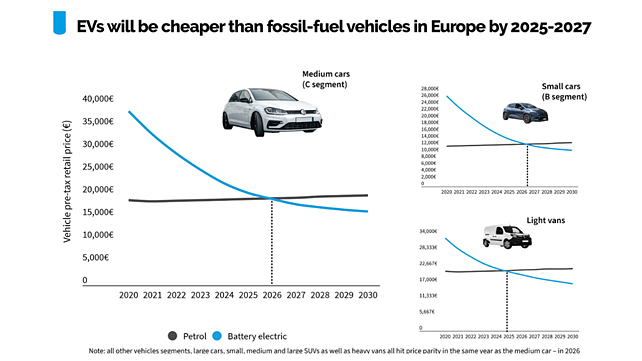

In just a matter of five years, electric vehicles will be cheaper than internal combustion engine vehicles due to falling battery prices and the development of optimised platforms. According to a study conducted by BloombergNEF (BNEF) and Transport & Environment (T&E), battery electric vehicles (BEVs) in all segments in Europe are expected to reach upfront cost price parity with equivalent internal combustion engine vehicles within the next product cycle.

Electric sedans (C and D segments) and SUVs will be as cheap to produce as petrol vehicles from 2026, while small cars (B segment) will follow in 2027, BNEF projects.

New chemistries, better manufacturing methods, innovative cell and pack design concepts and other factors contribute to average prices per kilowatt-hour declining by 58% from 2020 to 2030.

The report says an optimal vehicle design, produced in high volumes, can be more than a third cheaper by 2025 compared to now. However, risks remain, primarily in achieving low enough battery prices and managing demand uncertainty.

Julia Poliscanova, Senior Director, Vehicles & E-Mobility, T&E, said, “EVs will be a reality for all new buyers within six years. They will be cheaper than combustion engines for everyone, from the man with a van in Berlin to the family living in the Romanian countryside. Electric vehicles are not only better for the climate and Europe’s industrial leadership, but for the economy too.”

It also stated that uncertainties throughout the period to 2035 include raw materials prices that can become volatile and cancel some gains and the speed at which the supply chain can scale up rapidly and sustainably in Europe.

By 2025, BNEF expects 4.3 million plug-in vehicles to be sold in Europe, representing around 28% of all sales in that year. BEVs capture over half of those plug-in vehicles sales; the remaining are plug-in hybrid vehicles, which are likely to become an effective compliance tool for several automakers. Across Europe, short-term adoption is highly uneven. Strong policy support and automakers’ market strategies mean EV adoption in countries in the north and west of Europe far exceeds that of countries in the south or east.

The research also found that battery electric vehicles could reach 100% of new sales across the EU by 2035 if lawmakers introduce measures like tighter vehicle CO2 targets and strong support for charging infrastructure.

“With the right policies, battery-electric cars and vans can reach 100% of sales by 2035 in western, southern and even eastern Europe. The EU can set an end date in 2035 in the certainty that the market is ready. New polluting vehicles shouldn’t be sold for any longer than necessary,” Poliscanova added.