Increasing environmental awareness with a strong commitment from world governments to reduce carbon emissions is driving growth in global mobility technologies. The rapidly emerging opportunities in this space have led to an investment boom cycle with the mobility tech industry receiving $23.4 billion from Venture Capital (VC) investors in Q1 2021 alone, according to the financial data and software company PitchBook Mobility Tech Q1 2021 VC update released in May.

Boom cycle

According to Pitchbook, global mobility VC deal activity rose from 276 deals worth approximately $2.5 billion in 2011 to 1,331 deals worth $54.2 billion in 2020. The peak deal count was achieved in 2018, air taxis and autonomous driving technology, which are expected to deliver on-demand, low-cost, convenient, and environmentally friendly mobility tech with 1,499 deals worth $67.3 billion. There is growing optimism around electric vehicles, electric solutions that will continue to drive long-term industry growth.

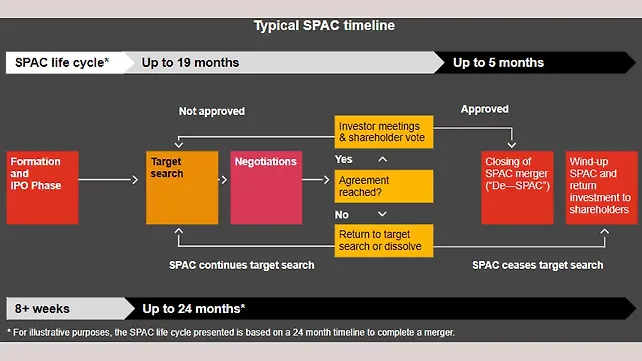

PitchBook states that Special Purpose Acquisition Company (SPAC) mergers have largely been successful for mobility tech companies. One of the reasons for this, is that SPAC listings enable mobility tech companies to provide long-term financial projections while facing lesser scrutiny relative to Initial Public Offerings (IPO).

Many mobility tech companies need large amounts of capital to scale their operations and often face an extended period, often running into several years before these companies start generating meaningful revenue. As a result, traditional IPOs, as a way to enter public markets, often do not find favour for such firms. “Now that SPACs have been legitimised and provide a clear path to exit, investors are flocking to back mobility tech companies,” Pitchbook states in its report. In Q1, 2021 alone, 43 US mobility tech startups merged with SPACs (or entered the process of doing so), representing a combined valuation of $ 104.1 billion as of the end of March. However, such SPAC listings could potentially be affected by future US Securities Exchange Commission (SEC) rule changes.

Several important major mobility tech VC deals took place in Q1 2021; mobility and fintech platform, Grab announced that it would go public in April and valued at $ 39.6 billion in the world’s largest SPAC merger. Electric Vertical Take-Off and Landing (eVTOL) air taxi pioneer Joby Aviation received a valuation of $ 6.6 billion, following its February announcement to list on public markets via a SPAC reverse merger. In January, electric vehicle developer and manufacturer Rivian raised $3 billion in funding, valuing the company at $ 27.6 billion.

Emerging Markets Witness Micromobility Gains

Pitchbook forecasts that the global micromobility industry will represent a $ 105.5 billion total addressable market by 2030. Africa and Asia are urbanising faster than the other regions of the world, according to United Nations (UN) reports, and by 2050 will feature urban populations of 56% and 64%, respectively. According to a 2014 UN report, India, China, and Nigeria are expected to account for 37% of the world’s urban population’s projected growth between 2014 and 2050. India alone is estimated to add 404 million urban dwellers, China 292 million and Nigeria 212 million by 2050.

Micromobility will play a key role in emerging markets as costs of car ownership are on the rise, and cities are increasingly focussing on decongestion and reducing carbon footprints. Micromobility providers in emerging markets will continue to benefit from an expanding middle class, increased smartphone usage and continued urbanisation. “We see opportunity in startups such as Vogo, Bounce, Grow Mobility, Neuron Mobility, and ezBike,” states the PitchBook report. Micromobility startups are also likely to drive the growth of electric two-wheelers, which as of 2020 comprised approximately 35% of global sales.

However, the Pitchbook report also states that, while enthusiasm for electrification, autonomous driving, and other car-based mobility technology is high, ‘VC investors continue to remain tepid about micromobility and is a phenomenon at odds with the large market opportunity of providing micromobility in emerging markets.’ This is especially the case for marquee global VC investors. However, despite their lack of interest, Indian micromobility startups have raised funds with their promise of catering for alternative transportation options to mass transit, taxis, and ride-hailing, which remains relatively expensive for most of the population.

Indian micromobility startups Vogo, Rapido and Bounce, have raised a cumulative total of approximately INR 1,400 crore (approx $ 192 million). Vogo started operations in 2016 and raised INR 83 crore ($ 11.5 million) in February from extended Series C round funding, which included Lightrock (earlier LGT Lightstone Aspada), Kalaari Capital, Matrix Partners India and Stellaris Venture Partners. Other companies operating in the same space, Rapido and Bounce, have received approximately INR 1,140 crore in Series D and Series B funding rounds, respectively.