The surge in demand for lightweight materials to reduce vehicle weight and carbon emissions and the growing consumer preference for pollution-free and efficient vehicles drive the global demand for Continuous Fibre Reinforced Thermoplastic Composite (CFRTPC) to reach $ 1.5 billion by 2031.

As per insights by Fact.MR, the market is set to expand at a rate of 1.7X, growing from $ 900 million registered in 2020.

The ability of CFRTP composites to offer strength and stiffness has resulted in their extensive use across various end products.

According to Fact.MR, the market will continue showcasing a steady growth rate, mainly on account of intrinsic features of fibre-reinforced thermoplastic composites, covering high strength-to-weight ratio, improved load-carrying ability, low-coefficient of thermal expansion, and resistance to deformation and cracks. Subsequently, the market will continue gaining from CFRTP applications across the electronics, automotive and aerospace industries.

Some of the leading players operating in the CFRTP composites market include Lanxess, TenCate, Celanese, Polystrand, Tri-Mack, AXIA Materials, US Liner, Aonix, Lingol and Ningbo Huaye Material.

Among various products, glass fibre composites are gaining traction and exhibiting higher sales of CFRTPC. The research firm has also estimated that it accounted for over 40% of the market share in 2020.

North America to dominate the global market

Regionally, North America is anticipated to dominate the market, accounting for over 50% of the market share. The demand outlook for the US remains positive, driven by the presence of major manufacturers, growing disposable income and surging demand for customised vehicles. As per the study, the market for CFRTPC totalled around $ 250 million in 2020.

'Increasing adoption of CRFTP composite materials by manufacturers for reducing vehicle weight and lowering carbon emissions will bolster sales prospects. To capitalise on available opportunities, manufacturers are likely to focus on capacity expansion,' says a Fact.MR analyst.

Key Takeaways

The research firm states that China is estimated to reach a valuation of around $ 350 million by the end of 2021. Backed by high disposable income coupled with the presence of major market players, the US is forecast to grow at an impressive pace. The US market for CFRTPC was totalled at around $ 250 million in 2020.

Japan and South Korea are projected to exhibit growth at a CAGRs of 3% collectively.

The European market for CFRTP composites is projected to expand at a CAGR of more than 4% over the assessment period 2021-2031.

Key drivers

Increasing demand for CFRTP composites for applications in automotive, aerospace, electronics and other industries will drive the market growth.

Surging demand for lightweight materials to reduce carbon footprint is bolstering future growth prospects.

However, the high production cost is expected to hamper sales of CFRTP composites, the report said.

CFRTP composites manufacturers are focusing on expansion and acquisitions to increase their global footprint and customer base.

In 2020, Mitsubishi Chemical Corporation announced its new pilot facility for carbon-reinforced thermoplastic materials in Fukui Prefecture (part of Japan's Honshu island). Operations are projected to commence at the end of 2021.

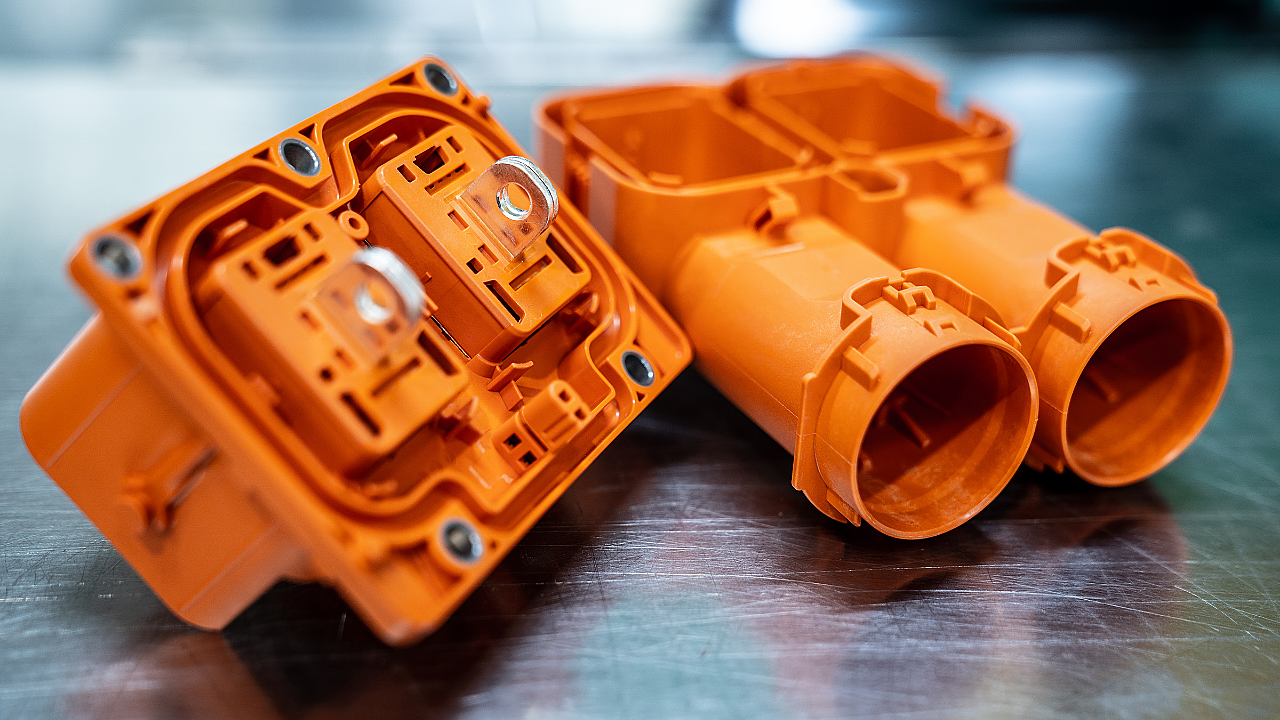

In 2020, Lanxess, a leading Germany based chemical company, announced its new line of flame-retardant thermoplastic composite material for electric vehicles.

Owing to the increasing growth of the automotive industry, the demand for thermoplastic polyimide has risen sharply. These are used in the production of automotive structural parts such as gears and bushes, and electronics. In addition, temperature-sensitive thermoplastic polyimide demand is expected to rise in tandem with aircraft demand due to rising population numbers and increasing consumer spending power.

Reinforced thermoplastic pipes

The oil and gas industry was one of the first to use reinforced thermoplastic pipes in large-scale manufacturing. Over the past five years, many oil and gas projects have been funded across the country. In addition, oil & gas demand has skyrocketed across the globe due to irreplaceable and widely used refined products, resulting in global demand for reinforced thermoplastic pipes.

Engineering thermoplastic

Engineering thermoplastics remain the most sought-after material due to their chemically independent macromolecules having the simplest molecular structure. As a result, the demand for high-performance engineering thermoplastics is expected to increase, as is the demand for amorphous engineering thermoplastics and engineering thermoplastic polymers, the research firm said.

Courtesy: Fact.MR. NB: Photo is representational; courtesy: Lanxess.