Business aircraft manufacturers have been announcing a strong increase in jet orders, indicating that the industry has almost completely shaken off the effects of the COVID-19 pandemic.It is in tune with Honeywell's 30th annual Global Business Aviation Outlook forecasts that finds up to 7,400 new business jet deliveries worth $238 billion from 2022 to 2031. It represents about 1% growth in deliveries from the same 10-year forecast a year ago. In 2021, surveyed business jet operators reported a sharp increase in used jet purchase plans, 12% above last year's report, equivalent to 800 additional used business aircraft, Honeywell said.

Honeywell's forecast methodology is based on multiple sources, including, but not limited to, macroeconomic analyses, original equipment manufacturers' production and development plans shared with the company, and expert deliberations from aerospace industry leaders.

According to Heath Patrick, President, Americas Aftermarket, Honeywell Aerospace, the increased demand for used jets is estimated at more than 6,500 units over the next five years, putting pressure on an already record low inventory and driving additional demand for new jets. 'Our latest operator survey results support continued private jet usage growth, as more than 65% of respondents anticipate increased business jet usage in 2022. Despite the ongoing challenges presented by the pandemic, flight hours have recovered and grown beyond pre-pandemic levels. The overall health of the business jet market is strong, and growth is expected to continue,' he added.

Key Findings

According to the company, the purchase plans for used jets show an increase in this year's survey. Operators worldwide indicated that 28% of their fleet is expected to be replaced or expanded by used jets over the next five years, up by three percentage points compared with survey results from 2020. In addition, business jet deliveries in 2022 are expected to be up 10% from 2021 in terms of units billed.

The longer-range forecast through 2031 projects a 3% average annual growth rate of deliveries in line with expected worldwide long-term economic growth.

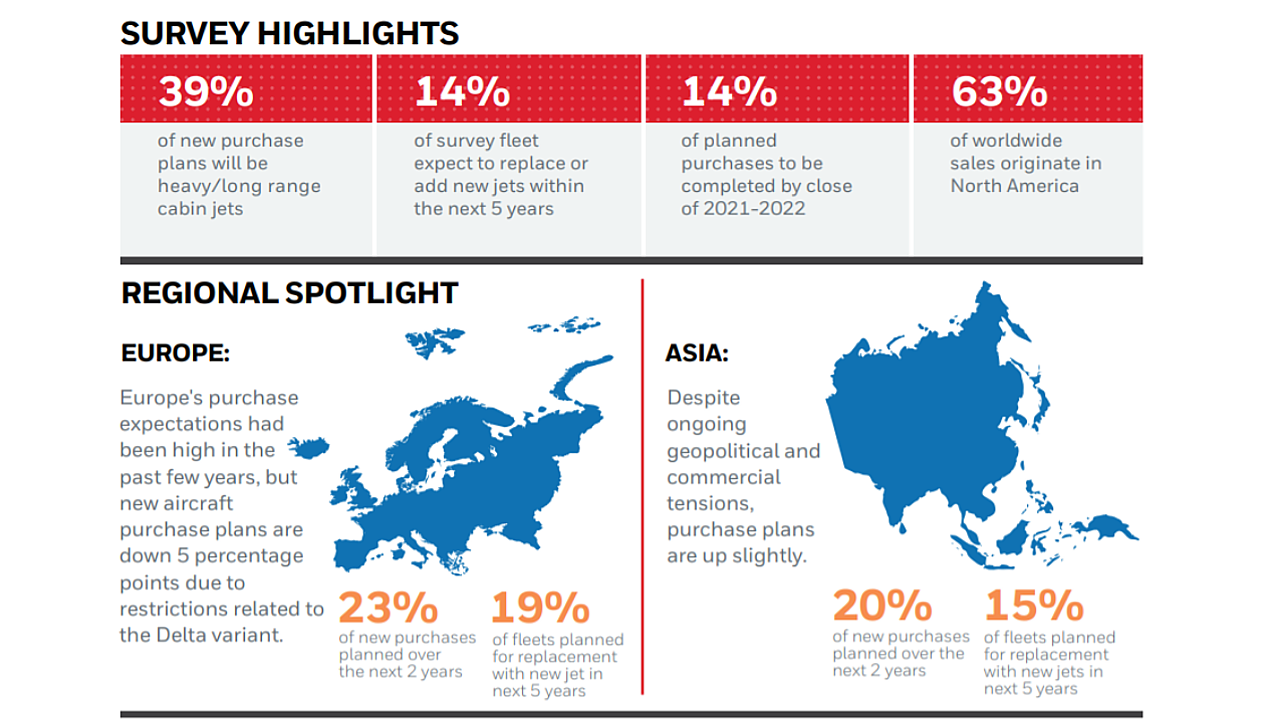

Five-year purchase plans for new business jets are down two percentage points compared with last year's survey. This can be attributed to uncertainty around the COVID-19 Delta variant at the time of the survey. In addition, fewer replacements drive the decrease in the fifth year; however, fleet additions grew by one percentage point.

The sharp increase in demand for used jets, coupled with a lower-than-ever inventory of used aircraft available for sale, will inevitably drive additional demand for new-build business jets. Among those with purchase plans of new business jets over the next five years, 29% of purchases are expected to occur in the next two years. This is just one percentage point lower than last year's survey, the report said.

Operators plan to make new jet purchases equivalent to about 14% of their fleets over the next five years as replacements or additions to their current fleet. Moreover, larger-cabin, heavy aircraft classes are expected to account for more than 72% of all expenditures of new business jets in the next five years.

The company also found that there would be minimal ongoing COVID-19 impact in 2021. As per the survey, nine out of ten operators in the survey said the ongoing COVID-19 pandemic has not postponed their new or used jet buying plans. In addition, nearly 100% of 2021 respondents said that they had not cancelled and do not plan to cancel delivery on a new aircraft, the report noted.

Year to date, business aviation usage trends point to a nearly 50% increase in flight hours in 2021 versus 2020, roughly 5% above 2019 (pre-COVID). About 65% of respondents globally expect to operate their business jets more frequently in 2022 versus 2021.

The 2021 survey respondents are not signalling sales of late-model aircraft due to COVID-19. Specifically, only 4% of all respondents in the survey are planning to sell one or more aircraft without replacement in the next five years compared with 10% in last year's survey.

Very few respondents (6%) reported that conditions for their flight departments had worsened in 2021, the report noted.

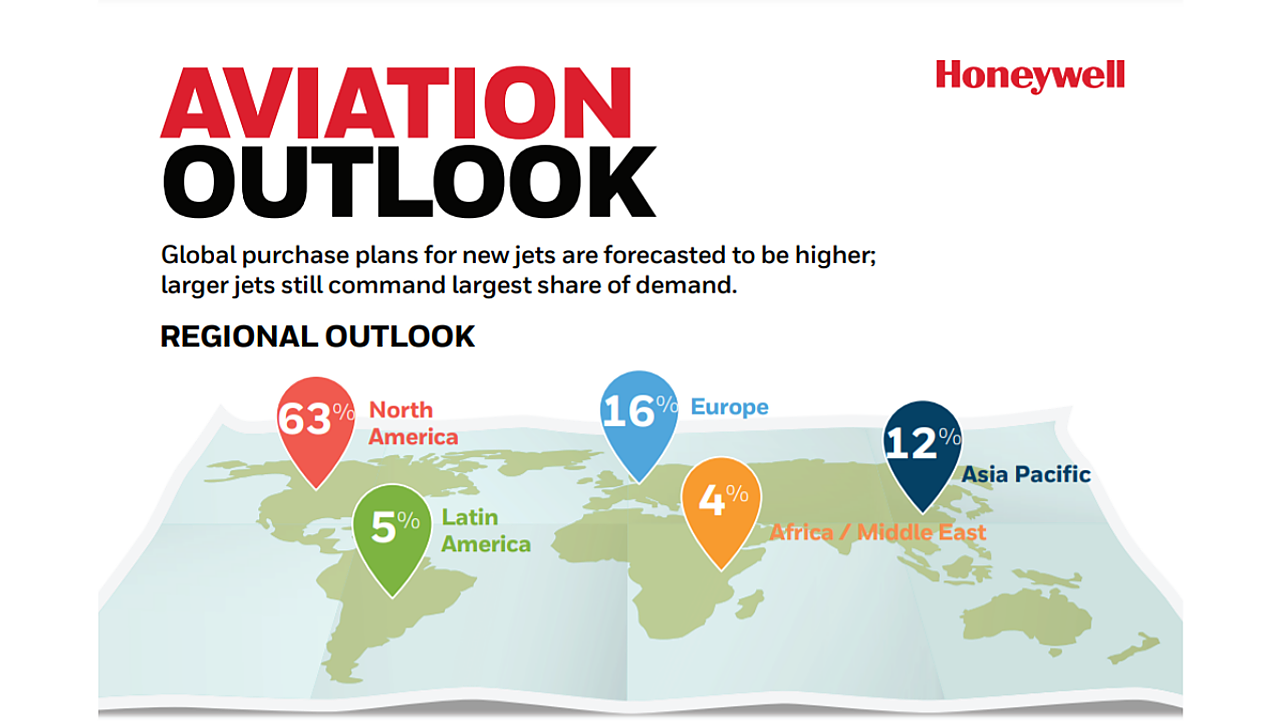

Based on the region, in North America, five-year new aircraft acquisition plans are down by three percentage points compared with last year. It is likely to be driven by the uncertainty caused by the Delta variant among smaller jet operators.

European operators' new aircraft purchase plans are down five percentage points year over year as the Delta variant forced governments to restrict travel across borders, creating uncertainty.

In Latin America, purchase plans recovered to 2019 levels, up to six percentage points versus last year.

Despite ongoing geopolitical and commercial tensions, purchase plans are up in the Asia Pacific, while for the Middle East and Africa, the survey marked a five-year low in purchasing plans in 2021.

Used Jets

In the next five years, plans to acquire used jets will increase by about four percentage points from last year's survey. As a result, 29% of used business jets will trade hands over the next five years, compared with a five-year projection of 25% in 2020.

The Global Business Aviation Outlook reflects current operator concerns and identifies longer-cycle trends that Honeywell uses in its product decision process. The survey has helped identify opportunities for investments in flight-efficiency upgrades, expanded propulsion offerings, innovative safety products, services, upgrades, and enhanced aircraft connectivity offerings. The survey also informs the company's business pursuit strategy and helps position the company consistently on high-value platforms in growth sectors.