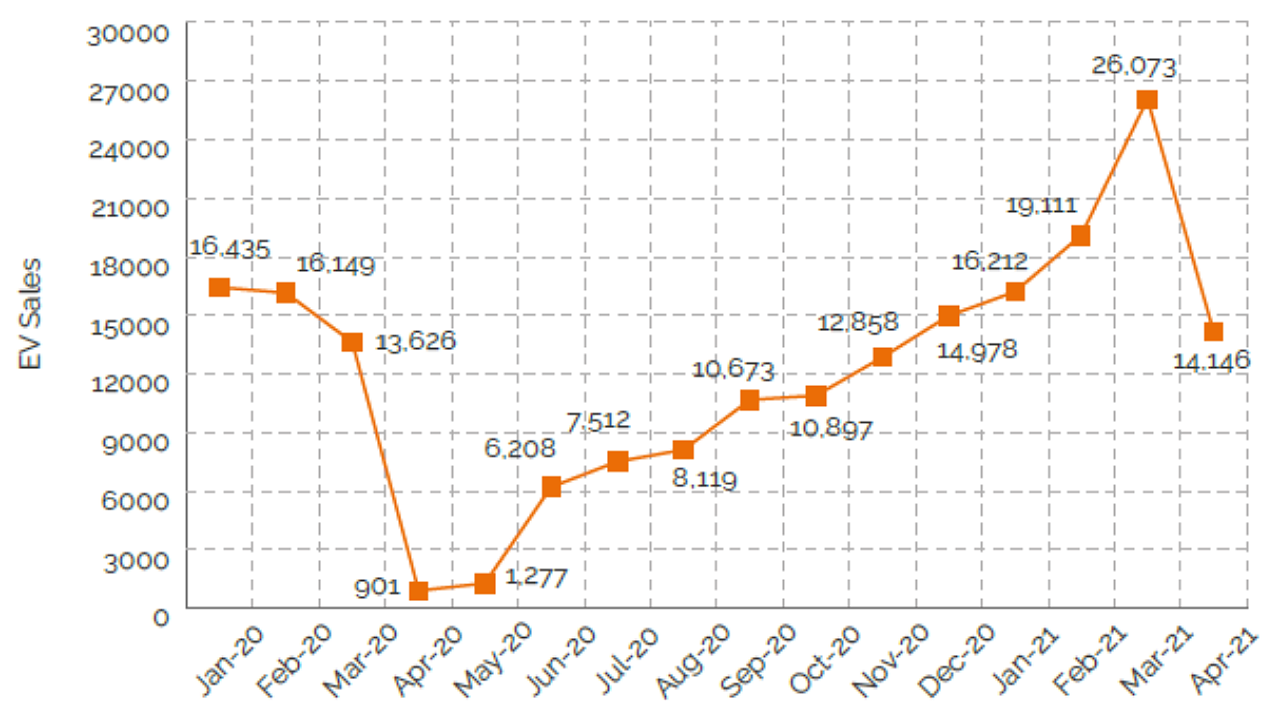

The first month of the new fiscal saw an overall drop in the registration of electric vehicle sales in the country, consultancy firm JMK Research & Analytics has reported.

In its monthly updates on the electric vehicle market, the firm said the EV sector reported total sales of 14,146 units, which is the lowest in the previous five months. Although the month-on-month (MoM) fall in sales is approximately 46%, the registrations increased year-on-year (YoY) by a staggering 1470%.

As of April 2021, the total sale of EVs in India is in the range of 690,000 units, JMK said in its study.

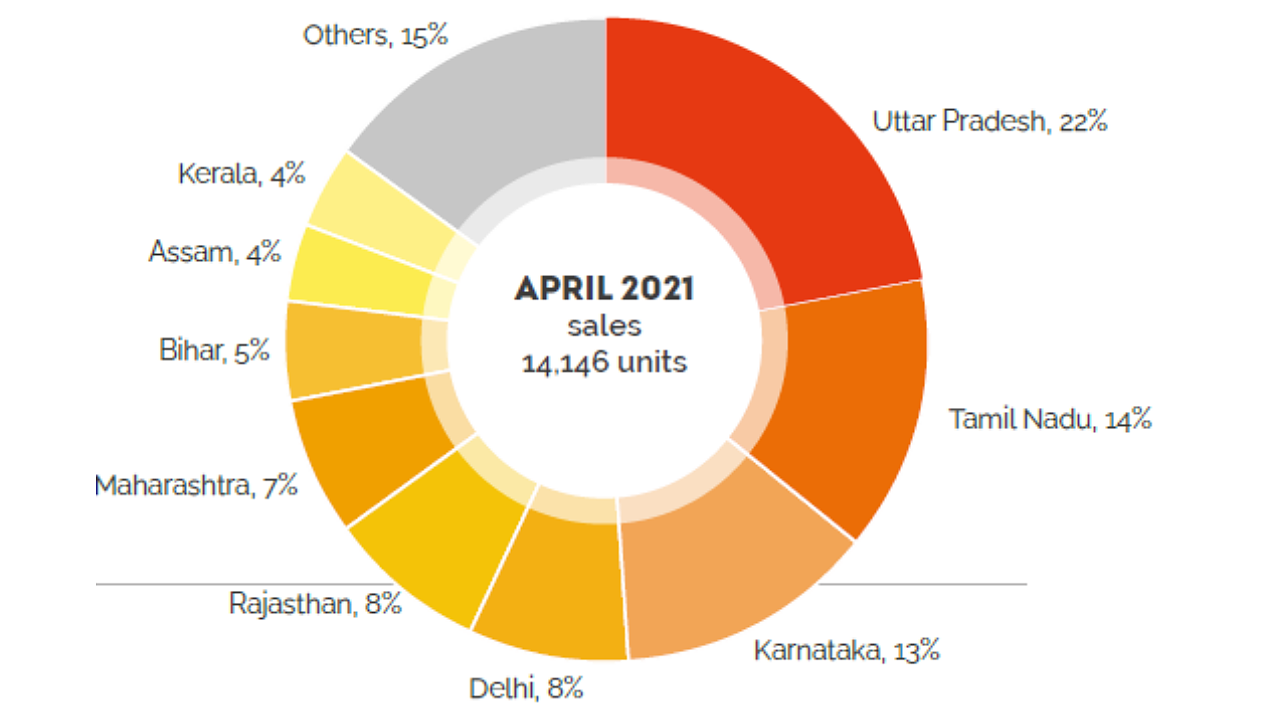

Among all the states and union territories in the country, Uttar Pradesh continued to report the maximum monthly registered EV sales, with 22% of overall country-wide sales in April 2021. Tamil Nadu is next with a share of 14%, followed by Karnataka (13%), Delhi & Rajasthan (8% each).

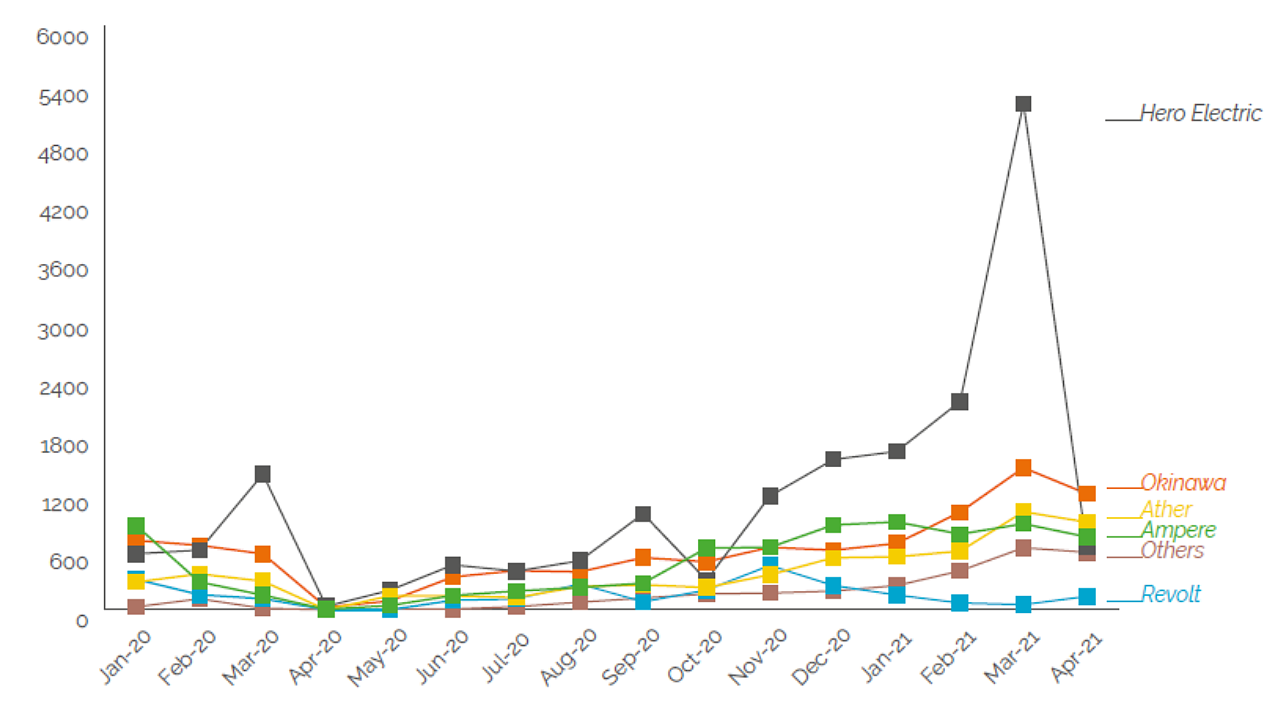

Looking at individual players in the EV market, JMK reported that Ampere, Ather, Hero Electric, Okinawa and Revolt collectively sold about 3,600 units in April in the high speed e2W category. This is ~58% lower than their collective sales in the previous month of March 2021. The YoY rise in this category for the five players, however, was 54X.

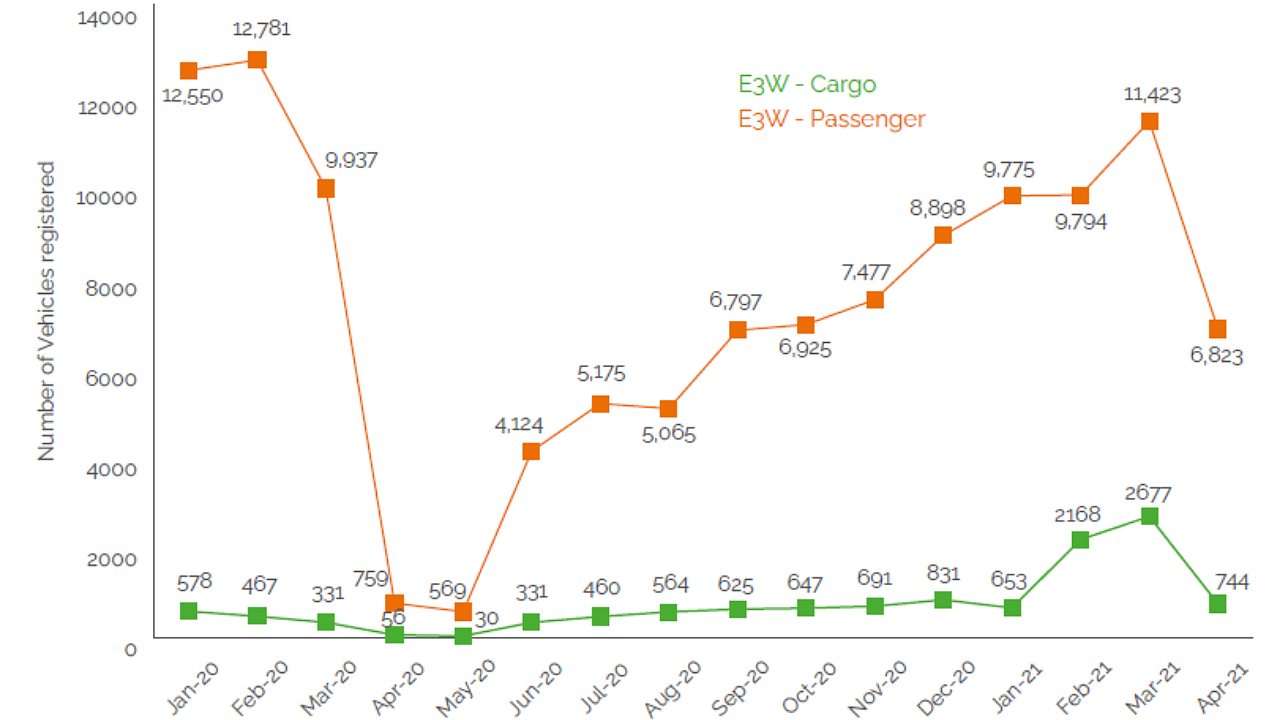

In the electric three-wheeler segment, the study reported that April 2021 saw the lowest sales in seven months for both the passenger and cargo segments. At 7,567 units, it has declined 46% MoM. The share of cargo-type e3W in the combined e3W sales for April 2021 has fallen to 9.8% from 19% in the previous month.

Policies and Regulations

In April, the Ministry of Power released the draft National Electricity Policy 2021, and has called for expert recommendations. An expert committee consisting of members from MNRE, CEA and NITI Aayog has been formed to present its suggestions and recommendations on draft NEP 2021 in two months, starting from April 27, 2021.

Section 17 of the draft covers creation of charging infrastructure, which states that ‘certain tariff related measures may be required to be undertaken for public charging stations’, and that ‘a separate consumer category may have to be created due to the specific nature of the load’.

The draft also mentions the use of Time Of Day (TOD) tariff to avoid charging during peak hours. It also talks about injecting the power back to the grid from EV batteries, when needed by the grid, and creation of a tariff structure and rules by the concerned SERC for the same. Aggregators may be allowed to aggregate the demand of multiple public charging stations to purchase renewable energy using open access, the policy draft states.

Product launches

April 2021 saw the introduction of a few new EV models in the country. DAO EV launched Model 703, Vidyut 106, Vidyut 108 and ZOR 405 electric two-wheelers, while Kabira Mobility launched the Hermes 75. Joy e-bike meanwhile launched four products in the market, including the Skyline, Hurricane, Thunderbolt and Beast two-wheelers. The other company to introduce a e2W was Geliose Mobility, which brought to the market its Hope two-wheeler.

Investments

There were a few interesting developments from an investment perspective in the Indian EV industry in April 2021.

Revolt Intellicorp raised INR 150 crore ($ 20.25 million) in equity from RattanIndia. EV-based logistics company Moeving raised $1 million in equity from a clutch of individual investors from various fields. The company also launched its operations in multiple cities. Oye! Rickshaw, meanwhile, raises INR 24 crore from Alteria Capital to expand its EV fleet.

Mahindra & Mahindra too announced it will invest INR 3,000 crore in its EV business in the next three years, while also looking for more alliances and partnerships. M&M is working on developing an EV platform by combining capabilities of its operations across the globe, including Detroit and Italy.

The company, which has set a goal of putting 500,000 EVs on Indian roads by 2025, has already invested INR 1,700 crore in its EV business in India with another INR 500 crore on a new research and development (R&D) centre.

The JMK study also reported that Simple Energy plans to raise $ 15 million ahead of its highly-anticipated scooter launch, codenamed Mark 2. Once launched, this product will compete with Ather’s 450X and Bajaj’s Chetak e2Ws. The company also announced that 60% of these funds will be invested in its manufacturing facility, which will produce 50,000 units annually.

Global Market Updates

General Motors has announced deals with major electric vehicle charging networks to offer its customers access to nearly 60,000 charging points across the United States and Canada. GM also introduced Ultium Charge 360, a platform which integrates charging networks, GM vehicle mobile apps and other services to simplify the charging experience for its EV owners.

The automaker had previously announced a $ 27 billion investment in EV and autonomous vehicles (AV) through 2025 and the launch of 30 new EVs by 2025-end. The company also announced its plans to expand its EV production with an investment of more than $ 1 billion in Mexico, adding a fifth plant in North America with EV production capacity. The automaker’s facility in Ramos Arizpe, Coahuila, will start making unspecified EVs for GM brands in 2023.

The Joe Biden administration’s $ 174 billion proposal to boost EVs calls for $ 100 billion in new consumer rebates and $ 15 billion to build 500,000 new EV charging stations, according to a US Transportation Department email sent to congressional staff, reports JMK.

The EV rebates, part of a $ 2.3 trillion infrastructure and jobs proposal, could be a big boost to US automakers, especially General Motors and Tesla Inc, which no longer qualify for $ 7,500 tax credits after they sold more than 200,000 zero-emission models.

Thailand, meanwhile, has announced its aim to only sell zero-emission vehicles in the country from 2035, as it works to transform itself from a Southeast Asian hub for the production of conventional autos to one making electric cars. Thailand’s bold plan also sets a target of having electric vehicles account for 50% of all new car registrations by the end of the decade.

By 2040, Honda Motor plans to switch entirely to electric vehicles. The company plans to transition to electric vehicles (EVs) and fuel cell vehicles (FCVs) by 2040. By 2030, the company expects EVs and FCVs to account for 40% of sales and it will further increase it to 80% by 2035 in all major markets, which include North America and China.

The new commitment from the company came soon after the country’s promise to cut emissions by 2030. Yoshihide Suga, Japanese Prime Minister has aimed at a 46% cut in emissions by 2030 and look for ways to go even further, nearly doubling from its previous target.

Finally, ABB will carve out its electric-vehicle charging business into a separate legal structure to prepare the unit for a potential listing and boost its ability to make acquisitions. The business, which builds fast electric chargers for cars and buses, had revenues of $ 220 million in 2020, and has had an average growth rate of 50% over the past five years.

Source: EV Monthly Updates - April 2021, JMK Research & Analytics