India's automotive components industry is a dynamic sector pivotal to the global automotive supply chain. A recent Rubix Data Sciences report highlights its growth trajectory fuelled by government initiatives, localisation efforts, and a burgeoning export market.

Market Dynamics

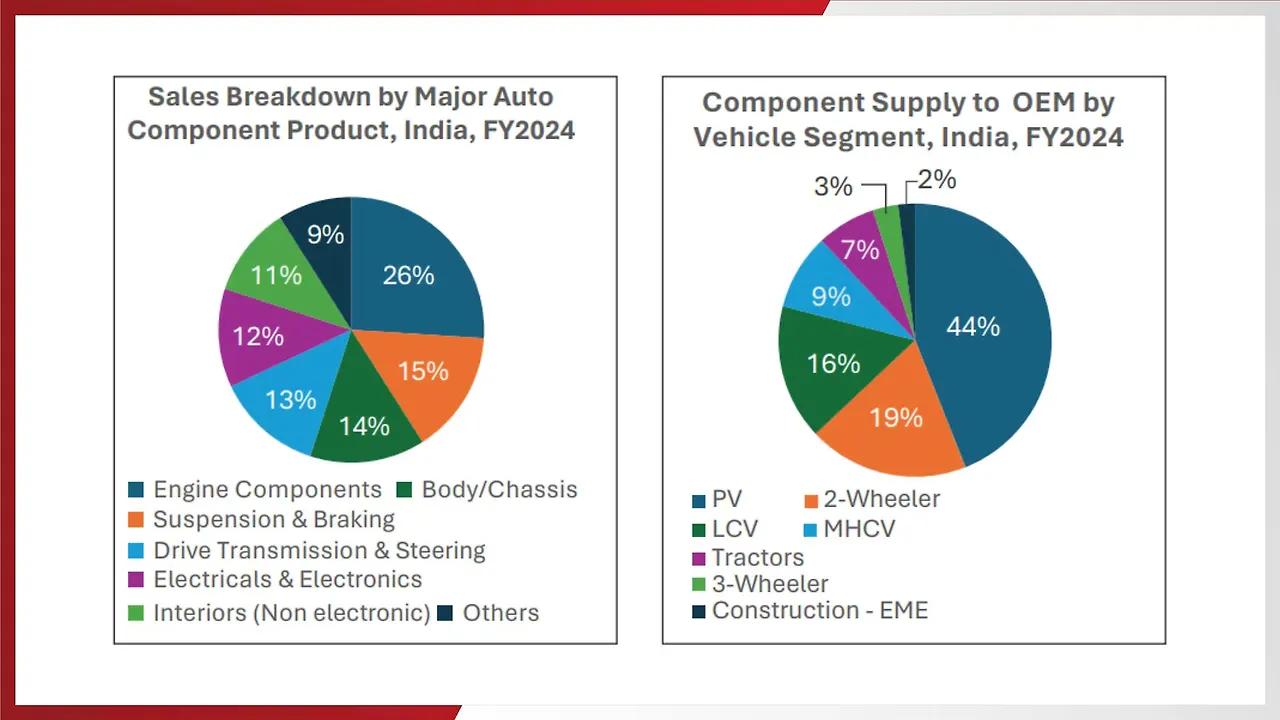

The industry has demonstrated resilience achieving a Compound Annual Growth Rate (CAGR) of 8% between FY2020 and FY2024, culminating in a total market size of USD 74.1 billion in FY2024. Projections for FY2025 indicate a further growth rate of 7% to 10%. This expansion is driven by steady domestic demand, export growth, and a thriving aftermarket segment. Notably, exports have seen a CAGR of 10%, reaching USD 21.3 billion in FY2024, underscoring India’s increasing significance as a global supplier.

The domestic aftermarket segment has also been robust, contributing USD 11.3 billion in FY2024, with an expected rise to USD 14 billion by 2028. This growth aligns with increasing vehicle ownership and extended vehicle lifespans, particularly in two-wheeler and passenger vehicle segments.

Shifting Towards Sustainability & Innovation

A pivotal trend reshaping the sector is the growing penetration of Electric Vehicles (EVs). In FY2024, EV components accounted for 6% of the industry's total output, doubling from previous years. Government-backed initiatives like the Production-Linked Incentive (PLI) scheme are bolstering investments in localisation and advanced manufacturing technologies. However, the reliance on imported EV batteries, particularly from China, remains a strategic vulnerability.

Challenges In Supply Chain Diversification

While localisation efforts are advancing, critical gaps persist. Currently, only 30%-40% of India’s EV supply chain is locally sourced. Battery cells, which constitute 35%-40% of an EV's cost, are entirely imported, highlighting an urgent need for domestic production capabilities. The government’s “Make in India” roadmap aims to reduce import dependency by identifying 28 key components for indigenisation, including advanced electronic and powertrain systems.

Regulatory & Technological Challenges

The industry's push towards greener technologies is further complicated by stringent regulatory requirements. Transitioning from BS VI to BS VII norms, expected by 2027, demands significant investments in advanced emission control systems. Furthermore, the shift from internal combustion engine (ICE) vehicles to EVs necessitates a radical overhaul in design, manufacturing processes, and workforce capabilities.

Role Of SMEs

Small and Medium Enterprises (SMEs), which contribute up to 80% of the industry's volume, are integral to the supply chain but face hurdles in scaling up and adapting to new technologies. Meanwhile, India is strategically leveraging global supply chain diversification, benefitting from the “China+1” strategy. Exports to key markets like the United States, Germany, and Turkey are rising, yet China’s dominance in the global EV ecosystem remains a challenge.

The industry is poised to benefit from a surge in connected car technologies, lightweight materials, and the growth of Advanced Driver Assistance Systems (ADAS). These innovations are reshaping consumer expectations, driving up the content per vehicle, and offering new revenue streams. Additionally, the government’s Automotive Mission Plan 2047 envisions India as a global automotive hub, targeting a fivefold increase in auto component exports by 2030.

Also Read

Li-ion Battery Market Faces Volatility Amid Raw Material Price Swings