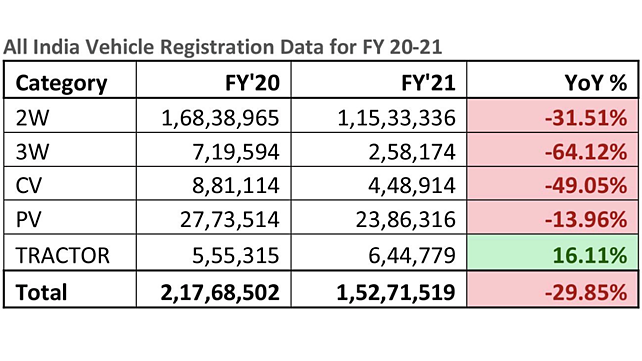

Auto retails sales in India declined by 30% in FY21 at 15,271,519 units when compared to 21, 768,502 units in FY20, recording the lowest sales in the last eight years, according to the data released by the Federation of Automobile Dealership Association (FADA) based on the Vahan portal, an initiative by the Ministry of Road Transport and Highways to record total vehicle registered across the country.

The decline in auto retail sales is primarily attributed to the global pandemic impacting the economy and overall consumer sentiment.

In terms of the different segments, except tractors which grew by 16%, all other categories were in red with 2W, 3W, CV and PV falling by -32%, -64%, -49% and -14%, respectively and way below FY13 levels.

Vinkesh Gulati, President, FADA, said, “India is currently facing one of its toughest times with the second wave of COVID creating havoc in everyone’s life. This time, the spread is not only limited to urban markets but has also taken rural India in its grasp.”

Unlike last year, the lockdown this time around has been imposed by State Governments and not the Central. Due to this, there have been no relief announcements that have come out till now, either by the Centre or RBI and Auto OEMs.

The apex body of automobile dealers has requested auto OEMs to handhold their dealers the way they did last year during the first phase of the pandemic as the situation is very grim in most of the states, and dealer principals, as well as their teams, are fighting for their survival from COVID.

FADA has requested OEMs to not burden dealers with high billings in all the states where lockdown has been announced.

It has also appealed to the central government to announce a financial package in terms of moratorium and RBI to release guidelines for relaxation of loan repayment equivalent to the number of days of lockdown each state has declared.

Auto retail sales declined by 28% in April 2021

Since April 2020 was under complete lockdown, the numbers could not be comparable. However, the total vehicle registration for April ’21 plummets by -28% at 1,185,374 compared to 1,649,678 units in March 2021.

The decline was seen across segments - 2W, 3W, PV, Trac and CV falling by -28%, -43%, -25%, -45% and -24% respectively.

Inventory at the end of April ’21

Average inventory for Passenger Vehicles ranges from 15 – 17 days

Average inventory for Two-Wheeler ranges from 30 – 35 days

Near Term Outlook

The first nine days of May have seen abysmal sales due to the lockdown announced by the majority of states. Lockdown also means dealership outlets to remain closed, thus meaning zero sales.

Considering the rising number of cases, one can expect the peak in terms of infections for India as a whole could be at least a fortnight away.

Everywhere dealerships are open, but the walk-ins have dropped to 30%, and customers delay their purchase decision. The just-concluded elections in states like West Bengal, Tamil Nadu, Kerala and Assam, movement of migrant workers back to states like Uttar Pradesh and Bihar can keep the curve rising.

FADA hence maintains absolute sluggishness for May as most of the states have announced the extension of lockdown till the end of the month.

Long Term Outlook

The second wave of COVID has unsettled not only urban but also the rural markets this time around. Recovery hence looks to take a longer time when compared to recovery, which came after first wave. The only ray of hope lies on monsoons on-time arrival, which is likely to enter India through the southern coast around June 1.

The country’s weather office has also said that India is expected to get average monsoon rains this year, thus raising expectations of higher farm output that is central to the country’s economy.

This will also lead to rural markets recovering faster than urban. Also, categories like tractors and two-wheelers will have a rub-off effect in terms of recovery.

FADA see’s overall recovery from the lows of FY21 and to reach the highs of FY19 only by FY23.