Bosch Limited remains steadfastly confident in India's growth trajectory and is committed to being an integral part of this promising journey despite the current global economic climate, marked by complexities such as logistical challenges and volatile crude oil prices.

Guruprasad Mudlapur, President of the Bosch Group in India and Managing Director of Bosch Limited, said the global economic forecast predicts a 3.2% growth for the world economy in 2024, though it appears uncertain. Amid these challenges, India stands out as a bright spot, being the fastest-growing large economy. The IMF has even upgraded India's growth forecast from 6.8% to 7%.

Despite some clear headwinds and recent turbulence due to elections, intense summer heat, and heavy rains, the overall economic forecast for India remains positive. Post-budget signals of policy continuity and stability are expected to support the 7% growth target, which bodes well for the overall economy.

“Lots of things are shaky. And every other week we hear something which is dramatically different and changes the context completely,” Mudlapur said. However, he is confident about the company’s growth and continues to invest significantly in research and development. Bosch Limited, which is primarily focused on mobility, power tools, and building technologies, has allocated INR 483 crore for R&D and an additional INR 332 crore for capital expenditure.

Despite global fluctuations in growth rates, electrification in India remains at just 2% of overall volumes. Mudlapur is confident that about 20% of passenger cars and about 70% of two-wheelers in the commuter segment will be electric by 2030. He also said that about 10% of HCVs will run on H2 ICE by 2030. It may be recalled that the company exhibited a truck hauled by H2 ICE engine at Bharat Mobility Global Expo last January.

Mudlapur said that the company is actively working on new projects, particularly in hydrogen technology, aiming to pilot and mature this technology for future implementation. It also emphasises software-defined vehicles and electrification in the mobility sector, with a focus on sustainability.

'The optimistic growth in the Indian economy, with higher disposable incomes, positions us favourably amid the continued demand in the auto sector. With sustained infrastructural investments, we are well-positioned for growth in our Power Tools and Building Technologies businesses. Bosch will continue to strengthen its portfolio through localisation and capitalise on the potential of alternative fuel technologies and electric vehicles to usher in a new era of mobility,' he added.

Q1FY25 Performance

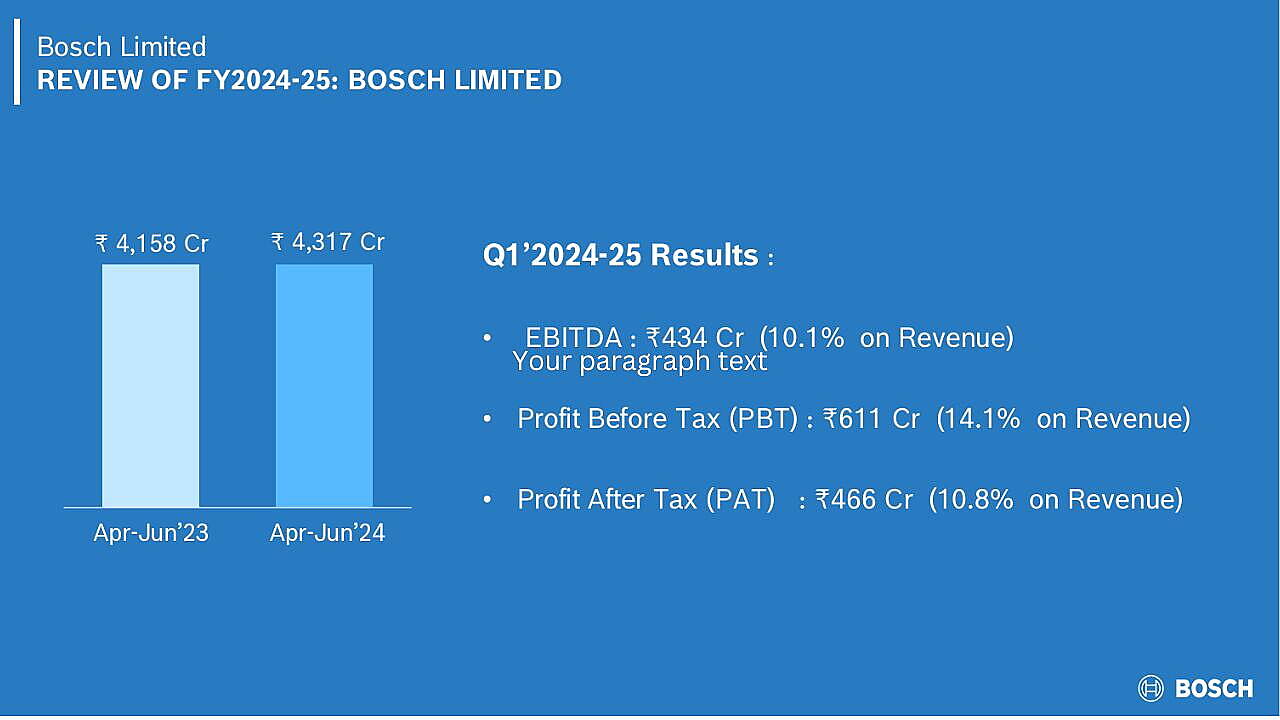

Mudlapur's optimism is evident in Q1FY25 performance of the company. Driven primarily by higher demand in the automotive market, especially within the passenger car segment, Bosch Limited has reported a total revenue from operations of INR 4,317 crore (Euro 481 million) for Q1FY25 the first quarter of FY25, representing a 3.8% increase over the same period last year.

The company reported a Profit Before Tax (PBT) of INR 611 crore, which is 14.1% of the total revenue from operations, reflecting a 14.7% increase over the previous year’s first quarter. Profit After Tax (PAT) stood at INR 466 crore accounting for 10.8% of the revenue from operations.

Mudlapur said, 'The financial year commenced with moderate growth in the automotive market despite the challenges of a high base from the previous year, a slowdown related to elections, and the summer heatwaves. Continued demand in the passenger car segment, coupled with growth in production and wholesale, resulted in growth for this quarter. However, retail sales have remained sluggish, leading to a rise in pipeline inventory. Despite the challenges, the overall sentiment in the automotive sector remains positive.'

In terms of performance for Q1FY25, the automotive segment saw an overall product sales increase of 4.1% compared to the same quarter last year.

The Power Solutions business, constituting 72% of overall automotive product sales, grew by 2.3%, driven largely by the passenger car segment due to sustained consumer demand.

The Mobility Aftermarket business segment saw an 8.1% growth compared to the same quarter last year, driven by increased market demand for new generation diesel components and strong performance in core product categories.

The Beyond Mobility business recorded a 5.8% increase in net sales over the same quarter of the previous financial year, fuelled by continuous growth in the Consumer Goods Product and Building Technologies segments.

Navigating Financial Stability

Regarding how the company manages its financial performance amidst challenges such as geopolitical uncertainties and the fluctuating global economy, Karin Gilges, Executive Vice President, Finance & Administration and Chief Financial Officer (CFO), Bosch Limited, said the company is actively pursuing localisation strategies to reduce reliance on imported goods and decrease material costs. By increasing the proportion of locally sourced materials, it aims to lower imported prices and enhance cost efficiency. This localisation effort is directly linked to their commitment to bolstering the Indian market, which remains their primary focus and core strength.

However, the challenges of international trade, such as increased surcharge fees and congestion, particularly around the Cape of Good Hope route to Europe, impact export activities. Despite these challenges, the company continues to manage exports strategically. Exports are conducted when necessary and feasible within the overall production and delivery network, ensuring they meet demand effectively.

While Bosch Limited maintains a presence in the export market, the Indian market remains its primary focus. The company's strategy reflects a balance between strengthening local operations through increased localisation and navigating the complexities of global trade to meet export demands when required, Gilges added. .

Sustainability

Mudlapur said that the company is carbon neutral on scope one and two since 2020, and holding an impressive ESG risk rating of 6.5, ranking second worldwide. It is extending its carbon neutrality efforts to scope three, including suppliers and OEM partners. Additionally, it been recognised as a great place to work for the fourth consecutive time, reflecting its strong people practices and sustained performance.

Also Read:

Bosch Limited’s Bidadi Plant: A Beacon Of Innovation, Diversity & Adaptation