Tork Motors is eyeing its best-ever revenue figures this fiscal. Kapil Shelke, Founder & CEO, Tork Motors, told Mobility Outlook that the start-up's revenue will be driven by its electric two-wheeler OEM and electric three-wheeler powertrain supplier businesses.

The Pune-based start-up counts Greaves, Okaya, Baxy, and Omega Seiki Mobility as its clients from the electric-three wheeler domain. Notably, these OEMs sell the most electric three-wheelers in India. It is also worth adding that electric three-wheelers have surpassed the sales of ICE-powered three-wheelers in India.

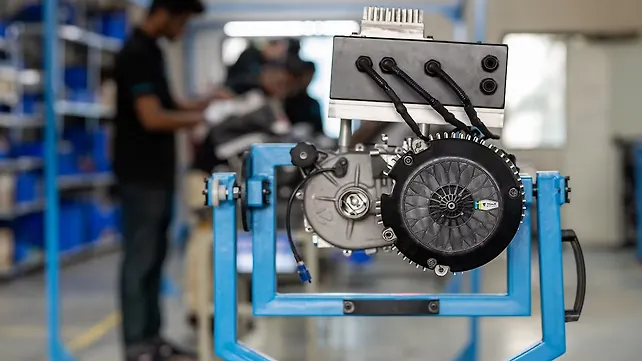

Design To Components Supply For E3W OEMs

Tork Motors's business-to-business model tie-up with these OEMs stretches beyond being a supplier of powertrains. The company starts working with an E3W OEM as soon as the latter hands over the Body-in-White (BIW) model to the former.

'We put everything that makes a shell an electric vehicle after the BIW stage. All the components from the electrical concept, ranging from motor, batteries, controller, wire-harness are designed, developed and installed into E3W BIWs by us,' Shelke said.

After the clients give the go-ahead to what the Tork team has developed, an order for a larger number of E3W components is placed. The E3W OEMs have to sign with Tork an exclusive agreement stating that the OEM will only source motor controllers, gearbox, ECU, and the display from the start-up as the intellectual property for the components remains with it.

The company also works with suppliers for the rest of the components that go inside an E3W. 'There are software changes in models of different OEMs but there are no hardware changes,' Shelke said.

Tork Team has so far supplied components for over 700 E3Ws, with its average ticket price ranging from INR 50,000 to INR 1,00,000 for every three-wheeler. The order book of the start-up includes those for components (including ideation and design) for over 1,500 E3Ws. Additionally, there is a development fee and a minimum order quantity clause that an E3W OEM must comply with to have the team working on its products. Tork claims to have developed over seven best-selling E3W models in the country.

No Supplier Plans For Electric Two-Wheeler OEMs

Shelke further explains that his start-up does not have the bandwidth to associate itself with other electric two-wheeler OEMs as a supplier. 'The proposition of being a supplier of electric two-wheeler powertrain is superb, and we have discussed with the team about the same, but our hands are full with the electric three-wheeler supplier business model,' he said.

Tork started delivering its Kratos electric motorcycle (INR 137,000 starting ex-showroom) about a month ago and aims to retail 250 to 500 units per month. The bottleneck that Shelke forecasts in selling higher numbers is the service network. He is sure it will only retail its electric motorcycles in geographies with ample service centres.

Hence, the company only retails Tork Kratos in Pune and areas around the city. Chennai, Mumbai, Bangalore, Surat, and Delhi are the cities where Tork will be opening its dealerships and service centres before the end of this fiscal.

Out of 135 individuals working in the Tork team, 110 people focus on research and development while the rest manage sales, production, and marketing. Shelke did not shy away from saying that his start-up will not be 'cash-positive' too soon despite making 'good' gross margins on two-wheeler sales and supplying components to E3W OEMs.

Tork has so far raised $10 million and is backed by Bharat Forge, Ratan Tata, and Bhavesh Aggarwal. The start-up has a manufacturing capability of 500 electric two-wheelers/month and has received bookings for over 4,800 electric motorcycles. Shelke, the only founder, stills owns 25% of the start-up.

Also Read

Will Scooter Sales Outnumber Motorcycle Sales In India?

Honda Overtakes Hero MotoCorp In 2W Registrations in Sep 2022