The transport industry has been using software to manage drivers, vehicles, and logistics operations, and the interest is growing. However, more than a third of the companies surveyed are not using these solutions, finds a study - The Connected Truck, which was carried out for the second time since 2016 by the renowned social research institute infas - Institute for Applied Social Science, on behalf of the technology company Continental.

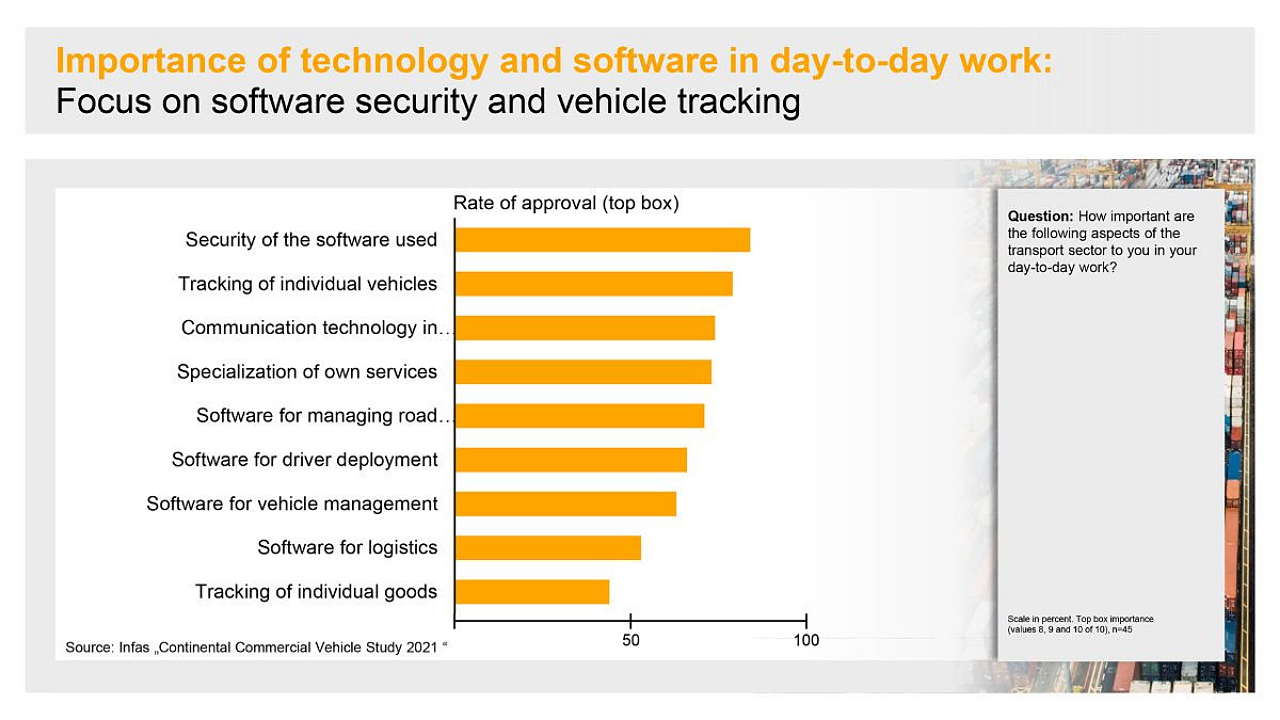

The percentage of non-users, with many of them, are small companies – is roughly the same as in the previous survey. In a reflection of current developments in this sector, it was also shown that logistics providers are mainly interested in driver-assistance functions and fuel-saving technologies when it comes to equipment. The study said that vehicle tracking and software security are also necessary, but companies are careful to invest.

Tailor-made solutions

According to infas, a direct comparison with the previous study (2016) reveals a clear trend. Logistics and transport companies that use software solutions are now more satisfied with them on the whole. In particular, the companies surveyed assess software for monitoring driver behaviour roughly half a point better on a scale from one to six than in 2016. This software is also the most important in day-to-day work, followed by software for planning driver deployment, vehicle management, and logistics operations.

On the other hand, although most of the companies surveyed use such software, many others use it rarely or not. More than a third – especially smaller companies – are non-users, the report said.

Gilles Mabire, Head, Commercial Vehicles and Services Business Unit, Continental, said, “Logistics companies that operate small fleets are just as much affected by rising costs and pressure to increase efficiency as large transport companies. But small companies are not yet convinced that software can significantly benefit them. The industry must address this issue and provide solutions that are tailor-made for these customers. It must also point out the advantages of existing solutions for smaller companies. If these big differences in use continue to prevail, the gap might grow between large, profitable companies that make extensive use of technology on the one hand and smaller ones with shrinking profits on the other.”

Demand for driver-assistance systems and fuel-saving solutions

The previous study identified that about two-thirds of the companies surveyed expressed a wish for more driver-assistance functions, and more than half would welcome further fuel-saving technologies. In decreasing order of importance, they showed an interest in more comfort functions in the interior, tyre pressure monitoring systems and systems for better communication with drivers.

Mabire said, “New regulations have been introduced to improve road safety and reduce vehicle emissions. An example is the EU directive to reduce CO2 emissions. As a consequence, the demand for these technologies will remain high, and it can be expected to increase.”

In addition, cost pressure continues to be a significant factor in the industry, so companies must save money where they can. Fuel accounts for a large portion of the costs in a fleet, where logistics providers can achieve the most significant savings, Mabire pointed out.

The pressure to cut costs and increase efficiency also plays an essential role in willingness to invest. Logistics providers need their investments to pay off quickly. More than three-quarters of the companies surveyed stated that investments in fuel-saving driving have to pay for themselves within two years – and for companies with small numbers of vehicles, this period is even shorter. Their requirements are challenging as significant benefits are expected from new technologies. Therefore, manufacturers and suppliers must develop solutions that yield economic benefits quickly, he added.

Tepid willingness to invest

The survey participants also emphasised their need for software that fulfils high-security standards. Increasing data traffic has opened up greater potential areas of attack for cybercriminals. So the industry must offer solutions that are suitably sophisticated and practice-proven. But security costs money; it can’t be provided for free, he said.

Only about half of the companies surveyed had already taken defensive measures for an attack on logistics or fleet management systems. Moreover, three quarters said they were not planning any significant investments within six to twelve months.

“Real willingness to invest is not keeping up with statements about the importance of this topic. One reason might be that no transport company has yet been the victim of a cyberattack. But the growing number of attempted attacks is a sign that the problem is becoming increasingly important,” Mabire added.