Bosch, the leading global supplier of technology and services, has announced that the company successfully came through the first year of the coronavirus pandemic, reporting € 71.5 billion in sales and € 2 billion in profits in 2020.

While sales were 6.4% below their previous-year level of 4.3%, Bosch reported EBIT margin from operations at 2.8%.

Overall, Prof Stefan Asenkerschbaumer, CFO and Deputy Chairman of the Bosch board of management said the company is in a satisfactory liquidity situation. The company continues to enjoy a healthy financial structure, and this will allow it to focus on areas of future importance, he said during the company’s annual press conference today.

Future Growth

Talking of future importance, Bosch has identified AIoT, electrification and green hydrogen as the areas that would drive future growth for the company. Dr Volkmar Denner, Chairman of the board of management, Robert Bosch GmbH called Bosch one of the winners in the transition to electromobility, and said the company is significantly expanding its software business by tying in artificial intelligence.

Bosch foresees that AI-enabled products will generate sales worth billions of euros over the next few years. The company wants to use AI to evaluate data relating to how its customers use its products. This will help Bosch provide software updates that create new functions and services for those customers.

In the field of video security, for example, video analysis based on neural networks opens up new possibilities. To this end, Bosch is integrating detectors both into new cameras and into an AI box that can be connected to installed devices. The first application is a traffic detector that will initially be able to detect and locate vehicles precisely in busy traffic situations, even under difficult lighting conditions, said the company.

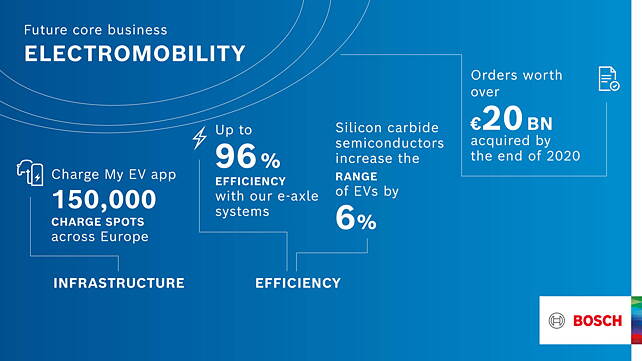

The second critical area that is fast developing as a core business for the company is electromobility. Over the years, Bosch has made heavy upfront investments in this sector – amounting to €5 billion – and Dr Denner has further committed to invest an additional €700 million this year alone. Sales revenue from electrical powertrain components is growing twice as fast as the market, at almost 40%, reported Bosch, and said its aim is to increase annual sales fivefold to a total of some €5 billion by 2025 and to break-even one year earlier. The company had acquired orders worth over €20 billion by the end of 2020.

Green hydrogen is the third big area Bosch is betting big on. The market for green hydrogen in EU alone will be worth almost €40 billion by 2030, growing annually at 65%, believes Bosch. Fuel cells convert hydrogen into electricity, and Bosch is developing both stationary and mobile fuel-cell solutions. From 2021 to 2024, Bosch plans to invest €1 billion in fuel-cell technology.

This year, the company plans to put 100 stationary fuel-cell plants into operation, which will supply electricity to users such as data centres, industrial manufacturers, and residential areas. Bosch estimates the market for mobile fuel-cell components to be worth around €18 billion by the end of the decade.

2021 In Perspective

Asenkerschbaumer said the company has made a successful start to 2021 with the first three months witnessing a 17% jump YoY. While 2021 is expected to be another challenging year, the CFO sounded confident. “The year 2021 will be an important milestone on our path to regaining our target margin of around 7% in the next two to three years,” he said.

Bosch expects the global economy to grow by just under 4% this year, after a contraction of around 3.8% last year. The effects of the semiconductor bottlenecks, which are difficult to assess, weigh heavy on how the results would eventually turn out. “The company is doing everything in its power to support its customers in this tense situation. However, an improvement in the short term is not to be expected, and the situation may also impact business developments in the current year,” Asenkerschbaumer said.

Commenting further on the existing situation, Asenkerschbaumer said in the long run, it is necessary to make all automotive supply chains less prone to disruption. Moreover, aligning its mobility business with areas of future importance such as electromobility, automated driving, and future electronics architectures calls for enormous upfront investments. “In this profound transformation, 2021 will be both a very important and a challenging year for us,” he said.