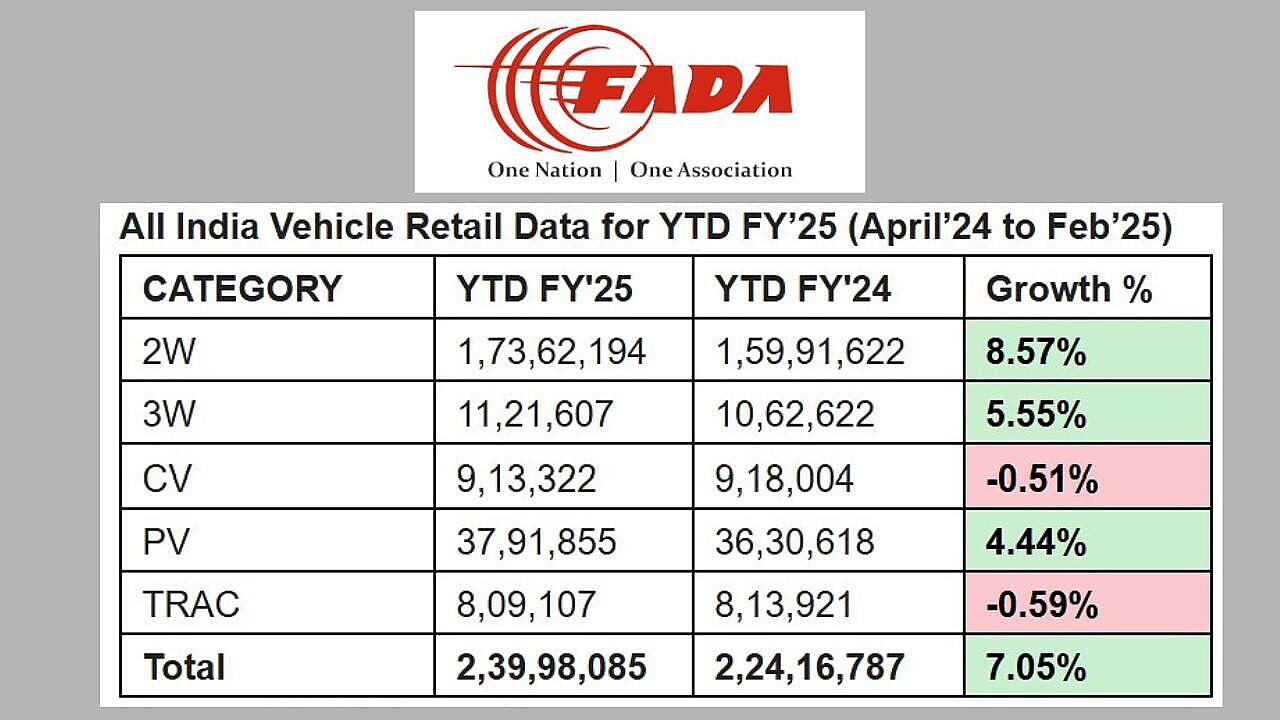

The Federation of Automobile Dealers Associations (FADA) released February 2025 vehicle retail data, reporting a broad-based 7% year-on-year (YoY) decline across all segments. While the industry had anticipated a “flat to de-growth” trend, 2W, 3W, PV, tractor, and CV sales fell by 6%, 2%, 10%, 14.5%, and 8.6% YoY, respectively.

FADA President C S Vigneshwar attributed the slowdown to inventory mismatches, weak consumer sentiment, aggressive pricing post-OBD-2B norms, and financial constraints affecting buyer decisions. He also raised concerns over OEMs pushing inventory without dealer consent, emphasizing that aligning wholesale allocations with real retail demand is crucial for healthy dealer viability and stock management.

Segment-Wise Performance

The two-wheeler (2W) segment, despite an 8.57% FY YTD growth, saw a 6.33% YoY drop in February. Urban markets faced a sharper 7.38% decline, whereas rural demand remained relatively stable (-5.5%) due to better agricultural sentiment and marriage-season purchases. Dealers pointed to inventory pressures, weak financing availability, and slowing customer inquiries as key challenges.

Passenger vehicles (PV) recorded a steep 10.34% decline YoY, despite 4% YTD growth. The entry-level segment remained sluggish, with delayed conversions and difficult sales targets. Dealers highlighted high inventory levels (50-52 days) and called for better alignment between OEM production and actual retail demand to prevent excessive stock burdens.

The commercial vehicle (CV) segment saw a 0.5% YTD dip, with February sales dropping 8.6% YoY. Weak transportation sector demand, tighter financing norms, and pricing pressures on bulk orders slowed sales. However, tipper demand remained strong, driven by government spending on infrastructure projects. Dealers remain cautiously optimistic for March as institutional buying and adjusted sales strategies could improve volumes.

Near-Term Outlook: Mixed Sentiments With Potential March Rebound

FADA’s dealer survey for March 2025 indicates 45% expect growth, 40% anticipate flat sales, while 14% foresee further de-growth. Market confidence remains dented by five consecutive months of stock market declines, impacting consumer discretionary spending. However, upcoming festivals (Holi, Gudi Padwa, Navratri) and year-end depreciation benefits are expected to drive sales recovery across 2W, PV, and CV segments.

Segment-wise expectations remain cautiously positive. In 2W, a strong agricultural output and festive demand could offset slow February bookings. PV sales may gain traction from festive pre-bookings, year-end incentives, and OEM schemes, while CVs are likely to benefit from increased government spending and institutional purchases, despite liquidity constraints.

Also Read: