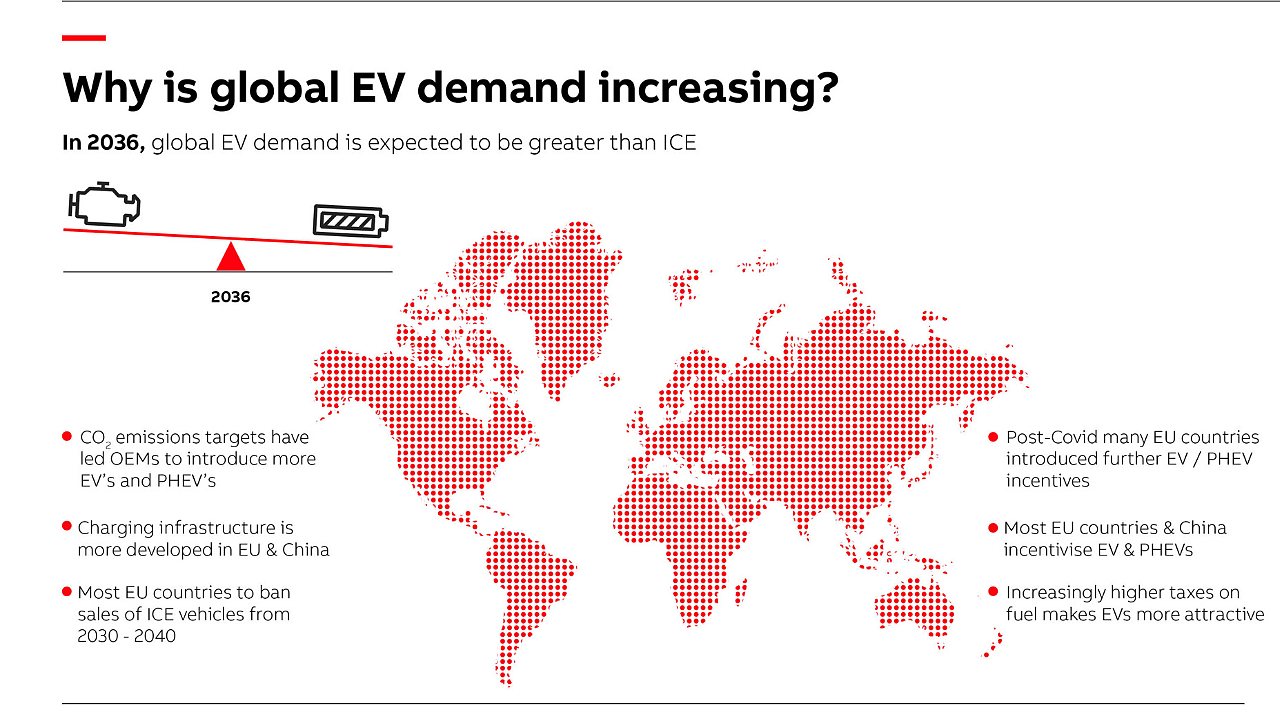

All-electric passenger vehicles are predicted to overtake sales of ICE-equipped equivalents by 2036. However, concerns over EV battery supply to meet the escalation in demand poses serious risk to the growth of electricity as a clean propulsion fuel, despite plans for 80 new global battery gigafactories.

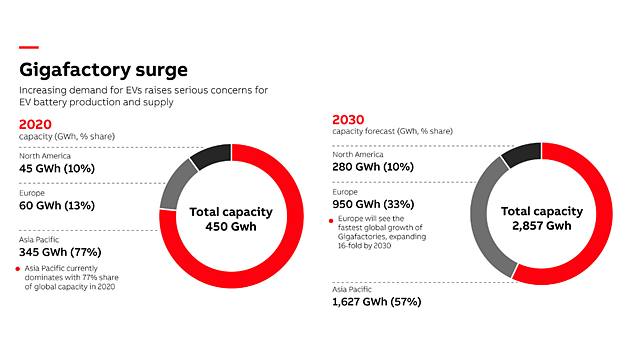

A recent report titled, ‘Electric Vehicle Battery Supply Chain Analysis,’ sponsored by ABB Robotics and authored by the automotive intelligence unit of Ultima Media has also outlined that although Asia leads electric vehicle battery production, Europe will make up vital ground over the next few years, while US manufacturers are also planning increases in capacity.

The report highlights the fact that lithium-ion batteries will reshape automotive supply chains, and that the future of battery supply will be diversified.

Lithium-Ion Batteries Will Reshape Automotive Supply Chains

Lithium-ion batteries are central to the success of automotive OEMs’ electrification strategies in terms of improving the driving range and price competitiveness of electric vehicles (EVs). Carmakers and battery manufacturers are aiming to improve battery quality and bring down prices to below $100 per kilowatt hour (KWh), a rate at which EVs can compete with traditional internal combustion engine (ICE) vehicles.

However, battery technology and prices are not the only factors at play. As EV demand rises, it is becoming especially critical for manufacturers to manage the procurement and production of batteries. And there are serious questions over whether supply will keep up with demand across the battery supply chain.

Even before the COVID-19 crisis, there were growing reports of OEMs facing production issues as a result of difficulties sourcing batteries and cells. In the aftermath of global shutdowns and subsequent restarts following the first wave of the pandemic, EV production again felt the squeeze in supply as demand ramped up, impacting output of key products like Tesla’s Model 3, for example.

More recently, the wider shortage of electronic components, including semiconductors and microchips, has compounded these issues. There are further bottlenecks in the supply of lithium and certain materials and minerals in the battery supply chain, with the risk of price spikes.

Such supply issues could lead to potential lost sales, unnecessary costs and lower profits for manufacturers at a particularly critical time. Analysis of the fast-developing battery industry reveals why many of these teething problems arise. Not only are there a new set of companies compared to the supply chain for internal combustion engines (ICEs), but the EV battery chain introduces new technologies, regulations, safety and environmental concerns.

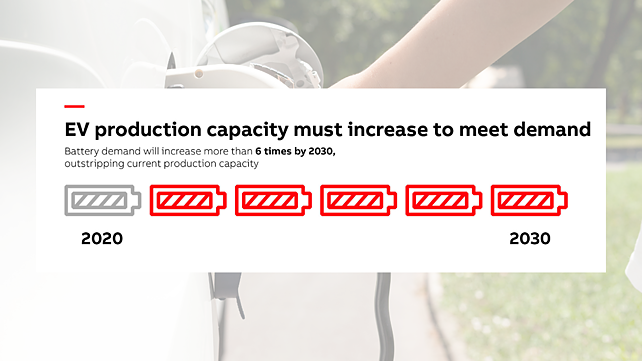

But growth of the sector is set to be exceptional, propelled by 20% CAGR for global EV sales over the next decade. Battery production capacity will likely need to outpace EV demand to meet the rising need for lithium-ion power in other sectors, along with mitigating supply and production constraints. We estimate that global capacity for lithium-ion batteries will increase from 450 gigawatt hours (GWh) in 2020 to more than 2,850 GWh by 2030.

This supply chain will help to redefine the automotive industry, bringing strategic opportunities for many manufacturers and suppliers – but also considerable risks and disruptions.

One clear finding in this report is that capitalising on the electric revolution will not just be about having the best technology or price – but also the need to build, secure and, where necessary, change battery capacity in different regions.

The Future of Battery Supply Will Be Diversified

The battery supply chain is highly complex, made up of a number of critical minerals, materials and components, many sourced and produced from companies relatively new to the automotive sector. The locations for materials stretch across regions, including China, Africa, Australia and South America. The production of lithium-ion cells is also largely concentrated in Asia.

As the battery represents 30% or more of the value of a vehicle, established OEMs and tier suppliers – not to mention governments – want to take more control of the battery chain, rather than see profits and jobs shift to other players and locations. It has been estimated that a complete European battery supply chain, for example, from upstream materials to recycling, would be worth up to €250 billion ($303 billion) a year and could create four million jobs across the EU.

OEMs such as the Volkswagen Group, Toyota, General Motors and BMW are establishing new supply partnerships and joint ventures to increase lithium-ion battery and cell production, in some cases with a view to commercialise this capacity by selling batteries to other OEMs. Tesla, meanwhile, is taking steps to gain more control and vertically integrate more aspects of battery production, including cell manufacturing but also the mining and processing of key materials. Other OEMs are considering the strategy that works best for them. But increasingly, carmakers are looking to a diversified battery strategy.

There are also emerging legislative and regulatory dimensions to this battery race. National governments in Europe and at the EU level, for example, are investing state money in supporting the development of a regional battery supply chain – as well as legislating for higher localisation rates. Trade agreements such as the EU-UK free trade deal, as well as the US-Mexico-Canada Agreement (USMCA) include targets for increasing regional battery content.

In February, Joe Biden, the new US president, also signed an executive order to undertake a strategic review of critical supply chains, including for large capacity batteries for electric vehicles, as well as for semiconductors. Increasingly, over dependence on a single region or set of suppliers is seen not only as a competitive issue but also one of potential national security concern.

The competition is increasingly contentious. In the US, LG Energy Solution – the battery-focused division spun off by South Korean battery giant LG Chem – filed a trade-secret lawsuit against SK Innovation (SKI) that has resulted in a 10-year ban on SKI selling and importing batteries in the US (with an exception for supplying existing contracts with Volkswagen and Ford), raising serious questions over current supply and battery production plans. It also highlights how important securing and diversifying battery supply will be for OEMs.

Despite these challenges, a firm outline of an expanding battery supply chain is clearly taking shape. Battery manufacturers and start-ups have announced construction of more than 80 new gigafactories across the globe to produce lithium-ion cells and batteries, and many more will be needed over the next decade. Europe, though still far behind China and Asia in battery and cell production, is set to emerge as a major player, with the most announcements for new gigafactories so far. The US and North America have lagged behind but are also set for growth. China is expanding its base even further and will likely play a major role in the global battery and finished electric vehicle supply chain.

The race to electrification will inevitably bring pain and disruption to many parts of the supply chain. For OEMs, developing and producing ICE powertrains have been part of how brands differentiate themselves; phasing out petrol and diesel threatens many manufacturing and engineering jobs, too. As EV powertrains have fewer components, many existing suppliers may be threatened and even eliminated.

But electrification and especially the battery supply chain represent one of the most significant growth opportunities across the automotive industry. The new manufacturing networks, supply patterns and business relationships will play a large role in defining the next generation of the automotive value chain.

Wrap-Up

The report’s researchers point to the importance of battery pack assembly being located close to or within car assembly facilities. Co-locating battery pack assembly not only boosts sustainability by reducing transportation, it increases flexibility.

The high price of EVs will increasingly create a barrier to further market penetration. Reducing vehicle cost has therefore become a whole-industry focus. Given that the battery represents up to a third of vehicle costs, ABB is focused on solutions that improve battery manufacturing productivity.