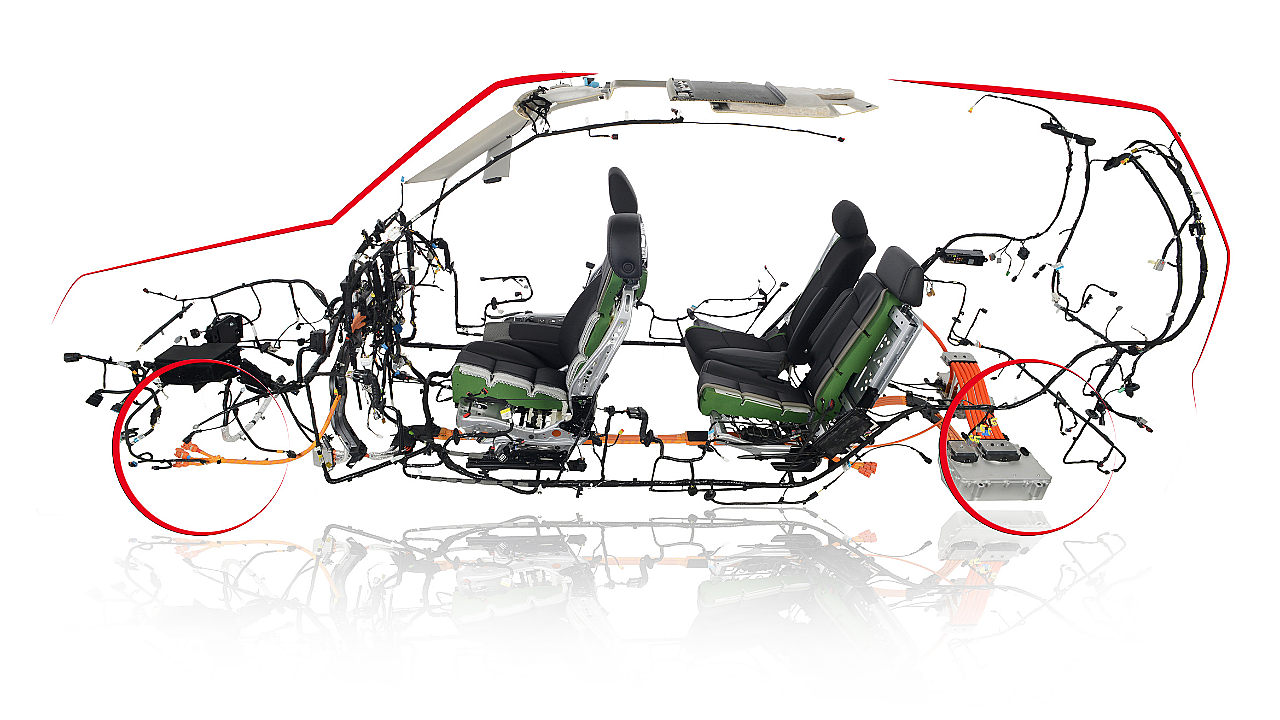

Surging demand for automotive wire for chassis and safety applications is augmenting the growth in the market, which is predicted to expand at a CAGR of 5.9% between 2021 and 2031 compared to the 0.2% CAGR registered in the past half-decade.

According to the recent report by Future Market Insights, the global automotive wires market is estimated to total $ 9.8 billion in 2021.

Increasing sales of automotive vehicles such as passenger cars and commercial vehicles is a primary factor driving the market. According to the International Energy Agency, around 88 million cars were sold worldwide in 2019. This rise in sales of vehicles is estimated to propel the demand for all automotive components such as automotive wires in the coming years.

Governments of various countries are adopting initiatives to promote electric vehicles (EVs) as a means to enjoy a safer drive and curb carbon emissions. For instance, the Indian Government announced allocating $ 139 million under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles Scheme to promote EV sales. A slew of such initiatives is expected to create remunerative opportunities for the market since automotive wires are among the key components used in EV production.

Based on material type, the copper segment is projected to account for the dominant share in the market. Factors driving the growth in the segment are high conductivity, reliability, ductility, and small-bundle sizing capabilities of copper compared to other material types.

According to an analyst of Future Market Insights, leading manufacturers are investing in research and development (R&D) activities to develop lightweight and high-performance automotive wires that can perform more than one operation to reduce the overall weight of vehicles and increase energy efficiency. This is expected to bode well for the growth in the market.

Some of the key players operating in the market includeLeoni, Sumitomo Electric Industries, Fujikura, Delphi Automotive, PKC Group, Furukawa Electric, Yazaki Corporation, General Cable, Lear, Draka, Samvardhana Motherson, Allied Wire & Cable, Coroplast Fritz Müller, Kromberg & Schubert, Acome and Yura Corporation.

Key Takeaways

Sales in North America are anticipated to rise at 4% CAGR between 2021 and 2031, owing to the increasing sales of passenger cars in the US.

The Europan market is projected to expand at a CAGR of 5% through 2031, on the back of increasing demand for e-mobility in the UK and Germany.

India is expected to account for a significant share in the South Asia market, favoured by the increasing government initiatives to promote EV sales.

Japan and South Korea are forecast to emerge as desirable markets, collectively accounting for nearly 5.2% of overall automotive wires sales in 2021.

Based on vehicle type, the electric vehicle segment is estimated to register the fastest growth, driven by rising concerns regarding carbon emissions.

Key Drivers

Increasing installation of advanced electronic features in modern cars such as multimedia distribution on rear-seat entertainment is expected to accelerate the sales of automotive wires. Besides, the rising use of low-tension electrical wirings for starting, lighting, signalling, charging, and instrument panel circuits in electric vehicles and hybrid cars fuel the demand for automotive wires.

However, less conductivity and low ductility of aluminium compared to copper hinder the demand for automotive wire across the aluminium segment. In addition, the high cost of electric vehicles and lack of charging infrastructure across countries such as Australia, Poland, India, Hungary, and others is hampering the sales of automotive wires in the electric vehicles segment.

As per Future Market Insights, the top five players in the global automotive wire are Yazaki Corporation, Sumitomo Electric, Aptiv plc, Leoni, and Lear Corp. These companies are estimated to account for 75% of the total sales in 2021.

Key manufacturers are focusing on entering into partnerships, mergers, acquisitions, and collaborations to expand their production facilities to gain a competitive edge in the market. Besides this, some of the players are investing in research and development to enhance their product portfolio, the research firm added.

Courtesy: Future Market Insights. NB: Photo is representational; courtesy: Lear Corporation.