institutions.

The tractor segment experienced a notable decline, with sales dropping by 11.95% YoY. This decline was primarily due to erratic monsoon patterns and the resultant uneven geographical distribution of rainfall, impacting agricultural activities in certain regions.

Commercial vehicles (CV) saw a modest growth of 5.93% YoY, supported by ongoing infrastructure projects and increased activity in the mining sector. However, the segment faced headwinds such as continuous rainfall, negative rural market sentiment, and high vehicle prices.

Challenges

The uneven distribution of monsoon rainfall has been a double-edged sword for the auto retail market. While some regions benefited from abundant rains, others experienced deficits, impacting consumer sentiment and agricultural activities. This inconsistency is reflected in the mixed performance across various segments.

Another critical challenge is the high inventory levels in the PV segment, which have put dealers under financial strain. FADA has urged OEMs to be cautious and financial institutions to implement stringent checks before releasing inventory funding to prevent the escalation of non-performing assets (NPAs).

Looking ahead, the Indian Meteorological Department (IMD) predicts 'above normal' rainfall in the second half of the monsoon season, driven by potential La Niña conditions. This could further influence agricultural activities and, consequently, the auto retail market. The upcoming festive season is expected to provide a boost to sales across segments, aided by new product launches and ongoing promotional campaigns.

Dealer Sentiment

Dealer sentiment remains cautiously optimistic despite the challenges. The introduction of new models and the festive season are expected to drive sales. However, concerns over heavy rainfall, low customer inquiries, and high inventory levels persist.

FADA’s recent survey of its members revealed a neutral to slightly positive outlook for liquidity and market sentiment. About 51.08% of respondents expect growth in August 2024, while 38.10% foresee challenges continuing.

Also Read