It is now nearly a fortnight since Honda Motor Co had a detailed press meet on its electrification plans.

The event was significant since it was happening around the same time (April 26) as the recently concluded Auto Shanghai where Chinese carmakers sent out a strong message on their prowess in electric. The world’s largest automobile market was now going to be the centre of gravity for electric mobility whether its detractors liked it or not.

It was also an occasion for Japanese automakers to ponder over their own future with the Chinese clearly on the ascent. Media reports kept stressing on the point that Japan was a laggard in electric, especially big brands like Toyota, and it was in this backdrop that Honda held its press meeting.

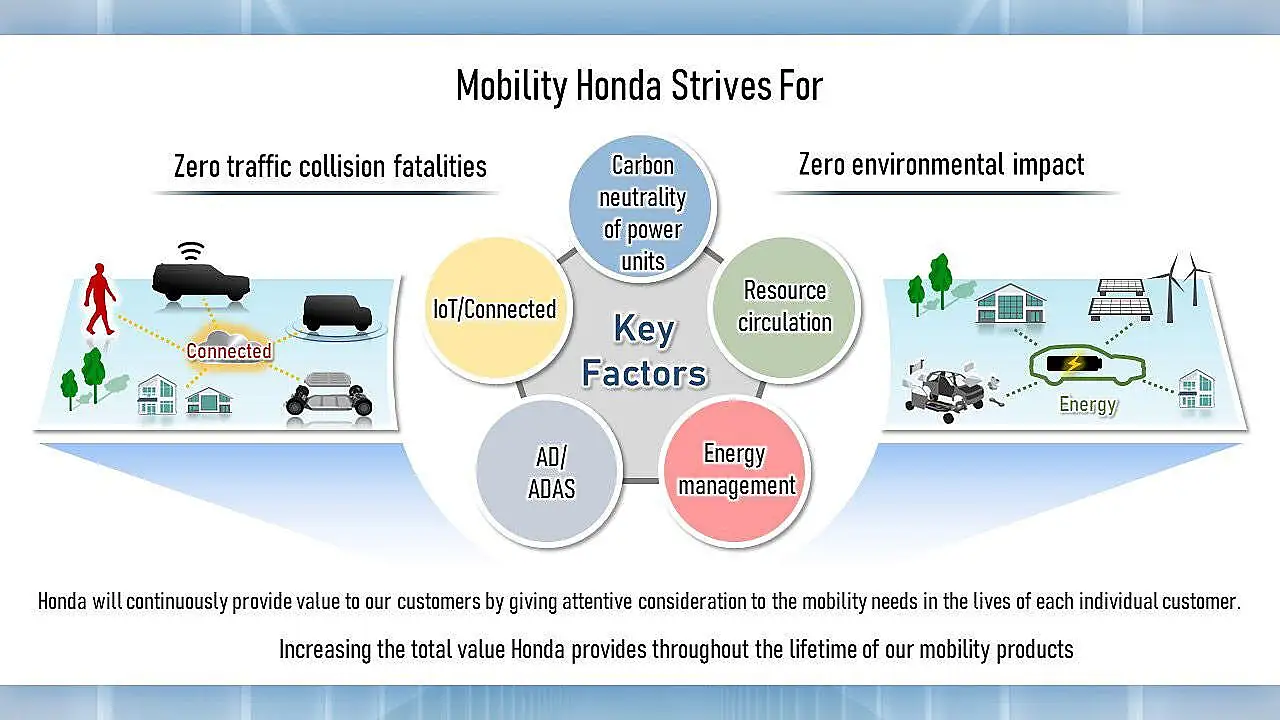

The company stated that it planned to increase the ratio of electric and fuel cell electric vehicles to 100% globally by 2040. By the end of this decade, Honda was targeting production of over two million EVs annually.

What was interesting was the company’s intent to make EVs 100% of its automobile sales in China by 2035, ahead of other regions. By driving home this message, Honda was only stating the obvious that all the action in electric was happening in China and it only made business sense to focus on this market.

Present at this press meet were Toshihiro Mibe, Director, President and Representative Executive Officer along with Shinji Aoyama, Director, Executive Vice President and Representative Executive Officer.

Familiar Name

The latter’s name is familiar to India since he was heading the operations of Honda Motorcycle & Scooter India (HMSI) over a decade earlier when the Japanese automaker had parted ways with its long-term ally, Hero.

Aoyama is especially remembered for his aggressive business outlook at HMSI where he had a successful stint after which he moved on to other global assignments, including the US, before returning to Japan in what is clearly a very senior position at headquarters.

From India’s point of view, Honda has little to show in its car business after a good 25 years. Even though it is in better shape financially, Honda Cars India has found the going tough and had to close one of its facilities at Greater Noida near Delhi as part of a restructuring exercise. It now operates out of the Rajasthan plant and is getting set to cope with even more aggressive competition.

The Japan press meet on April 26 saw the management point out that it was due partly to the contribution of the motorcycle business — “which has established a strong earnings structure” — that Honda has been able to secure “a sufficient level of free cash flow despite the tough business environment”.

Quite unlike Honda Cars India, HMSI has been a top performer even while it has not been able to dislodge Hero from its top slot. The company is the second largest producer of motorcycles and scooters but still perceived as a late entrant to the electric space compared to traditional rivals and a host of start-ups mushrooming across the Indian landscape.

Two-Wheeler Roadmap

Globally, Honda is planning to launch 10 or more electric motorcycle models by 2025. At the press meet, Honda stated that it aims to increase annual sales of electric models to 3.5 million units (equivalent to approximately 15% of total unit sales, as of 2030).

It will introduce an electric scooter equipped with a Honda Mobile Power Pack swappable battery in Japan, Europe and Indonesia before the end of 2023. The company is also exploring “a range of future models” including those equipped with a power source other than swappable batteries while “envisioning the future business environment, market uses and technological advancements”.

Whilst on the core topic of electrification, Honda has also made a reference to the chip crisis where it is “taking various actions” to deliver products to its customers as soon as possible. The short-term measures include strengthening relationships with suppliers and other initiatives like dual-sourcing of key parts and the development of alternative parts.

In the medium to long-term, the company has stated that it has been “building cooperative relationships and enhancing collaboration” with semiconductor manufacturers, including the strategic tie-up with TSMC of Taiwan through which it “strives to ensure stable procurement” of semiconductors.

Charging Services

Keeping pace with the enhancement of its EV line-up, Honda will begin offering vehicle charging services. For home recharging, based on the Honda SmartCharge (an EV charging service available in North America), it proposes to roll out an energy business that uses the power supply capability of EVs.

For public charging, the company will work toward the establishment of an EV charging services environment for its customers in collaboration with providers of convenient and reliable charging networks.

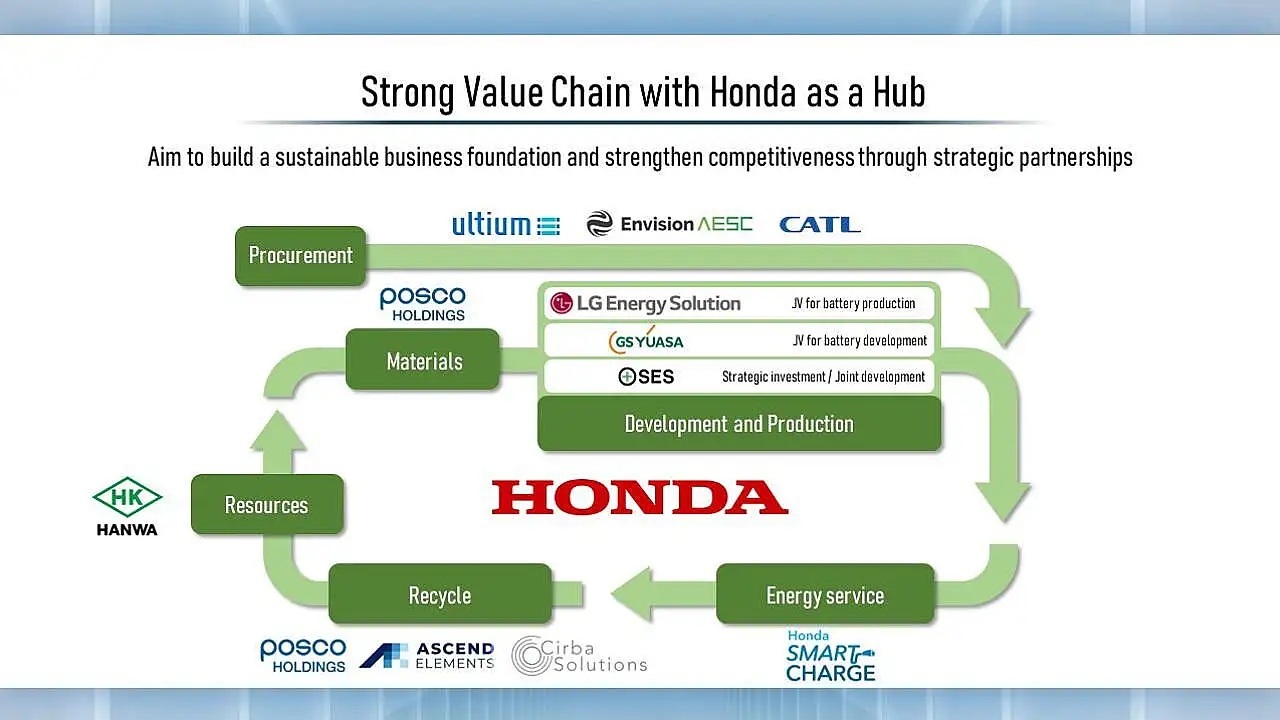

To ensure steady progress in electrification, Honda will enter into various strategic partnerships. These will be in areas ranging from procurement to resource circulation of batteries and battery resources.

As for battery procurement and development, the company has stated in the press meet that it has been strengthening its external partnerships for liquid lithium-ion batteries and is now on track to have “good prospects for stable procurement” of its global requirements.

Honda will also develop and introduce next-generation batteries such as semi-solid-state and all-solid-state batteries. Along with GS Yuasa, a Kyoto-based Japanese company, it will develop high-capacity, high-output liquid lithium-ion batteries for EVs.

Leveraging Alliances

The Japanese automaker will begin operation of a demonstration line for the production of all-solid-state batteries in 2024, which will be introduced in its models in the second half of the 2020s. Honda is jointly developing semi-solid-state batteries (lithium-metal secondary batteries) with SES AI Corporation of the US, an EV battery research and development company.

When it comes to battery resource procurement and circulation, the company will leverage a strategic partnership with Hanwa Co to ensure stable procurement — in the medium to long term — of nickel, cobalt and lithium.

In the area of resource circulation, it will use recycled resources through strong partnerships with businesses, including collaboration with Ascend Elements and Cirba Solutions (both US-based), and a “comprehensive partnership” with Posco Holdings of South Korea.

While gearing up for full-fledged EV production, Honda will retool three existing plants in the US to establish “highly efficient and flexible” production lines. It also intends to make its Saitama factory in Japan its first carbon neutral plant by March 31, 2026.

Honda will further strengthen its alliance with General Motors, which will see joint development of affordable electric vehicles. The two companies will continue “exploring a broad range of collaboration”, which will increase competitiveness in core electrification components.

To further strengthen its open innovation functions through close coordination with corporate strategies, Honda established Honda Innovations Co in Japan in April to serve as the global head office for this activity. The company will be hoping that the new electric roadmap will hold it in good stead for the future, especially with China all set to carve a niche for itself globally.

Also Read: