Unlike passenger vehicles and tractors, the two-wheeler segment continued to be in the doldrums in August as the top five manufacturers’ sales continued to slide in negative territory.

As the segment that was already facing decline due to economic loss in the middle class is now facing semiconductor shortage, impacting the sales of especially the premium two-wheelers.

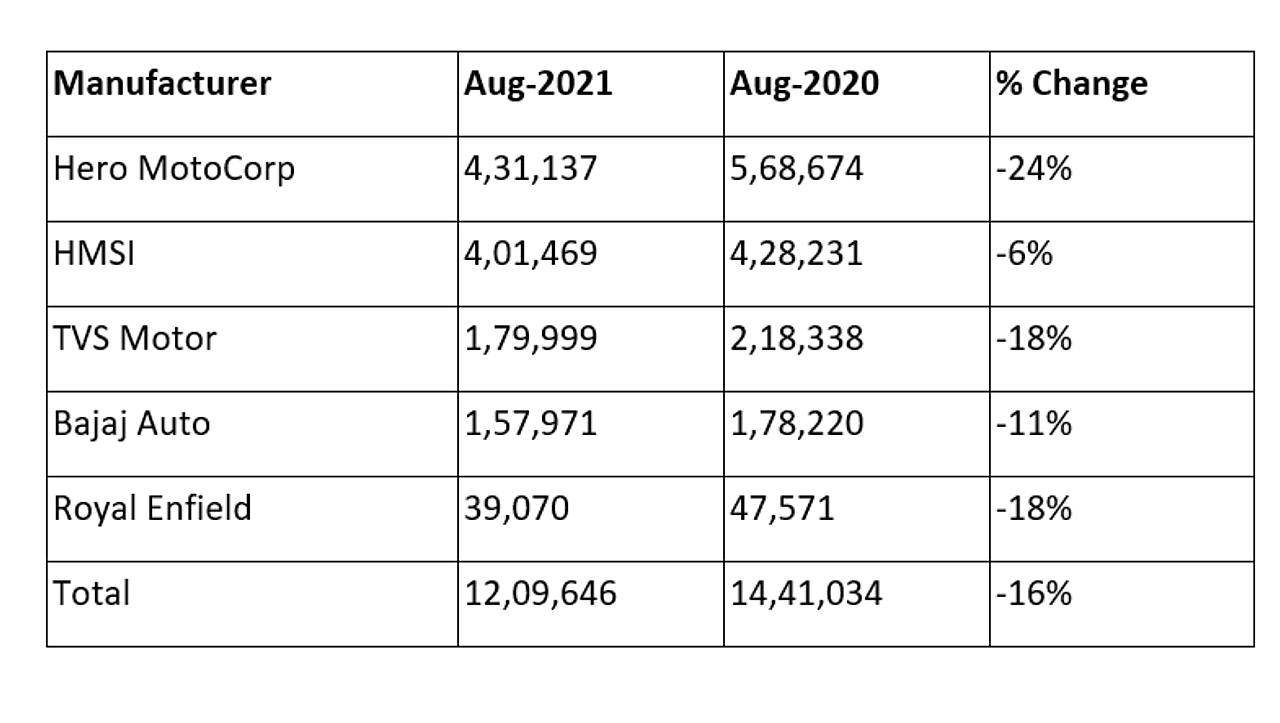

As per the data released by the companies, the top five two-wheeler manufacturers’ overall sales stood at 1,209,646 units in August 2021, witnessing a fall of 16% compared to 1,441,034 units in the same month last year.

Rohan Kanwar Gupta, Vice President & Sector Head - Corporate Ratings, ICRA, said, August 2021 witnessed a sequential growth of 6% in 2W domestic wholesale volumes (as per data released by top OEMs). However, the 12.09 lakh units sold were 16% lower on a YoY basis and nearly 13% lower than August 2019 (pre-pandemic) levels.

“The performance reflects some impact of semiconductor chip shortages on the production of high end (>150cc) 2Ws,” he added.

Industry experts also indicate that entry-level continue to remain under stress because of the economic loss and a part of consumers opting for electric two-wheelers because of the high petrol prices.

The retail 2W registration data shows a 14% sequential decline in August 2021 (and on a YoY basis around 7% higher). The data indicate that high fuel inflation and escalating cost of ownership (due to commodity price pressures) continue to impact sentiments.

“While a possibility of the third wave and delta variants continue to remain a risk to steady offtake, a decent monsoon, upcoming festive season, and healthy pace of vaccination are expected to support sentiments (and volume recovery) in the forthcoming months,” added Gupta.

India’s largest two-wheeler manufacturer, Hero MotoCorp recorded the steepest fall of 24% at 431,137 units in August 2021 compared to 568,674 units in the same month last year.

However, the two-wheeler manufacturer is optimistic about the festive season because of several positive indicators, such as the decent monsoon that encourages farm activity in most parts of the country and the several government schemes in the social sector.

“Also, with COVID- 19 vaccination gaining pace and last-mile retail opening up further, the numbers are expected to be positive in the coming months,” the company said in a statement.

Similarly, rival Honda Motorcycle and Scooter India (HMSI) is too optimistic about the demand in the coming months after registering a decline of 6% in sales in August 2021.

Yadvinder Singh Guleria, Director – Sales & Marketing, HMSI, said, “The month of August ushers the onset of the festival spirit in the country. With a steady month on month recovery in terms of enquiries and customer walk-ins, we are cautiously optimistic moving forward, expecting conversions to retails. Further, we shall be starting deliveries of our recently unveiled motorcycle CB200X in September.”

TVS Motor Company registered 274,313 units sales in August 2021 against 277,226 units in August 2020. Domestic two-wheeler registered 179,999 units in August 2021 as against 218,338 units in August 2020. “With pandemic restrictions easing and the festive season soon approaching, we expect the retails to improve significantly in the coming months,” the company said.

Motorcycle registered sales of 133,789 units in August 2021 as against 119,878 units in the same month last year. Scooter registered 87,059 units in August 2021 against 87,044 units in August 2020.

However, semiconductor shortages continue to impact the production and sales of premium two-wheelers.