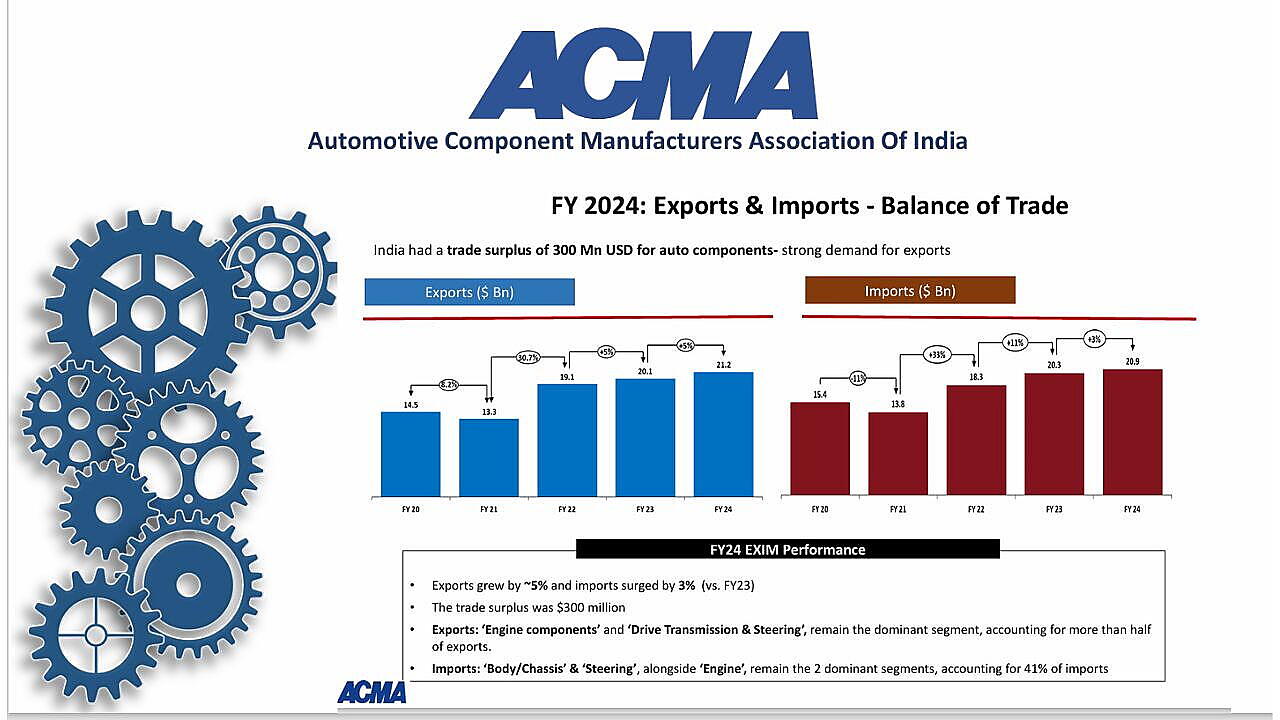

Exports of auto components recorded a trade surplus of $300 million in FY24, a significant turnaround from the $200 million deficit in the previous year. Earlier, it recorded trade surplus in FY22.

According to Automotive Component Manufacturers Association of India (ACMA), the industry experienced robust growth in exports, increasing by 5.5% to $21.2 billion in FY24, even as overall merchandise exports declined by 3%. Imports grew by 3% to $20.9 billion, with imports from China remaining flat, indicating potential for the Indian auto components industry to enhance its global contribution and carve out a niche in the international market.

Key export items include drive transmission & steering, engine components, body & chassis, and suspension & braking systems. North America and Europe saw notable growth in exports, with North America accounting for a 4.5% increase and Europe a 12% increase. The key export destinations included North America (32%), Europe (33%), and Asia (24%).

Majority of imports came from Asia (66%), followed by Europe (26%) and North America (8%). Key import items included engine components, body & chassis, suspension & braking, and drive transmission & steering.

The industry managed to grow its exports despite several challenges, including geopolitical issues and disruptions in key locations such as the Red Sea, Singapore, Sri Lanka, and China, which led to container shortages and port congestion. These cascading issues resulted in freight companies imposing congestion charges, thereby increasing overall transportation costs. To avoid the Red Sea, trade routes have become significantly elongated, complicating access to Europe, which accounts for 33% of India's auto component exports.

Addressing the logistics challenges fueled by geopolitical issues and congestion at key international ports, Shradha Suri Marwah, President of ACMA and CMD of Subros, explained that the government is unable to directly address these issues as they pertain to international shipping lines. Therefore, the government emphasises localisation to reduce import dependence. Vinnie Mehta added, 'We present the industry's concerns to the government, and if there is a concrete suggestion, the government listens well to ACMA.' Marwah expressed hope, saying, 'We are optimistic that the situation will improve soon, but no one can predict when.'

She further stated, 'We are working together with the government on their Automotive Mission Plan 2047. The government has outlined a long-term strategy, broken into phases, with substantial collaborative efforts across the industry. Patience is required as we navigate these ongoing developments.'

Discussing the recently presented Budget, Marwah highlighted its favourable provisions for the sector, emphasising significant thrust on skilling, inclusivity, and support for startups. The MSME sector, which constitutes 70% of the auto component ecosystem, received a substantial boost through credit guarantee schemes. Infrastructure investments, particularly in road development, have had a positive cascading impact on the industry. However, logistics challenges persist, affecting time to market, production timelines, and working capital management.

The growing focus on electric vehicles (EVs) and alternative fuels like CNG presents new opportunities for the auto component industry. The EV segment, which accounted for 6% of the overall turnover in FY 2024, against 3% in the previous fiscal, is expected to grow as charging infrastructure improves and government incentives increase.

'The good news is that our sector is still growing, including in terms of value addition. While growth may not be at the pace we expected, we are becoming increasingly entrenched in manufacturing ecosystems. There is a significant emphasis on design, localisation, and deep localization,' Marwah added.

Also Read:

Auto Comp Sector Sees A Decade Of Growth, Braces For New Challenges