As Indian two-wheeler owners clock more kilometres on their vehicles, they are increasingly reporting quality-related issues—especially in the electric scooter segment, according to the J.D. Power 2025 India Two-Wheeler Initial Quality StudySM (2WIQS) released today.

The study, redesigned for 2025 and conducted in collaboration with Differential, Singapore, reveals that customers who ride their vehicles beyond 2,500 km within the first six months of ownership experience an average increase of 9 problems per 100 vehicles (PP100), compared to lower-mileage users. A lower PP100 score indicates higher initial quality.

Electric Scooters Most Affected By Early Wear & Tear

Electric scooters recorded the steepest rise in problems, with higher-mileage owners reporting 98 PP100, nearly double the rate of other two-wheeler segments combined (53 PP100). Key trouble areas include brakes, lights/electricals, and fit and finish.

“While initial satisfaction with performance and build quality is on the rise, early wear and tear is causing concern,” said Pronab Gorai, Engagement Director at Differential, Singapore. “Issues such as braking inefficiencies, vibrations, and component durability can shake consumer confidence. If not addressed, they may drive customers to switch brands in search of better long-term reliability,” he said.

Overall Industry Quality Improves, But Key Problem Areas Remain

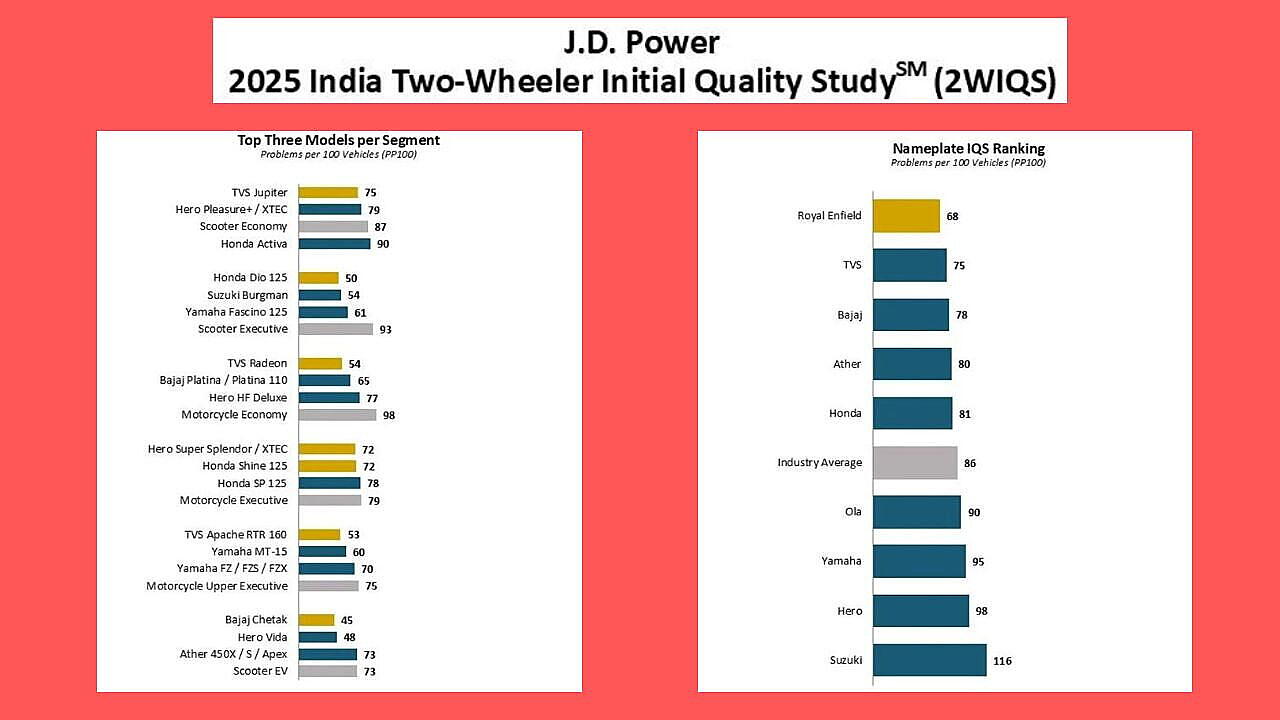

The overall initial quality score for the industry stands at 86 PP100 in 2025. The most reported issues include:

- Engine problems (18 PP100)

- Lights and electricals (15 PP100)

- Brakes (15 PP100)

However, there is a silver lining: 58% of owners reported experiencing fewer problems than expected, a significant improvement from 44% in 2024. Interestingly, electric scooter owners were the most pleasantly surprised, with 61% saying their issues were fewer than expected.

Top-Performing Models and Brands in Initial Quality

Segment Leaders (Lowest PP100):

- Scooter Economy: TVS Jupiter – 75 PP100

- Scooter Executive: Honda Dio 125 – 50 PP100

- Scooter EV: Bajaj Chetak – 45 PP100

- Motorcycle Economy: TVS Radeon – 54 PP100

- Motorcycle Executive: Hero Super Splendor XTEC / Honda Shine 125 – 72 PP100

- Motorcycle Upper Executive: TVS Apache RTR 160 2V – 53 PP100

Brand Leader

- Royal Enfield topped the rankings with a segment-leading score of 68 PP100, earning recognition for its consistent quality in the initial ownership period.

Atsushi Kawahashi, Senior Director at J.D. Power Japan, emphasized the strategic value of these insights stating, “Measuring initial quality is crucial for automakers seeking to improve satisfaction, reduce warranty costs, and enhance brand loyalty. Proactively addressing issues can also improve resale value and strengthen competitive edge in a rapidly evolving market.”

Study Scope & Methodology

The 2025 2WIQS study is based on responses from 6,503 new two-wheeler owners across 42 Indian cities, covering 80 models from 12 brands. It evaluates ICE and electric two-wheelers separately across eight problem categories, replacing engine and transmission for EVs with battery/charging and pick-up/performance.

Also Read: