Shailesh Chandra uses a cricket analogy to describe the Tata Motors journey in passenger cars over the last three years.

“We are not on a weak wicket as we were…it is not the same first five overs when the ball is swinging and you are tentative. Right now, you see that you are 150 for 2 in 25 overs and you can launch into the next 25 overs with greater confidence,” says the Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility.

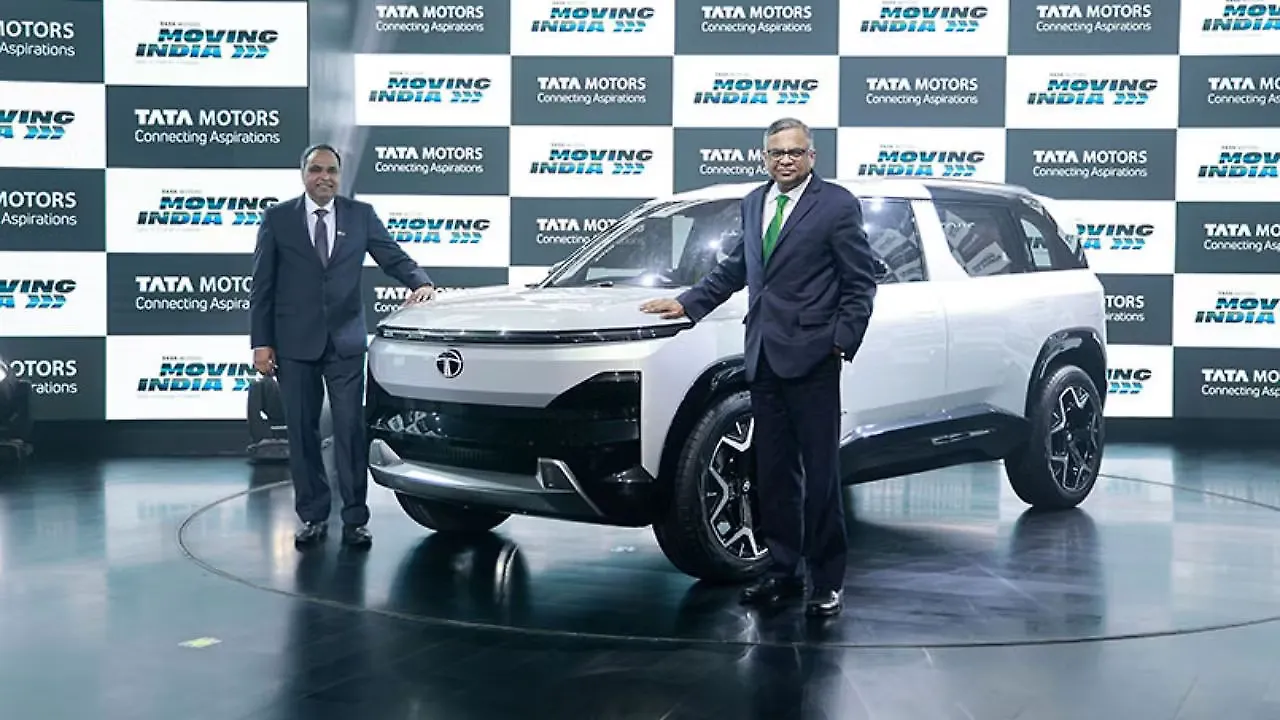

The interview with Mobility Outlook is happening at the (recently concluded) Auto Expo at Greater Noida near Delhi and Chandra is visibly pleased with the momentum that is now clearly in place within the company’s ecosystem.

He also has reasons to be pleased given that passenger vehicle sales in calendar 2022 totalled 527,000 units and put Tata Motors at a very strong No 3 slot just being Maruti Suzuki and Hyundai Motor.

“Crossing the 500,000 mark in 2022 was a big milestone in 2022,” says Chandra. When he took charge in FY ’20, the business was the “lowest ever” with a 4.5% market share and doing about 135,000 units against an installed capacity of 450,000 unit

On A Fast Wicket

Those capacities were, of course, meant for older models but were just lying idle and if “you had to turn around”, it would have had to come from capacity utilisation. “It was about growing the business very fast and at that point in time, I would have possibly said the aspiration was to get to 500,000 units in five years,” continues Chandra.

The fact that this goal has been achieved in three years naturally makes him and his team feel “very proud and happy” since this meant growing nearly four-fold from the lows of April 2020. “We are confident of the brand and the ability to grow it further…the market loves us and if we go about our task with the right mindset, products and aggression, people will support us,” he says.

The Tata Motors brand is clearly strong today and the association with safety, technology, green vehicles etc are also helpful which means the foundation is firmly in place. However, to grow volumes, there are “multiple ammunition that you need” in terms of new products, expanding in segments that will grow fast, growing the network, making sure that capacities are in place and so on.

Stepping On The Gas

It is now back to the cricket narrative for Chandra. “You will have to do something different in the next 25 overs from what you have done in the first 25 (overs). The manner in which you approach, strategise and build new assets to enable you (reach your target) must be different,” he says and this is precisely what the company showcased at the Auto Expo with its product range.

Clearly, Chandra is passionate about the road ahead or, more specifically, how the game is panning out on the cricket pitch. “I am 150 for 2 chasing 350 and I feel comfortable compared to the first five overs when I had lost a wicket or two. I know the task is still very high at 25 overs so I have to plan the next five overs, the next 10 and, finally, the last 10 overs,” he elaborates.

The reference here is to the need to create a factory “which will take us to that level” and here is where the acquisition of the Ford plant at Sanand in Gujarat becomes a critical part of the growth story. Today, Tata Motors has a capacity of 50,000 units a month which can go up to an additional 10-15% with some de-bottlenecking.

However, this “massive” 300,000-units annual capacity at the Ford facility, which will be ready in the next 12-18 months, means that “the enablements” are ready. Beyond this is the need to expand the network from the present level of 1,200 outlets which by itself is a rapid jump from 750 outlets three years ago when the turnaround exercise began.

“The enablers of demand fulfillment and generation is something we need to work on at a certain pace. It is also important to invest in products at the same time which will win in the market with new technology,” says Chandra.

Focusing On The Right Segments

All this is a “huge ask” in terms of investments, not only in products but underlying aggregates. Beyond this, the top priority is to strategise and focus on entering only those segments where growth rates are high and exit shrinking categories. “This is what we are working on and need to check out at each step if we are achieving the milestone or have to go in for course correction,” he elaborates.

While it is a no-brainer that electric will “grow very fast”, the CNG space is going to be the next powertrain on the ICE (internal combustion engine) side which will get the benefit of both emissions and operating costs. Right now, however, it is his contention that both these technologies of the future are handicapped with “certain compromises” for the customer.

On the electric side, “we are taking away” the compromises every year by way of charging infrastructure, home charging comfort, range enhancement, price at comfortable levels etc.

No More Compromises On CNG

“On CNG, nobody has done that and we are going to disrupt the market by taking away all the compromises,’ reiterates Chandra. CNG-powered cars today have fewer features with the focus on cost while there is a complete loss of boot space. Moreover, if there is any price fluctuation — as has been the case over the last year when its prices have doubled — people shift from CNG to petrol.

“The customer mood will change and today CNG is opted for solely because of low running/operating costs while the compromises continue to exist,” he continues. Tata Motors intends to be the disruptor here and had done this earlier when it brought in the CNG versions of Tiago and Tigor with premium features.

The CNG versions of Punch and Altroz showcased at the Expo do away with boot space compromise and ensure that there is no reduction in cylinder capacity or range. The cylinder has been split into two so that boot space is not entirely compromised and performance is assured “like in SUVs”.

Getting Future-Ready

Chandra is confident that CNG and electric powertrains will grow and this is why the company is getting future-ready with new products that are in the next phase of growth. As he points out, cars were in the range of INR 3.5 lakh a decade earlier and, five years, doubled to INR 6 lakh and further to INR 9.5 lakh today. Going forward, it is logical to assume that their price tags will further increase to INR 12.5 lakh.

According to Chandra, the next wave of growth will happen in the 4.3 metre segment —mid SUVs — and the objective is to “disrupt the market with two products in ICE. The Sierra in its modern avatar will be launched in 2025 as an EV and then ICE.

“We are focusing on an expansion of our portfolio to cope with the next wave that is growing and will be the most disruptive on CNG and electric. It will be a different story altogether and this is the next wave of growth from these segments,” he says.

While conceding that CNG prices are still high, it is only a small section which is sensitive to a price rise while most people are still confident about its operating costs compared to petrol. From the company’s viewpoint, the idea is to ensure that the disruption in CNG by way of better performance, boot space and features will more than make up for any drop in sentiment with a price rise of the fuel.

International Roadmap

While there are plans to look at exports over the next three years, the domestic market is top priority. “We will have a roadmap in the coming year for international business and can cater to big markets because of electric. We are competing with the big players in India anyway,” reasons Chandra.

While conceding that there will be challenges en route, especially in an era of global volatility, he believes it is only inevitable to cope with this reality while continuing to focus on deeper localisation.

“We are 55% local except for the cells and the group has shared its intention to get into this over the next few years. Then comes the raw material which we need to secure with strategic tie-ups. Hopefully there will be breakthroughs in EV technology that will then reduce dependence on one geography,” explains Chandra.

By the end of the day, technology which is commercially viable will make electric more widespread and “we are keeping our eyes open on these breakthroughs for partnerships in the next decade”. The key lies in being hopeful about the future, he declares.

Also Read:

Tata Motors Unveils 14 Commercial Vehicles & Concepts