Leading automotive technology company providing mission-critical systems and components for electrified and non-electrified powertrain segments, Sona BLW Precision Forgings (Sona Comstar), has received six new orders in Q1FY23 for supplying components and systems relating to EVs, with three each in India and international markets.

Sharing details on the company’s Q1FY23 performance with Mobility Outlook, Rohit Nanda, CFO, Sona Comstar, said the company also clinched seven orders in the non-EV segment, with three from Indian companies and the rest overseas.

A European PV OEM has awarded the company two new programmes to supply final drive differential assemblies for their upcoming EV models, adding INR 1,607 crore to the order book. The production is expected to commence in FY26.

In addition, the company has also received an order from a leading Indian two-wheeler OEM to supply traction motors for their flagship electric scooter model, which added INR 913 crore to the order book. The production is likely to commence in FY23. Already the company had businesses for 30 new programmes worth INR 18,600 crore till March 2022. With the current orders, the cumulative value of the order book for the quarter ending June 2022 stood at INR 20,500 crore, he said.

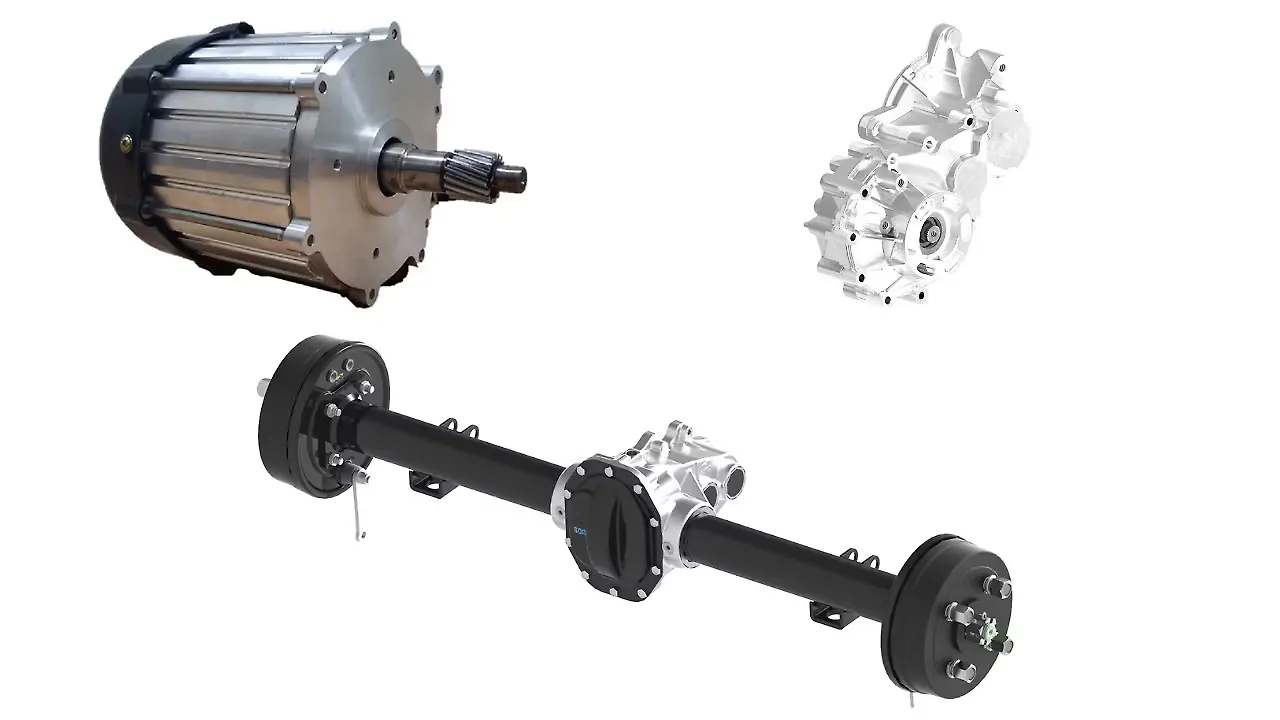

The company’s key products are differential assembly, differential gears, conventional/hybrid starter motors, EV traction motors and residual categories. According to Nanda, 30% of the revenue came from differential gears, 27% from the differential assembly, 17% each from micro-hybrid starter motors and conventional starter motors, 4% from CV traction motors and 5% from the residual category.

“Our fastest growing segments are differential assemblies and EV traction motors. Most of these systems that we sell are for EV business. Both programmes have been launched during the past three to four years,” Nanda said.

To a query on the share of the revenue from the new businesses that began during the past three to five years, Nanda said about two-thirds of it relates to EV business. Most of these would be differential assemblies/gears and EV traction motors within EVs. “We foresee the larger part of the growth for us coming from the EV segment,” he mentioned.

The system supplier reported a revenue of INR 589 crore with 18% YoY growth, the highest ever in a quarter. About 29% revenue share from Battery Electric Vehicles (BEV), the revenue growth from this vertical is 68% YoY. Its EBITDA of INR 143 crore with an EBITDA margin of 24.2%. Its PAT witnessed a growth of 5% YoY to INR 76 crore calculated after excluding the exceptional income of Q1 FY22.

Seeking his response on the technological additions that helped the company report the highest revenue in Q1FY23, Nanda said the start of production of components/systems for any programme from the RFQ stage is 18 to 24 months. Therefore, investing in R&D for a long time helped the company to not only offer solutions to its customers but also honour its commitment in the shortest possible time. On average, the company spends about 3% of its revenue on R&D. In the case of differential gears for EVs, the expectations from the customers are for managing increased traction due to higher torque and NVH levels, which are addressed by the in-house R&D.

In addition, the company’s capabilities in developing controllers and software for traction motors in-house and integrating them to offer customers either as a full system or part helped in addressing customers' evolving requirements. Although developing software is in the nascent stage, “we expect this also become significant as we go along,” he said.

The INR 900 crore Capex announced last year for a period of three fiscal remains intact as it is aligned based on the production plan for the following three years, he noted.

Asked if the new programmes for EVs came at the cost of businesses from non-EVs, he replied negatively and said that these businesses came due to the company's capabilities and the ability to address the needs swiftly. “We expect this trend to accelerate because the trend of electrification is catching on, and we also started working on this much earlier,” he said. The global trend for EVs is growing, and the same in India, especially for 2/3Ws, is growing significantly. The company believes this trend will improve during the next ten years, eventually enabling the company to grow.

Are there opportunities to make the new businesses more profitable than those coming from conventional businesses? Nanda said this business will become more profitable over time as already “our products are profitable if not equally profitable. In some of the products (for EV) are more profitable than the conventional ones. In the overall spectrum of margins, it would be towards the lower end,” he averred.

Right now, this space is competitive with much competition from China. Going forward, the Indian Government’s policies to encourage local sourcing, and with the volumes building up leading to economies of scale, the profitability will improve. Besides, the young organisation with a flattish structure and frugal way of operating, relying on in-house capabilities rather than outsourcing expensive inputs, will also help in containing the expenditure, he said.

Nanda believes that the impending growth of commercial vehicles (CVs) that is expected to bounce back as it experienced two recessionary trends and a pandemic hit slowdown during the last eight odd years will help the company grow further as the company holds 90% market share for gears for CVs.