Wheels India, a leading manufacturer of wheels, air suspension systems and industrial components for the construction and windmill industry, has drawn up an INR 200-crore capital expenditure programme for FY24, which will gradually ramp up production across the four segments - commercial vehicle, tractor, aluminium wheel and windmill machining. Last year, its capex stood at INR 143 crore.

Srivats Ram, Managing Director, Wheels India, said, “The capex will be prudently done. There is a positive feel about the way forward. We have orders on hand. But it will not be a roaring jump.”

Dwelling on various topics, he said there was a perceptible slowdown in Europe. “Inflation is still high in Europe. It is like hitting a brake. Once you hit it full, then it will have to be released slowly. Customers expect things to improve in Europe by Q3FY24,” he said.

He said costs had increased because of the Ukraine war, and “it has more or less stabilised now.” The US, too, was slowing down, but the slowdown was gradual there. “The US has triggered the IRA - individual retirement account (moving towards infra for clean energy).So, a lot more investment is likely to be there. De-risking is still something that everyone is looking at in the US and that provides opportunities for Indian companies,” Ram said.

Double-Digit Growth

“Exports looked up for us in Q4FY23 and we expect this trend to continue into this year. We are looking at double-digit growth to come back in our exports this year, though there is uncertainty in the overall global environment. We are building on our existing relationships with global customers and getting into new platforms. Overall, this year looks promising on the exports front,” he said.

Domestic Market

On the domestic market, he said, “Growth is still there in India when everywhere else in the world there is talk of negative growth. We have made reasonable inroads in the aftermarket segment and have reached close to 5% share to our overall business. It is for the first time it has reached such a level. There is a certain amount of positivity in the domestic market. Commercial vehicles were quite strong in Q4FY23, and we are continuing to see some momentum this year. Government investment in infra should give a fillip in this segment,” he said.

Growth Drivers

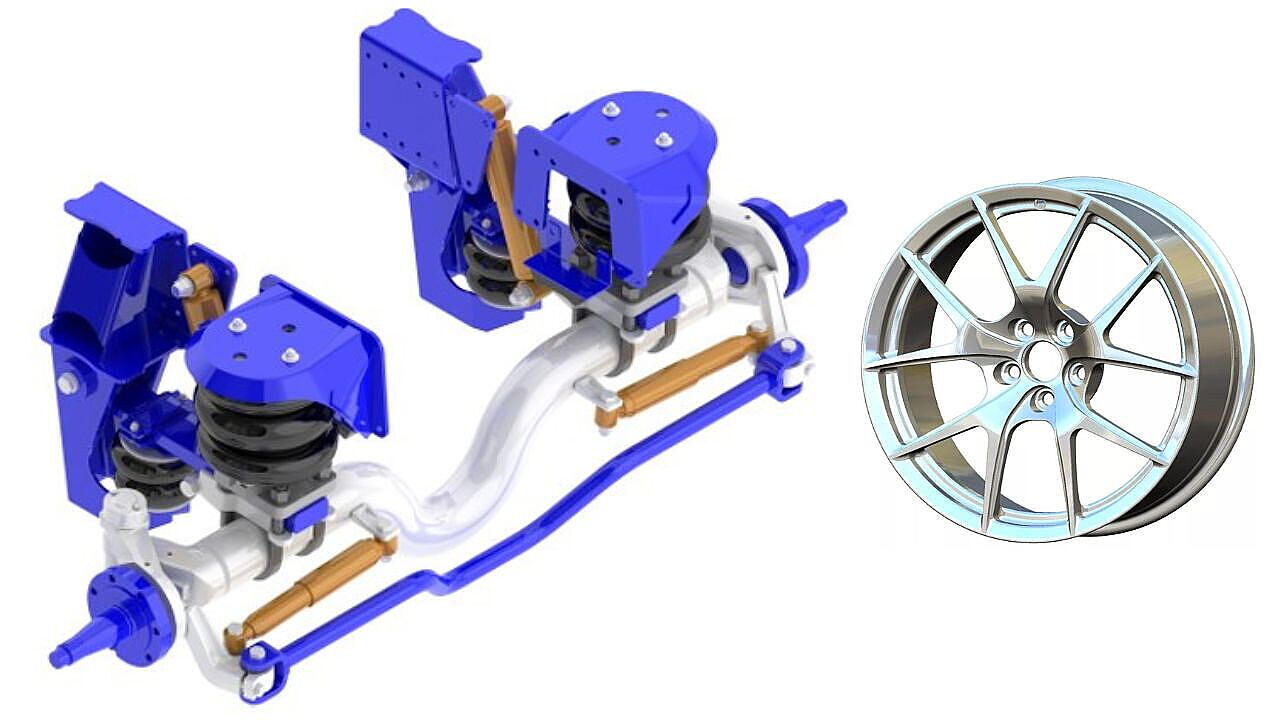

Cast aluminium, he said, was looking very strong, with the initial supplies to the first OEM taking place this month. “We will start ramping this up with a second customer in Q3FY24. Air suspension has reached close to 10% of our overall revenues and will remain strong. The windmill business will grow from strength to strength,” he said.

EV Business

To a query, he said that the transition to EV (electric vehicle) was happening slower than what had been written about. “A lot depends on the inflection point. Once the inflection is reached, then it will grow at a faster pace. But, it will not be a wave of EV taking over,” he said.

The move to EVs in the bus segment was happening already. “We are working on suspension for 4-5 manufacturers in the bus segment and expect a stronger growth starting the second half of this year. Even at a 25% shift to EV in 5-6 years, it will be good business and will give a certain amount of boost,” he added.

Debt Scenario

To a question on funding the capex, he said that the company’s debt would be lesser at the end of this year than at the start. “We are looking at investments through internal accruals,” he said.

Quizzed on the margins, he said the margins were not impacted because of the increase in raw material prices as “there is a pass-through with the customer”.

Wheels India, meanwhile, registered a net profit of INR 65.2 crore in FY23 against INR 79.8 crore in FY22. Revenues for the year grew 18% to INR 4,332.1 crore compared to INR 3,686.7 crore in the previous year.

“We registered a significant growth in the air suspension division during FY23. The CV and earth mover wheel business also did well in FY23. Machining of large castings, which was commissioned in September 2022, was ramped up towards the end of FY 2023,” he added.

Also Read: