The second wave impact on the economy will be felt more pronounced in rural areas than in urban areas, notwithstanding the Indian Meteorological Department’s forecast of a near-normal monsoon in 2021, says India Ratings and Research (Ind-Ra).

The ratings and research agency says the impact on the economy will be due to loss of demand impulse rather than supply-side disruptions.

In the last fiscal year, the COVID spread was largely an urban phenomenon, despite the large-scale reverse labour migration.

In fact, what saved the rural areas during the period was the timely arrangements the state governments had put up to quarantine migrant labours before letting them enter their homes and intermingle with the local population.

This prevented the spread of COVID-19 in rural areas and the production activities, and in turn, rural consumption largely remained unimpacted.

However, the current situation is different as the highly infectious mutated strain of COVID-19 has already spread to rural India.

Health ministry statistics show that the country’s 394 districts out of 718 had a case positivity rate of over 10% on 20 May 2021.

Such a high rate of positivity rate is being recorded even when the level of testing is low in rural India.

“This means that the pandemic in many areas may be spreading and has already spread without getting adequately captured in official statistics. This may result in inadequate government intervention to contain the pandemic and higher fatality,” the agency said in a press release.

In a situation like this, even if agricultural income remains intact, there is a strong likelihood that the expenditure behaviour of rural households will be different.

With rising COVID-91 infections, households in rural areas would be more concerned about the rising or an expected rise in health expenditure and would cut down on non-essentials.

As such, the share of the government in the current expenditure on health in India is only 27.1%, and households bear an overwhelmingly large share of 62.4%.

Also, if they are forced to take debt to meet out of pocket expenses on health, it can be more damaging than other types of household debt.

As these expenses generally occur during illness, it limits one’s ability to work, leading to depletion of household savings and unanticipated economic shocks.

According to an estimate, over 60% of the rural households with hospitalised cases borrow, sell their assets (including gold) or rely on contributions from friends and relatives to pay for inpatient care.

The second factor that will adversely impact the rural demand during this period is the decline in non-agricultural activities, as most of these activities require high human contact, be it work of a carpenter, blacksmith, auto/tractor/cycle repair, construction, transport, storage etc.

Thus, even the employment offered under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in rural areas may be less effective if family breadwinners fall to COVID-19 infection.

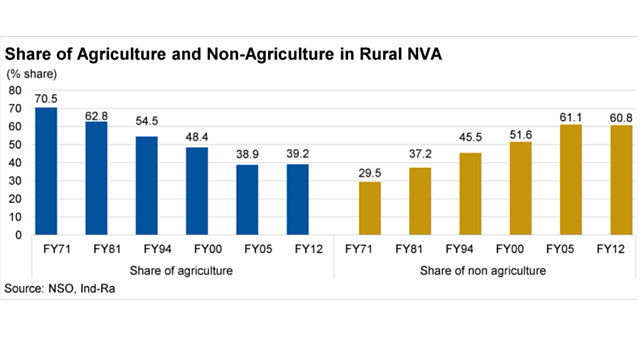

The slowdown in non-agricultural activities and non-agricultural income will have a serious impact on rural demand since non-agricultural income constitutes nearly two-thirds of the rural income.

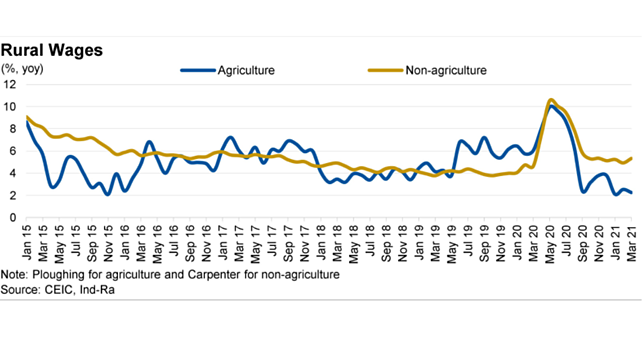

The third factor that will impact rural demand unfavourably in FY22 is rural wages. In fact, the largest chunk of the rural population consists of daily wage earners and not farmers.

Rural wage growth both for agricultural and non-agricultural activities has declined lately. Average agricultural wage growth during November 2020-March 2021 fell to 2.9% from 8.5% during April-August 2020 (November 2019-March 2020: 6.0%).

Similarly, wage growth for non-agricultural activities during November 2020-March 2021 declined to 5.2% from 9.1% during April-August 2020 (November 2019-March 2020: 4.3%).

Under this scenario, while demand for agricultural credit and agricultural inputs such as fertiliser could remain strong because of the third consecutive year of near-normal monsoon, the demand for FMCG products, automobiles, especially tractors and two-wheelers is expected to suffer.

Way Forward

Ind-Ra believes the answer to the current economic woes lies in the domain of medical sciences alone, and the focus has to be on strengthening the ongoing vaccination drive. In the interim, providing free rations, income support, higher allocation under the MGNREGS would go a long way in reducing the injury inflicted by the pandemic in the rural area.