Automobile consumers are shifting their focus towards lightweight vehicles because of rising concerns about environmental pollution, eventually driving the global metal stamping market size to reach $ 270.32 billion by 2028, Grand View Research said.

According to the US-based market research and consulting company, the market is expanding at a CAGR of 3.8%.

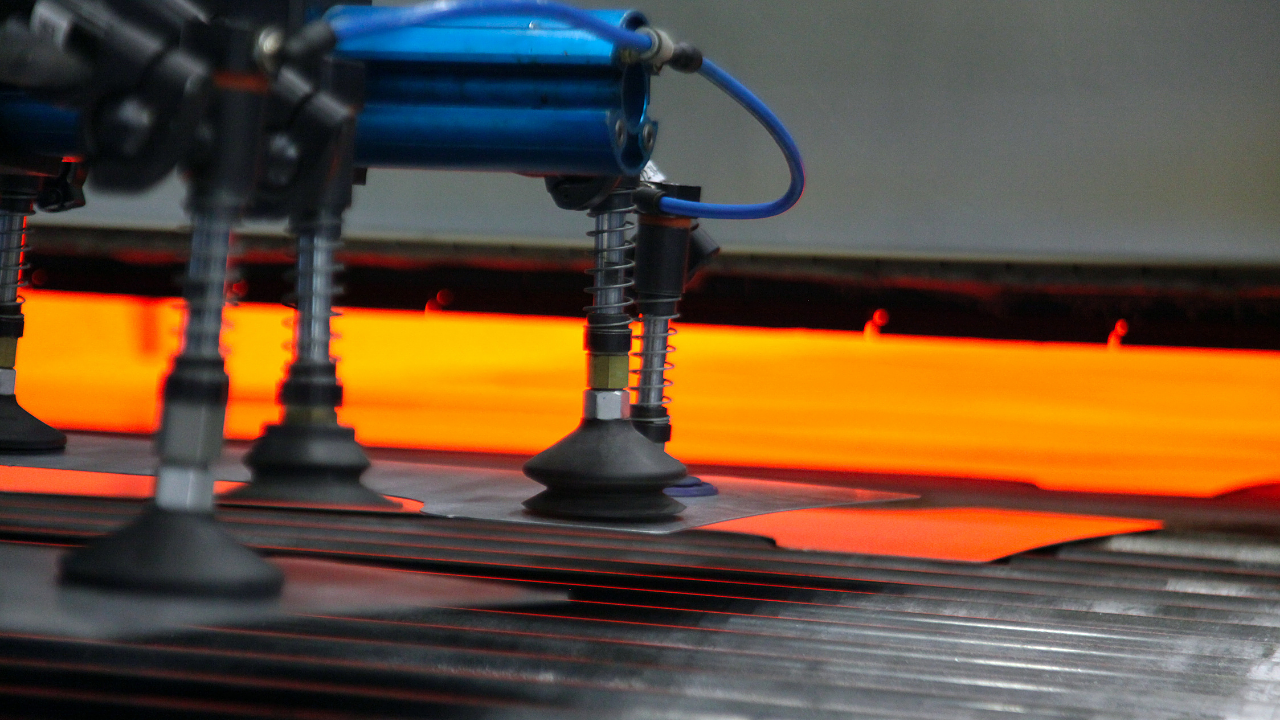

The increasing production of automobiles is anticipated to drive the demand for metal stamping as it is used to manufacture car body panels, transmission components, and interior and exterior structural components.

Some of the metal stamping market players include Acro Metal, Manor Tool & Manufacturing, D&H Industries, Kenmode, Klesk Metal, Clow, Goshen, Tempco Manufacturing, Interplex Holdings, Nissan, Gestamp and Ford.

The blanking segment is anticipated to progress at a CAGR of 3.2% in revenue over the forecast period. It is due to the automotive industry's increasing demand for its precise and superior stamping ability.

The bending segment's share of revenue in 2019 was 16.7%. Products manufactured using this process ensure stability and durability; thus, it is primarily used in auto components.

Consumer electronics is the fastest-growing segment in terms of revenue, with a CAGR of 4.3% over the forecast period. The growth is attributable to the increasing utilisation of lightweight metal components to improve the durability of electronics.

Industrial machinery accounted for a revenue share of 19.2% in 2019; it is driven by the growing demand for machinery and automation to improve output efficiency.

In terms of region, North America is expected to witness a CAGR of 2.5% in terms of revenue. It is anticipated to continue dominating the overall metal stamping market owing to the increasing production of automobiles and consumer electronics.

According to the Center for Automotive Research (CAR), the global light vehicles sales reached around 94 million in 2018 and are expected to reach nearly 110 million by 2026. The growing demand for lightweight vehicles is encouraging auto component manufacturers to increase their production capacities and engage in new product developments, which, in turn, is anticipated to augment market growth over the coming years.

Major automobile manufacturers with in-house component manufacturing facilities are expanding their production capacities to meet the growing demand for automobiles.

For instance, in February 2019, Ford Motor Company announced to invest $1 billion in Chicago assembly and stamping plants. With the investment, the company plans to add all-new stamping lines and all-new body shops and paint shops used to manufacture 2020 Ford Explorer, Police Interceptor Utility, and Lincoln Aviator. Thus, increasing the production of these vehicles is anticipated to drive product demand over the coming years.

In the Asia Pacific region, increasing demand for consumer electronics such as mobile phones, computers, laptops, and headphones is likely to boost the demand for metal stamping as it is used in manufacturing metal frames such as metal headbands used in headphones.

Change in consumer preferences towards enhanced audio experience and a rapidly growing music industry, and advancement in VR technology are the significant factors that are expected to drive the demand for headphones. This, in turn, is likely to propel market growth over the coming years, the research firm said.

Courtesy: Grand View Research. NB: Photo is representational; courtesy: Gestamp.