As global automakers look to make good on their promises of an electrified future, consumer interest in adopting more sustainable powertrains is driven by reduced fuel costs, climate concerns and better driving experiences.

A recent study by leading audit, consulting, tax and advisory firm, Deloitte has found that the limitations of electric vehicles continue to attract many buyers to internal combustion engine (ICE) vehicles globally.

There is also limited willingness among consumers to pay for advanced technologies, including alternative powertrains, found the study. A majority of consumers, including 53% of those in the US, are unwilling to pay more than $ 500 for advanced technologies such as autonomous driving, enhanced safety and connectivity.

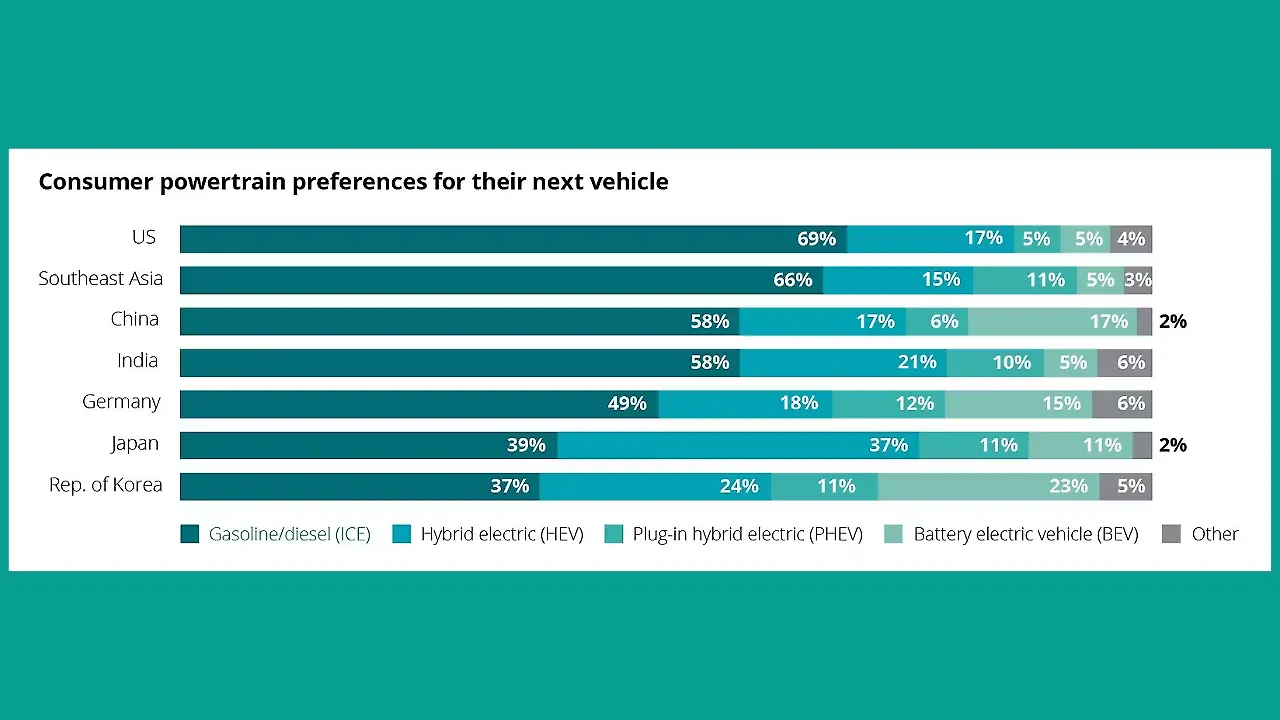

Even as OEMs globally continue to invest in EVs, ICE vehicles continue to dominate future US vehicle purchase intentions (69%).

Alternate Powertrains

The study reported interesting findings as far as consumers’ interest in alternate powertrains are concerned. Battery electric vehicles (BEVs) found favour with 23% respondents in the Republic of Korea – the highest in the world – followed by China (17%) and Germany (15%).

Hybrid electric vehicles (HEV/PHEV) were found to be most preferred by Japanese consumers at 48%, followed by the Republic of Korea at 35%.

Among consumers in the US, Germany, Japan, the Republic of Korea, India and Southeast Asia, the two biggest motivators for EV adoption continues to be mounting concerns about climate change and emission reduction. In Japan and India, 76% respondents said they would prefer to charge their EVs at home, followed by the US (75%) and Germany (70%).

Among those planning to charge their vehicles at home, two-thirds (66%) of Americans will leverage traditional power grids, while consumers in India, China and Southeast Asia plan to use both the regular grid and renewable power.

Demand for public charging is highest in the Republic of Korea (38%) and Southeast Asia (29%).

The study also checked on consumers’ concern about driving range and found it to rank topmost across consumers in Germany (24%), China (22%) and the US (20%). US consumers expect fully charged EVs to travel upwards of 800 km, while those in China, Japan and India were found to be content with a range of around 400 km.

The lack of public charging infrastructure is top of mind in Asia – Southeast Asia at 28%, the Republic of Korea at 26%, India at 23% and Japan at 19%.

Road Ahead For Vehicle Purchases

Among other aspects, the study also found that consumers shopping for new vehicles prefer traditional, in-person experiences in favour of virtual platforms. Three-quarters (75%) of US consumers, 89% in Southeast Asia and 78% in Germany prefer in-person experiences.

However, virtual retailing is gaining traction for its convenience, speed and ease of use. Consumers in most countries, nonetheless, would prefer purchasing directly from an authorised dealer, including in the US (48%). Japanese consumers, in contrast, would prefer to buy directly from the OEM (49%).

Virtual vehicle sales are most often driven by convenience for those in the Republic of Korea (68%), Japan (41%), Germany (40%) and the US (39%), while ease of use ranks highest for consumers in China (33%), India (27%) and the US (25%).

In India and Southeast Asia (64% and 63%, respectively), COVID-19 has significantly impacted car buying decisions for consumers, while more than two-thirds of US consumers (69%) say the pandemic has not affected their vehicle purchase plans. Moreover, 45% consumers in India and 31% in Southeast Asia cited an increased desire in acquiring a vehicle to avoid public transportation; only 14% of US drivers reported the same.

Personal Mobility Most Desirable

While personal vehicle ownership maintains its position as the most desirable mode of transportation, shared mobility offerings, including vehicle subscriptions and ride-hailing services, are making a slow return to pre-pandemic levels, Deloitte found. A significant 76% of Americans prefer personal vehicles as their primary means of transport. Public transportation, meanwhile, has a significant share among consumers in the Republic of Korea (31%) and Japan (27%).

Vehicle subscription services are still to gather good traction in the US. Approximately one-third of US consumers are interested in vehicle subscription services for access to different car models, brands of vehicles and pre-owned vehicles (each at 32%). Convenience, the flexibility to exchange vehicles, and the availability of vehicles are the main drivers for engaging a vehicle subscription service in the US, the study found.

In Conclusion

Deloitte’s “2022 Global Automotive Consumer Study” is based on a survey of more than 26,000 consumers from 25 countries conducted between September and October 2021. While the automotive sector focuses on the road ahead and a return to its pre-pandemic pace of growth, consumer values remain aligned with familiarity and affordability, said Deloitte.

Jason Coffman, US Automotive Consulting Leader and Principal, Deloitte Consulting LLP said, “As we've seen with the global supply chain, challenging existing paradigms in the automotive sector is often complicated and costly, and convincing the customer to pay for further mobility services in a free app world is a difficult proposition.”

Despite challenges, the industry remained remarkably committed to electric mobility, said Karen Bowman, Vice Chair, Deloitte LLP and US Automotive Leader. “The growing interest among consumers to be more sustainable, along with rising fossil fuel costs, create a compelling opportunity for EV manufacturers. Global automakers should communicate this value proposition for consumers and strengthen the requisite charging infrastructure to further drive their success in the market and enable a truly electrified future,” he said.