Shortage of raw materials and the rising demand for battery materials due to expanding global energy demand from other sectors fuel the growth of the global EV battery reuse market is projected to grow at a CAGR of 34.3% between 2022 and 2031.

According to the recent report by Valuates Reports, the EV Battery Reuse Market, by source, Hybrid Electric Vehicle (HEV), Plug-in Hybrid Electric Vehicle (PHEV), Fuel Cell Electric Vehicle (FCEV)), battery chemistry, vehicle type, and application: Global Opportunity Analysis and Industry Forecast, estimated at $0.2 billion in 2021, is anticipated to reach $3.9 billion by 2031.

The report stated that the EV battery reuse market is anticipated to increase due to rising concerns about energy security and significant cost savings throughout the predicted period.

Influencing Trends

Concerns about the sustainable availability of battery materials have been raised due to the rapidly expanding EV market. These include supply concerns brought on by large geopolitical cobalt concentrations, social and environmental effects of mining, the availability of cobalt and lithium reserves, and the necessity for swift supply chain upscaling to meet anticipated demand.

Reusing EV batteries will aid in addressing the lack of battery raw materials and rising global energy demand. These factors are expected to drive the growth of the EV battery reuse market.

Due to increasing investments in communication towers worldwide, it is predicted that the EV battery reuse market will expand across base station applications. Reusing EV batteries can provide the energy storage system that base stations need to provide a steady power supply for efficient operation.

According to Valuates Reports, direct reuse is one of the easier options, where salvaged batteries from insurance write-offs are evaluated and tested to be usable before being offered as replacements in other EVs. This approach is comparable to current markets for internal combustion engine powertrain components.

Batteries could also be used as grid-scale solar storage or to replace conventional grid-connected combustion turbine peaker facilities for peak shaving. This factor is expected to drive the growth of the EV battery reuse market. The battery reuse lifetimes anticipated by this application are at least ten years. The grid stability problems with renewable energy can be solved using battery energy storage. The battery can be used as a grid backup power source by DSOs and energy providers.

Research and proof-of-concept projects are receiving funding to enhance EV second-life applications. For instance, funding is being given to research and studies that demonstrate the viability of EV second-life uses. This factor is further expected to drive the EV battery reuse market.

Market Share Analysis

According to the report, in 2021, Asia-Pacific dominated the global market for reusing EV batteries. In this region, there is a high need for diverse batteries across several industries. In addition, the existence of a sizable population and expanding industrial prospects in the area have increased the demand for battery recycling and reuse facilities.

The EV battery reuse market is dominated by the commercial vehicle segment globally. Electricity is used to power commercial vehicles instead of diesel or fuel. Manufacturers have been forced to create ECVs for the entire world by the rising demand for low-emission transportation and official support of zero-emission transportation for commercial electric vehicles, including buses, trucks, pickups, and vans, through subsidies and tax refunds.

The lithium manganese oxide segment dominates the global EV battery reuse market. In addition, electricity, gas, water meters, fire and smoke alarms, security equipment, and other devices frequently use lithium manganese oxide batteries.

The category of battery electric cars dominates the expansion of the worldwide EV battery reuse market. The market is expanding due to rising demand for environmentally friendly mobility solutions to reduce pollution levels and the availability of tax incentives. In 2021, the base station application held the greatest market share, the report noted.

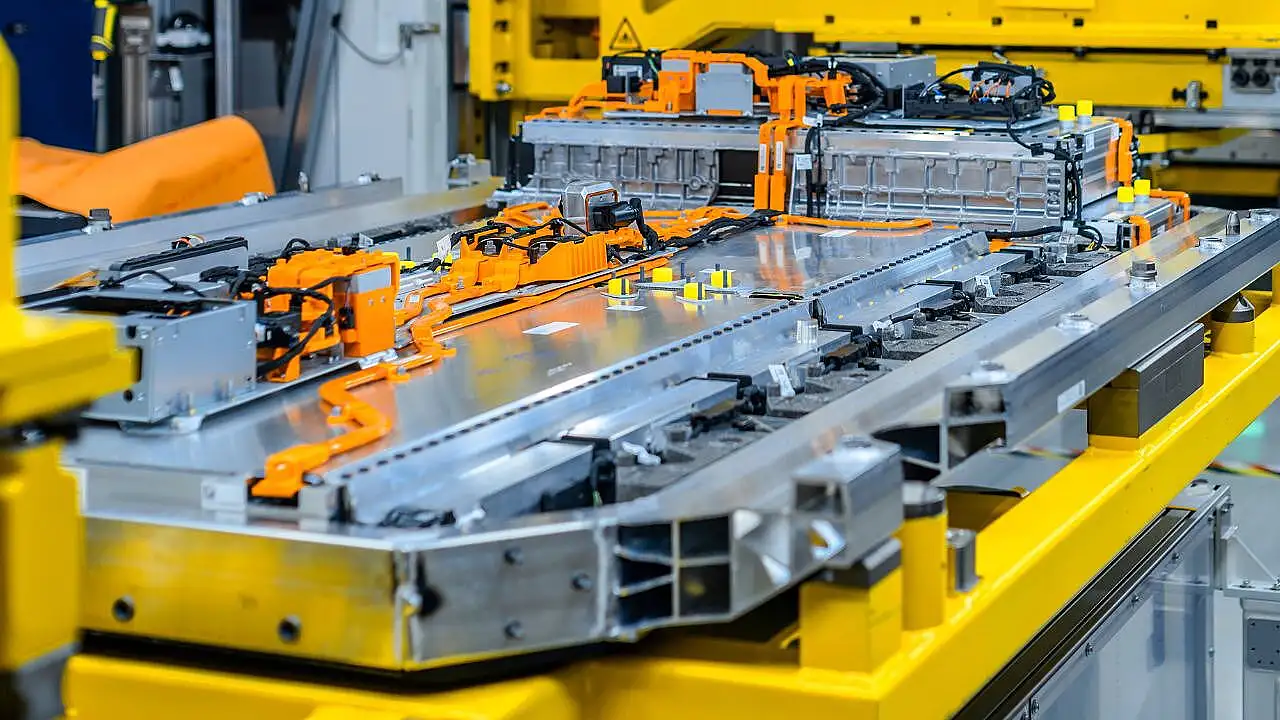

Courtesy: Valuates Reports. Photo is representational; courtesy: Mercedes Benz.

Also Read:

Volvo Group To Produce Battery Module In Ghent, Belgium

Lohum Joins Glencore To Recycle Lithium-Ion Battery Packs

India Must Focus On Indigenous EV Battery Manufacturing: ADL