Driven by a strong call for environmentally conscious vehicle technologies, the global automotive exhaust systems market is poised to reach $82.06 billion by 2030, heralding a robust CAGR of 7.7% from 2023 to 2030, according to a recent report from ResearchAndMarkets.

This significant surge comes as stringent government emissions regulations take centre stage, propelling the demand for advanced automotive exhaust systems and after-treatment devices.

Titled 'Global Automotive Exhaust Systems Market Size, Share & Trends Analysis Report,' the report delves into the intricate dynamics of this transformative market, covering components, fuel types, vehicle types, and regional insights from 2023 to 2030. An intricate dance between regulatory compliance, sales surges in passenger cars and commercial vehicles, and a quest for lightweight emission systems defines the narrative of this automotive revolution.

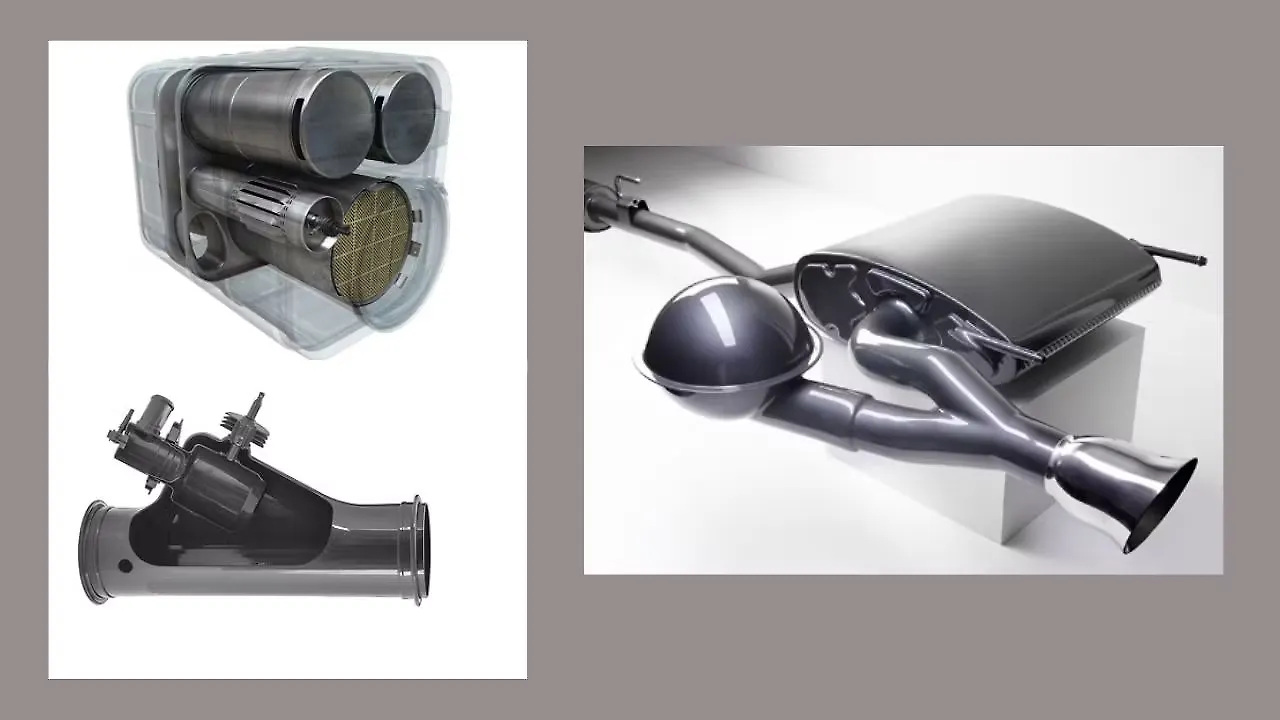

As the automotive industry steers towards a greener future, OEMs are pioneering innovations in materials, drivetrain efficiency, and aerodynamic design to shed vehicular weight. Conventional exhaust systems, predominantly crafted from stainless steel, cast iron, and mild steel/carbon steel, are facing a formidable challenge from lightweight alternatives made from composite metals with high-temperature resistance.

Leading the charge in this innovation race is Tenneco Inc., presenting lightweight compact systems and after-treatment solutions aimed at enhancing fuel economy and thermal management. These efforts underscore the industry's commitment to environmental stewardship and efficiency.

However, the pandemic's disruptive touch has left its imprint. In 2020, COVID-19 caused a ripple effect, disrupting supply chains and temporarily halting production at various facilities worldwide. Companies like Eberspacher weathered a decline in unit volumes and revenues, indicative of the pandemic's toll on the automotive industry.

Regional Landscape: Asia Pacific Takes The Wheel

In 2020, Asia Pacific commandeered 60% of the automotive exhaust systems market, a dominance expected to persist with a projected CAGR of around 7% over the forecast period. Key players in the region, notably China and India, are steering the global automotive narrative.

According to the report, China, the reigning giant in automotive manufacturing since 2008, continues to wield influence, with production volumes surpassing those of the European Union. India, the fifth-largest automotive manufacturing country globally, is expected to witness the highest CAGR, thanks to the government's proactive initiatives outlined in the Automotive Mission Plan 2016-2026.

Market Highlights

Component Dynamics: The muffler segment is set to steal the spotlight, projected to register the highest CAGR of over 8.6% from 2023 to 2030. The surging demand for dual-exhaust muffler systems, particularly in mid-sized and luxury vehicles, fuels this growth.

Fuel Type Leadership: Gasoline emerges as the largest segment in 2022 and is poised to retain its dominance throughout the forecast period.

Vehicle Type Resilience: The commercial vehicles segment emerges as a stalwart, projected to expand at the highest CAGR of around 9.4% over the forecast period. This growth is propelled by the escalating demand for commercial vehicles across the transportation and logistics sectors.

As the automotive exhaust systems market accelerates towards this remarkable USD 82 billion milestone, the wheels of change are not just turning; they are leaving an indelible mark on the landscape of automotive innovation, environmental consciousness, and regulatory compliance. The journey towards a cleaner and more efficient automotive future has well and truly begun, the report noted.

Courtesy: ResearchAndMarkets. Photo is representational; Courtesy: Tenneco.

Also Read:

Meritor Joins ConMet eMobility To Enable Zero-Emission Trailers

New Emission Norms Will Lead To A Rejig In Tractors HP-wise Mix